Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

The energy crisis in Europe continues to diminish as prices return to something approaching useful. Cleantech investor and co-host of Redefining Energy Gerard Reid pointed out that natural gas prices were off 80% in nine month, and wondered if they might approach zero.

I wondered what the impact of the EU emissions trading scheme (ETS) budget guidance would be. I recently looked through the guidance through 2050, noting that it turned into US$203 per ton of CO2 in 2030 in 2023 dollars, $287 in 2050 and $296 in 2050, roughly aligned with the social cost of carbon that Canada and the US EPA agree on. I did a quick so-what comparison between the impact on a notional wind farm and natural gas plant, and any gas plant operating in 2035 would have be running a tiny percentage of the time and getting very big money for their electricity to break even.

But I hadn’t really done a per-commodity assessment until this comment and thought it would be interesting. I picked wholesale electricity prices per MWh, the cost of cement per ton and the cost of methanol per ton.

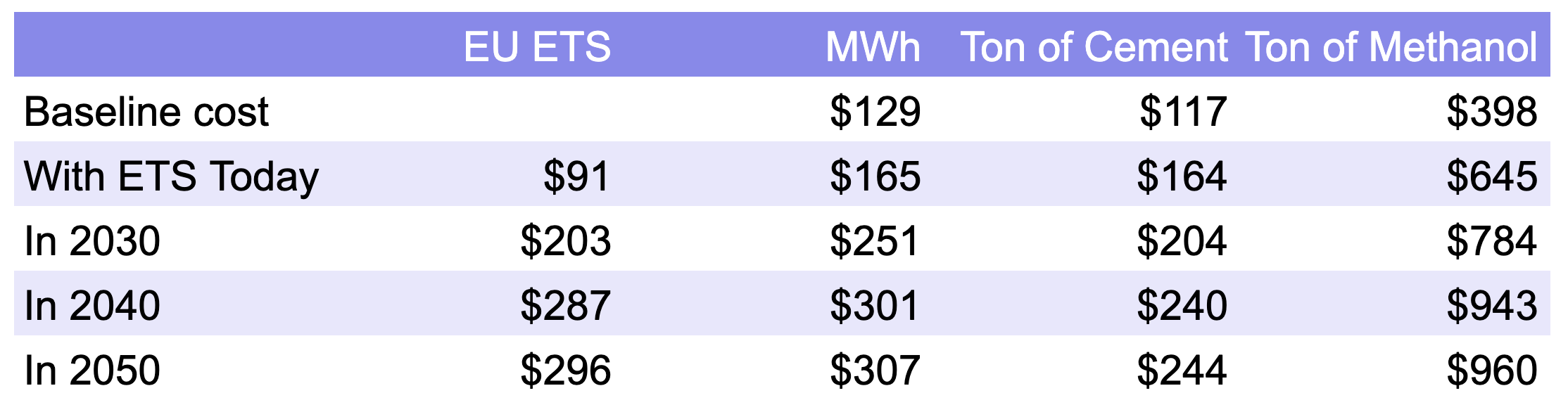

At present, those commodities have the following recent average EU wholesale prices. A MWh at $129. A ton of cement at $117. A ton of methanol at $398.

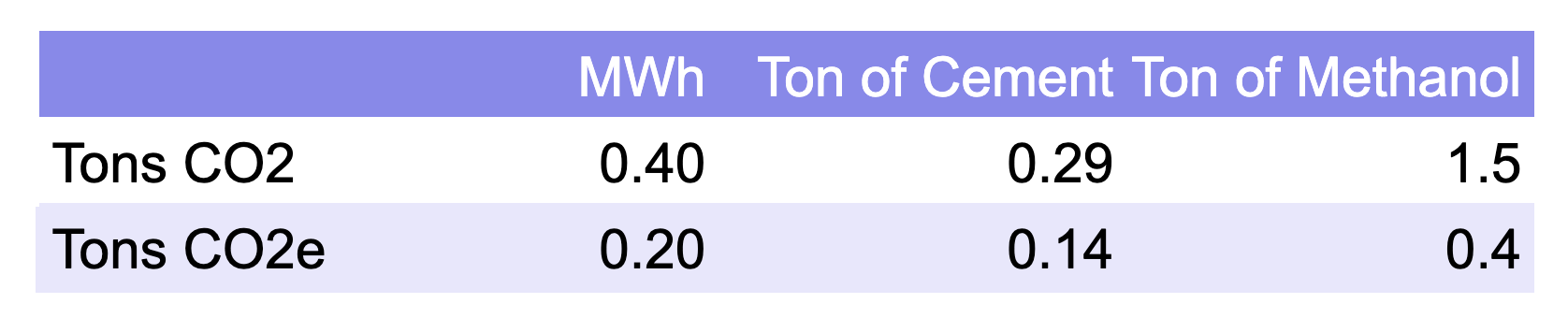

This is natural gas-focused and each of those commodities has a primary pathway for its creation which uses natural gas. Electricity is generated in natural gas generation units which emit about 0.4 tons of CO2 for every MWh, along with 0.2 tons of CO2e from leaking methane in Europe (more in the USA, even more in many other parts of the world).

Cement uses natural gas to heat the limestone kilns and clinker drum. It takes 4,982,000 btu of natural gas per ton of cement. At 36,303 btu per cubic meter and 0.76 kg per cubic meter of natural gas, that’s just over 0.1 tons of natural gas. When that burns, it creates just under .3 tons of CO2. That of course comes with a chaser of leaking methane, about 0.14 tons of CO2e. For this effort I’ll ignore the roughly double CO2e emissions from the limestone to quicklime process and focus on the easy pickings of natural gas for heat.

Methanol is at a whole new level. Methanol is made from natural gas and is up to 1.5 tons of CO2 per ton of methanol, along with another methane leakage chaser of perhaps 0.4 tons.

CO2 and methane CO2e emissions just from natural gas per MWh, ton of cement and ton of methanol, chart by author

Today the EU ETS doesn’t apply to methane and other carbon dioxide equivalents like NOx. In 2026, it will. And that’s when the carbon border adjustment mechanism will kick in and all of the embodied CO2 and CO2e in imported goods will be priced as if they were manufactured in the EU. The world’s third largest economy is effectively applying a carbon price to every country that exports to it from anywhere in the world, which is to say almost all of them.

At the EU’s current ETS price point of $96, electricity generated from natural gas should cost an extra $36. Every ton of cement should cost an extra $47 just for the portion of emissions from the use of natural gas (and about double that due to CO2 from the limestone to quicklime process). Each ton of methanol should cost an extra $247.

Cost of a MWh, ton of cement and ton of methanol with EU carbon price just on the natural gas in 2023 dollars, chart by author

In 2030, using the EU’s budget guidance for business cases of $203 per ton of CO2e which includes the methane, the numbers go up considerably. Up $122 per MWh, $87 per ton of cement and a whopping $386 per ton of methanol.

And so on. There is nothing free about natural gas of course, and that wasn’t what Reid was suggesting. But the raw commodity prices don’t tell the story today and certainly don’t tell the story in the coming years and decades.

Anything which uses fossil fuels is going to be priced out of the market very rapidly. A MWh of wind energy that has about 0.008 tons of CO2e that receives $129 on the wholesale market today will cost the end user perhaps $0.07 to use when the carbon price is applied. In 2050, the CO2 intensity of wind energy will have dropped considerably as the manufacturing, distribution and construction of it decarbonize, so it will possibly be in the range of 0.002 tons of CO2e. That might cost the end user $0.06 more.

You can’t decarbonize natural gas generation without bolting on a lot of technology at great expense and burning a lot more energy to get it down to merely worse than wind or solar. The additional costs aren’t at the level of the projected carbon prices, but they are still vastly above the carbon price on wind and solar. As natural gas electricity is already more expensive than wind and solar, it’s just going to be less and less competitive over time.

For cement, the alternatives aren’t quite as clear cut. It is possible to use electric heat for the prices listed above and hence reduce those adders to approaching zero as electricity decarbonizes. The CO2 from the limestone to quicklime process is still outstanding and is roughly double the energy hit, and this is one of the few places I consider that carbon capture and sequestration might have an economically competitive play. Of course, CCS’ boat will be floated exactly the same distance as all of the other low-carbon competitors for cement which are extant but currently aren’t economic. We’ve had alternatives for years, we just chose not to afford them.

As for methanol, it has alternatives, but they aren’t great or inexpensive. Manufacturing the roughly 170 million tons of methanol today is a carbon problem in the range of 500 to 700 million tons of CO2e, a very significant carbon problem, in part because about a third of it is made from coal gas with even higher emissions. Methanol can be made from anthropogenic biomethane, but sources like landfills and dairy barns aren’t nearly as concentrated as natural gas. Modern efficient methanol factories require 3,000 tons of methane a day or more, and big landfills might emit around that much in a year.

Anaerobic digesters where waste biomass gets turned into biomethane are a different climate problem, in that they tend to leak badly throughout their supply chain. Any pathway that goes through a high global warming potential gas like methane should be viewed with skepticism. The alternative is synthetic methanol, where the CO2 comes perhaps from the cement plants and the hydrogen comes from electrolysis, but as hydrogen can be green but can’t be cheap, that’s an expensive pathway too. It also can’t reuse existing methanol plants as the process is completely different.

There’s no pathway for methanol that isn’t much more expensive than it is today, so anywhere that there is an alternative, it is likely to be used instead. One way or another, the price for methanol is going way up.

The net of this is that while natural gas the commodity is getting cheaper in recent months, the cost to users will be going up and up over the coming years if they are in the EU or export anything to the EU. That’s true in Canada as well, where the carbon price already applies to methane as well, although the price point is well below the EU’s right now. As an indication of where Canada’s price will be going, the social cost of carbon calculation the country shares with the USA has the real cost of every ton of carbon being much more expensive than our carbon price.

If anything in your value stream uses fossil fuels, and you are competing with organizations which don’t have fossil fuels in their value streams, you are going to be losing business fast in the coming years.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

EV Obsession Daily!

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

Tesla Sales in 2023, 2024, and 2030

CleanTechnica uses affiliate links. See our policy here.