Gold stocks are rallying in the short-term, but the real move may still be ahead

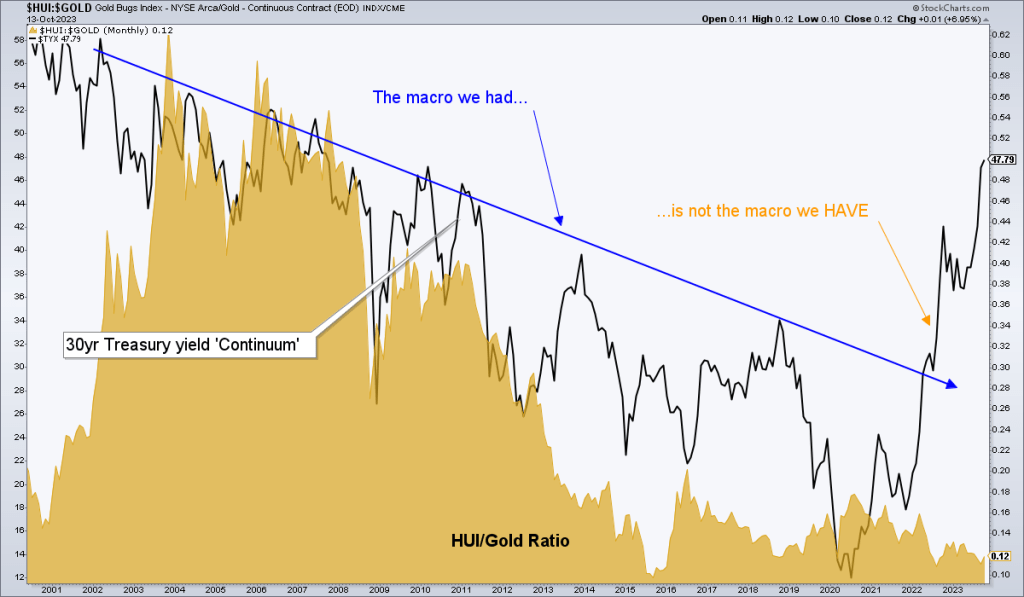

This article views the gold stock sector’s big picture bullish situation from the standpoint of a single indicator, the HUI/Gold ratio and its relationship to the 30 year Treasury bond yield.

On the shorter-term and without going into tactical detail in a public post, the gold stock sector will either continue bouncing to end the correction that has been in force since the spring or it will take a final plunge. A final shakeout that could come amid vastly improved or improving fundamentals. As of the end of Q3 those fundamentals had not improved. They had degraded.

Indeed, we reviewed both the technical and fundamental situations in Friday’s NFTRH Trade Log & Notes, and have been tracking each routinely in weekend reports. We will be present and accounted for when the time is right to pound the table because NFTRH is committed to right-minded, as opposed to promotional or hopeful analysis.

Back on the big picture, I find views like this compelling. While there is no particular rhyme or reason for the HUI/Gold ratio to have tracked the 30 year Treasury bond yield ‘Continuum’ on any given interim phase (and it has not done so), over the last 20 years the downtrend in long-term yields has coincided with a downtrend in the gold miners vs. the monetary metal they dig out of the earth. In other words, the yield has coincided with the HUI/Gold ratio.

With many (but not all) upside pings of the blue line on the chart above, the 30 year Treasury yield indicated inflationary pressure running hot and thus, a bad time to be getting bullish on gold mining. Need any further proof that sources touting inflation as a reason to buy gold stocks are wrong?

The Atlantic

Gold stocks have routinely been impaired during the long inflation cycle. The Continuum is nothing if not a picture of a long disinflationary trend in bond market signaling that, especially since the 2001-2003 time frame,

While the likes of Ben Bernanke really put the process on steroids, Alan Greenspan was regarded as a trailblazer in inflationary policy-making. He birthed the age of Inflation onDemand, with little regard for sound practices and much regard for the asset owner classes. Bernanke simply took the playbook and ran with it (to hero status). Together they launched and tended the 20 year phase of inflationary policy-making masked as heroism. Bernanke may have been “the hero”, but Greenspan was the “Maestro”, was he not?

As to ‘why’ the chart’s trend relationship between the HUI/Gold ratio and the yield may prove bullish for gold miners, since gold is proven to out-perform the miners during inflationary phases, what might happen when the macro flips the other way? If our view (that the current disinflationary Goldilocks trade will morph into a liquidity-constrained deflation scare before the next inflation phase) is correct, gold stocks should out-perform when the yield normalizes (pulls back)? Probably not the minute that yields obviously top and drop (inflationist bugs will be unloading, after all), but eventually the miners will grind out a bull market (or more accurately, continue the highly volatile one in place since 2016) that few will expect.

I don’t expect the old downtrend in the yield to reemerge, but a hard drop amid deflationary pressure would benefit the miners in relation to gold. It’s not just a chart telling us that. It’s the fact that gold has under-performed inflated commodities and markets since 2020 and often over the last 20 (inflationary) years, as the miners leveraged its under-performance (as pictured in the HUI/Gold ratio).

Leverage works both ways. But most will not expect it to work in a positive way because herds were well tended by previous macro trends. Think of the big spike in the yield as a handle. The end.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. Subscribe by Credit Card or PayPal using a link on the right sidebar (if using a mobile device you may need to scroll down) or see all options and more info. Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter@NFTRHgt.

*********