Overview

Economic signals generally continue to be a mixed set causing no consensus on the prospects for a recession or growth in 2023 or 2024. Interest rate increases by the central banks, hit a temporary pause but inflation trends remain uncertain and additional interest rate increases remain possible. Financial markets, especially in fixed income, financial and utilities equities have been under pressure due to interest rate increases. Gas prices in North America have started a slow climb out of summer bottoms but a warm winter looms. Oil prices have broken out over 90 dollars.

There is a growing realization that Permian drilling is moving on to Tier 2 locations. If Permian Tier 2 wells are the marginal barrel, then higher WTI prices are implied.*[1]

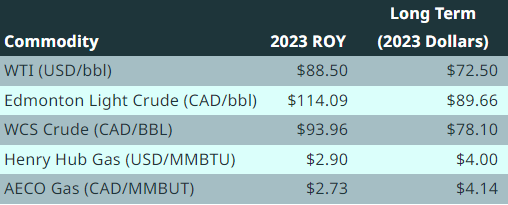

GLJ has made no changes to our long term expected oil prices and gas prices but has adjusted our short-term price expectations to reflect the market’s actual outcomes and near term futures markets.

Natural Gas Prices

North American natural gas prices began a slow climb out of summer lows. As always, Q4 2023 and Q1 2024 prices in North America and Europe will be strongly weather dependent. Warm weather allowed Europe to avoid a gas pricing catastrophe in 2022/23 and Storage filled higher than historical averages. As the embargo on Russian pipeline gas continues, the price of natural gas may remain unusually volatile.

Oil Prices

WTI prices have broken out from the narrow trading range observed in the previous quarter. It is unclear if the market will support this price, or prices will break out even higher. Increased WTI and Brent prices are likely due, in part, to withheld OPEC supply and perhaps a Permian plateau. Very low oil storage in the USA is also a factor. WCS differentials narrowed in summer, as is commonly observed. The fourth quarter is historically a period of widening WCS differentials.

Inflation and Exchange Rates

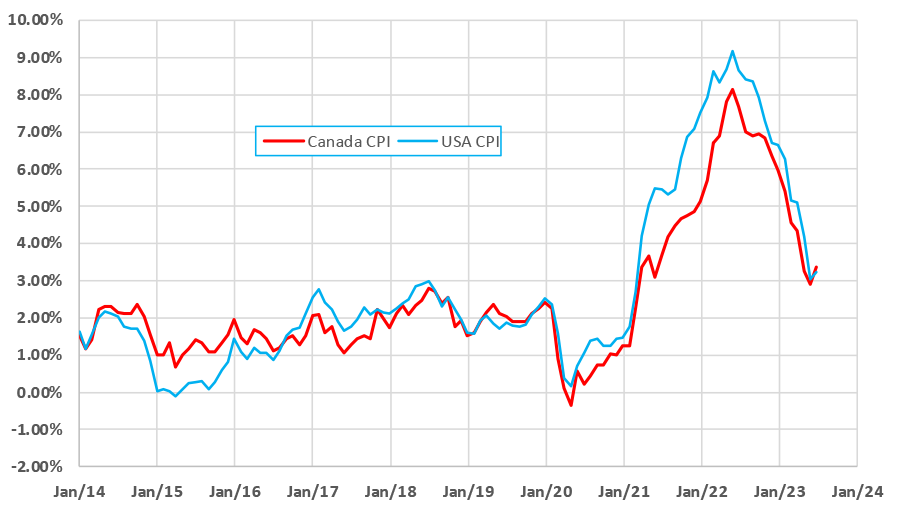

While the USD dollar has been strong against most major OECD currencies, the Canadian dollar has been able to stay within its recent trading range. Exchange rates have been volatile as the market absorbs interest rate policy differentials, inflation rate information, and aggressive fiscal and monetary policies. Central banks’ approach to inflation has been to raise interest rates aggressively and a drop-in inflation rate has been observed since the peaks of 2021. The timeline and feasibility of achieving the major central banks’ goal of 2% remains extremely uncertain. Many analysts see a long-term inflation rate well above the 2% target. GLJ’s view is that although interest rates may be plateauing, they may remain at current levels for some time. Central banks may have difficulty in moving interest rates down as inflation remains pervasive, and governments are issuing record quantities of debt. Inflation trends (CPI) in the USA and Canada are presented in the following chart:

GLJ’s Forecast Values for Key Benchmarks

GLJ Price Charts

[1] https://oilprice.com/Energy/Crude-Oil/The-Imminent-Peak-In-Permian-Oil-What-Does-it-Mean-For-Investors.html

https://www.mrt.com/business/oil/article/Permian-Basin-oil-and-gas-output-reaches-new-17721340.php

https://blog.gorozen.com/blog/the-permian-basin

Share This:

Next Article