Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Tesla continues to be the best selling brand in Europe, but the Volkswagen brand continues to recover.

Approximately 270,000 plugin vehicles were registered in August in Europe, +68% year over year (YoY). That’s the market’s highest growth rate since June 2021. Unfortunately, the overall market also grew fast, +21%, as it is finally recovering from a couple of bad years.

Last month’s plugin vehicle share of the overall European auto market was 30% (22% full electrics/BEVs). That result pulled the 2023 plugin vehicle share to 23% (15% for BEVs alone).

Most of the plugins’ good moment came from BEVs, which kept gaining momentum in August, growing 106% YoY. This was their first three-digit growth rate since June 2021. This is visible in the BEV vs. PHEV sales breakdown as well, with pure electrics accounting for 75% of all plugin sales in August, against a yearly average of 67%.

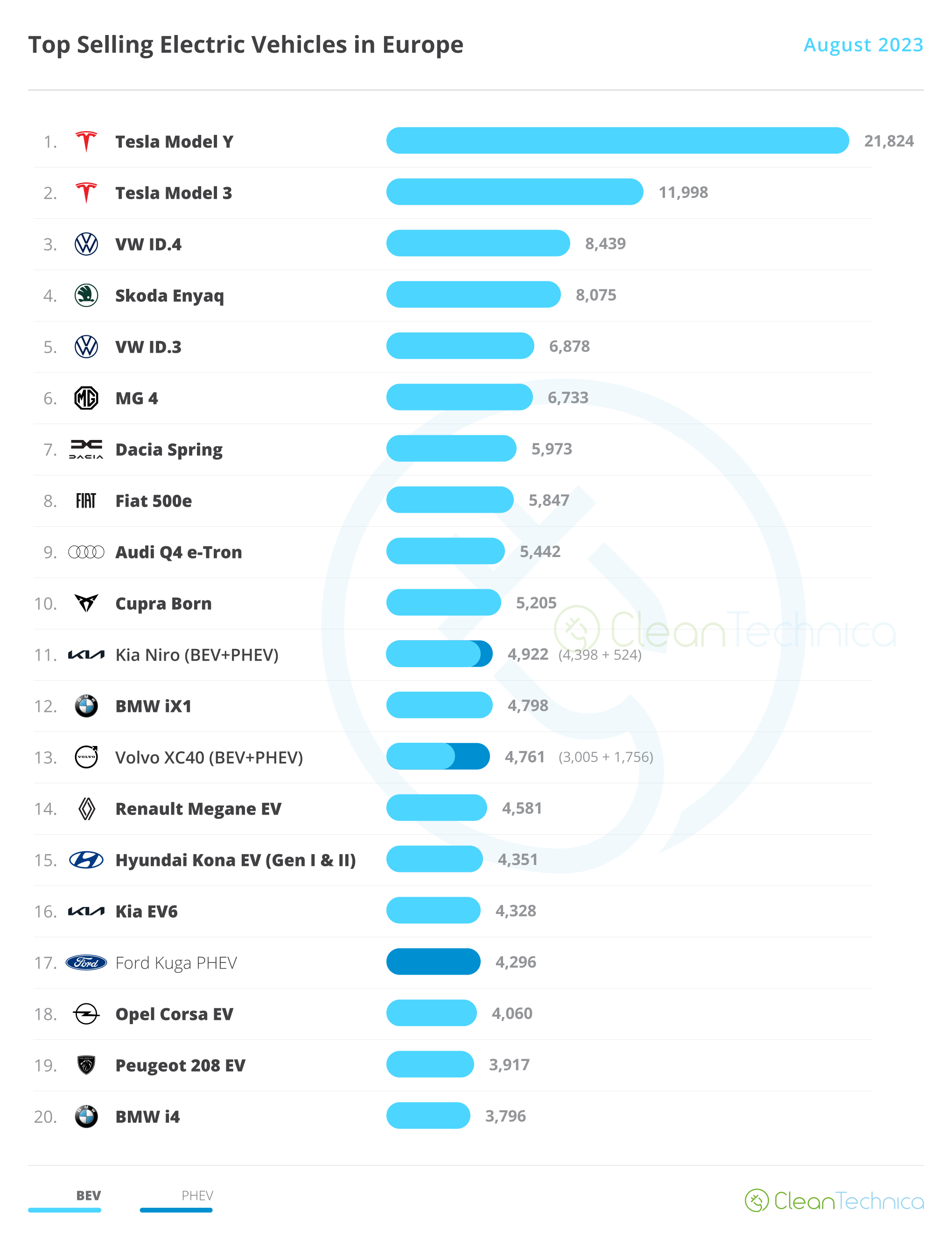

The highlight of the month was Tesla getting both gold and silver. In particular, the Model 3 had a surprisingly good performance — even though the Model Y had far more sales. Also, the Skoda Enyaq, in the 4th spot, continued on its record-breaking streak. But let’s look closer at August’s plugin top 5:

#1 Tesla Model Y — For the 10th month in a row, Tesla’s crossover was the best selling EV in Europe. In August, the midsizer had 21,824 registrations. This year could be considered “Peak Model Y” in Europe. The midsized crossover should continue to post similar results in the coming quarters in Europe, but do not expect sales to increase significantly over current volumes, as I am confident the Model Y has already reached the market’s natural limits. Also limiting its growth will be the refreshed Tesla Model 3, which could steal some sales from it, even if Europeans aren’t really into sedans these days. Regarding last month’s performance, the Model Y’s biggest European markets included Germany (4,795 units), France (3,051 units), and the UK (2,313 units), but other countries also posted four-digit results, like Sweden (1,506 units), Norway (1,452), the Netherlands (1,231), and Belgium (1,187), confirming the Model Y’s popularity in Scandinavia and Benelux.

#2 Tesla Model 3 — The midsize sedan fulfilled Tesla’s best expectations, with another podium presence thanks to 11,998 registrations, and that’s just before the refreshed Model 3 shows up on European shores in October. Speaking of the refreshed model, I believe the biggest improvement is the interior, which now feels more inviting and less like an austere solitary confinement division in Sparta. Specs wise, the range improvement (+22 km in the standard RWD version, +27 km in the AWD version) allowed it to remain among the best in the market, helped by the more competitive prices. On the other hand, the front styling has lost personality. … Love it or hate it, the previous version had a sporty vibe, almost Porsche-like, which made it look cool. In my opinion, the new front is too generic. Next to it, even Toyotas start to look nicer. Maybe that is the price to pay for success — when you reach a certain level of sales, you lose the ability to stand out, in order to gather as many clients as possible. I guess the Toyota/VW-ization of the Model 3/Y was inevitable. With this, the Model S is again my favorite design in the Tesla stable. Too bad it is an 11-year-old design … which says a lot about the prowess design of the S, but also about the limited progress that came after it. A bit like the US senate, then … but I digress.

Back to the Model 3’s August performance, its main markets were the usual — France (2,258 registrations), Germany (2,015 registrations), and the UK (1,698 registrations) — but other more surprising markets also had big scores, like Spain, with 770 registrations, Italy(!), with 1,192 registrations, the Netherlands(!!), with 751 registrations, and Portugal(!!!), with 626 registrations. These last two were particularly surprising, as they were markets where the Model Y had consistently outsold the Model 3 by a wide margin. Fleet sales, maybe?

#3 Volkswagen ID.4 — The Volkswagen crossover won another podium position in August thanks to 8,439 registrations. With increased production availability, the ID.4 is now dependent on getting enough demand to reach the #2 spot in 2023. Maybe a price cut would come in handy, here? Just saying. … With revised specs coming soon, including an 82 kWh battery, maybe this could be a good time to review the pricing policy? Regarding the ID.4’s August performance, its main market was its home market of Germany (3,600 registrations), followed at a distance by Sweden (1,454 registrations) and Norway (712 units).

#4 Skoda Enyaq — The Czech crossover is a sure value in the EV arena, and although the VW ID.4 is the MEB-platform best seller, the good looking crossover has managed to end August with another record performance. The model had 8,439 sales, an amazing performance for the Skoda EV, especially when we consider that August is a holiday month and most of its competitors are taking a vacation and enjoying some piña coladas. … With this in mind, expect sales to continue strong in the coming months, especially now that production constraints seem to have finally ended. It is also worth considering that on top of the current record streak of the Czech model, the Spanish Cupra Born is also rising, having scored 5,205 registrations in the same period, a new year best. These two models’ performance should provide Volkswagen management some ideas for the future — either you create exciting and good looking products (Cupra Born), or you create practical and good-value-for-money models (Skoda Enyaq). I would say the VW ID.3 and ID.4 are neither of these. Regarding the Enyaq’s August results, the biggest market was Germany (3,345 units), followed by Norway (704) at a significant distance.

#5 VW ID.3 — Although it didn’t reach record sales levels, the compact German ended ahead of the #6 MG4, winning its category in August, something that stopped being a given ever since the Sino-British model landed in Europe. With 6,878 sales, the compact hatchback is currently one of VW’s cash cows in the EV arena, while leaving the spotlight (and Tesla fighting responsibilities) to the bigger ID.4. Looking at August’s performance, Germany (3,636 registrations) was its biggest market by far, followed at a distance by Belgium (958 units) and the UK (343).

Looking at the rest of the August table, the highlights are all in the second half of the table. The #12 spot of the BMW iX1 was celebrated with another record performance, this time 4,798 registrations, again beating the i4 as the highest placed BMW on the table. While a future position in the top half of the table seems certain for the BMW crossover, will it be popular enough to reach the top 5? Hmmm…

The second half of the table witnessed another record performance. The Kia EV6 ended the month in #16 thanks to a best ever result of 4,328 sales. It seems battery constraints are also easing in Korea. Will we see the Hyundai–Kia Group adjusting prices in a few months in order to push sales up? Fingers crossed….

It is interesting to see that the only PHEV model in the top 20 shows up way down at #17. A sign of things to come, or is this just the result of the incentives-derived BEV delivery peak in Germany?

Below the top 20, we had several models with positive performances, like the VW ID.5 reaching 2,836 registrations and the ID.Buzz finally gaining traction with a record 1,623 registrations. In the full size category, the Audi Q8 e-tron continued to remain in charge, thanks to July’s 2,449 registrations, but we have a surprise in the second spot, providing evidence once again of the effectiveness of doing slooow ramp-ups. The Mercedes EQE sedan is finally starting to live up to expectations, by getting a record 1,830 deliveries. That allowed it to beat the BMW iX (1,701 registrations) in the race for the runner-up spot in the full size category.

There was also good news in the Hyundai–Kia stable, with the Hyundai Ioniq 5 (3,407 units) scoring a year-best result, and the Ioniq 6 getting 2,012 registrations — a new best for the streamlined Porsche sedan.

The Chinese models are also starting to show up on the radar. The BYD Atto 3 (export-spec BYD Yuan Plus) had a record result, 2,694 registrations, while Great Wall’s Ora Funky Cat (Euro-spec Ora Good Cat) scored its first four-digit result, 2,360 registrations. China is rising….

Finally, in the Stellantis stable, we have some weak results from its best sellers. The best selling model was the Fiat 500e, in only 8th. The Stellantis highlight comes from Jeep, with the little Avenger EV scoring 2,112 deliveries in only its fourth month on the market. Expect for the Polish-made American model to start knocking on the door of the top 20 in a few months.

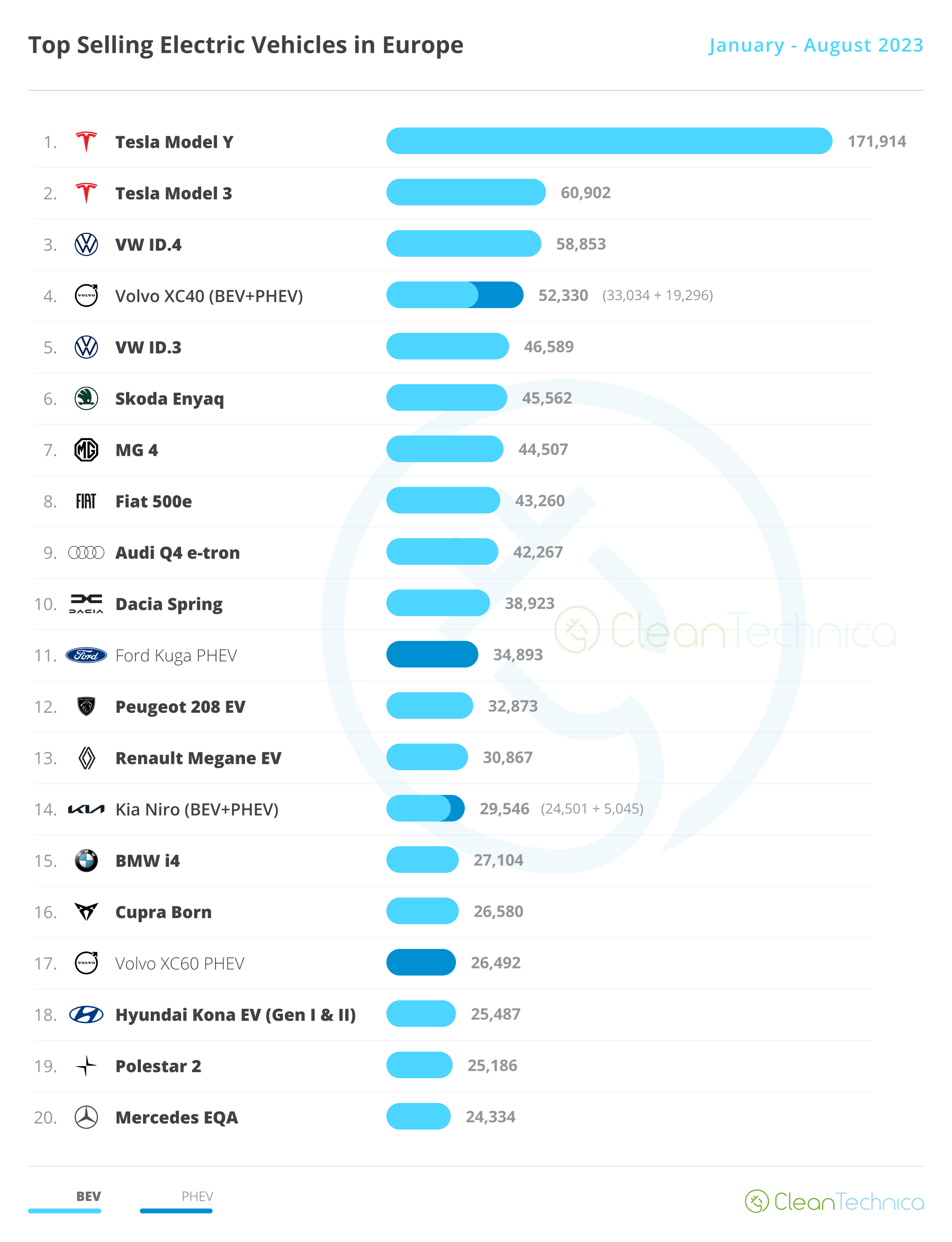

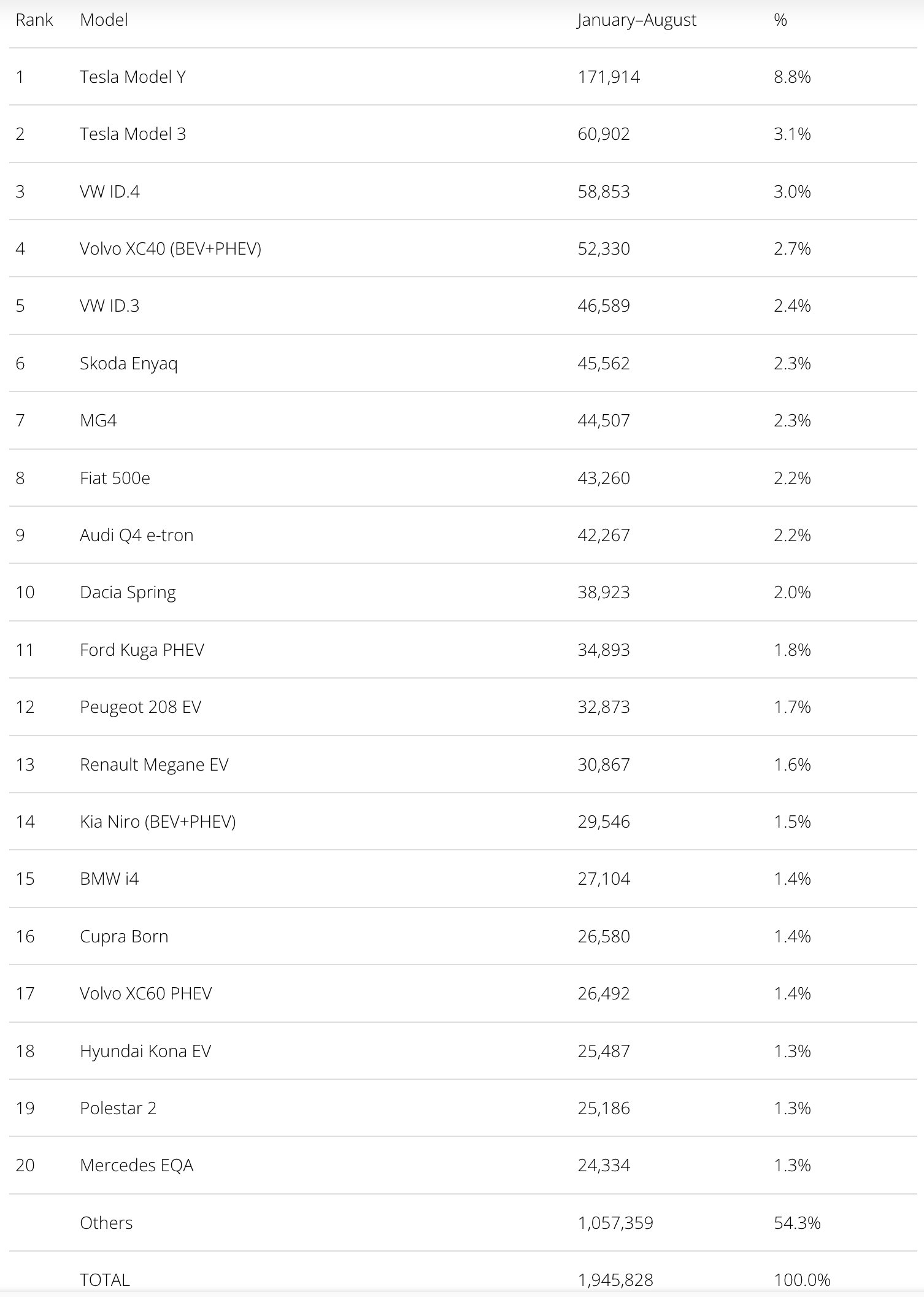

Looking at the 2023 ranking, with the Tesla Model Y having over two times as many deliveries as the new runner-up Tesla Model 3, the attention is now focused on the remaining podium positions.

On that topic, there are really only two candidates remaining for the silver medal. And if the production ramp-up of the refreshed Model 3 goes smoothly, the VW ID.4 shouldn’t have a chance to compete for the runner-up spot, as the Model 3 should have a BIG December.

Regarding the #4 Volvo XC40, it is probably already suffering from the comparison with Volvo’s newborn EX30, of which its 13th position in August could be an early sign of fatigue and future cannibalization. That might be good news for a number of models behind it, as not only the #5 VW ID.3 and #6 Skoda Enyaq could surpass it, but even the #7 MG4 could end the year ahead of the Belgian-built Swede.

Speaking of these models, the Skoda Enyaq continues to climb up the table, having risen one position in August to #6, surpassing another value-for-money champ, the MG4.

The remaining position changes happened in the second half of the table, with the BMW i4 climbing to #15 while the Cupra Born jumped two positions to #16.

In the last positions on the table, the highlight is the rise of the Hyundai Kona EV, to #18. The small crossover is currently in a generational change, but the new units from the new generation have allowed it to rise one spot up the table. In fact, it scored a year-best result of 4,351 units in August.

Just outside the top 20, we have a rising #21 BMW iX1 (24,169 registrations), which is now fewer than 200 units behind its arch rival, the Mercedes EQA. The iX1 could surpass it soon.

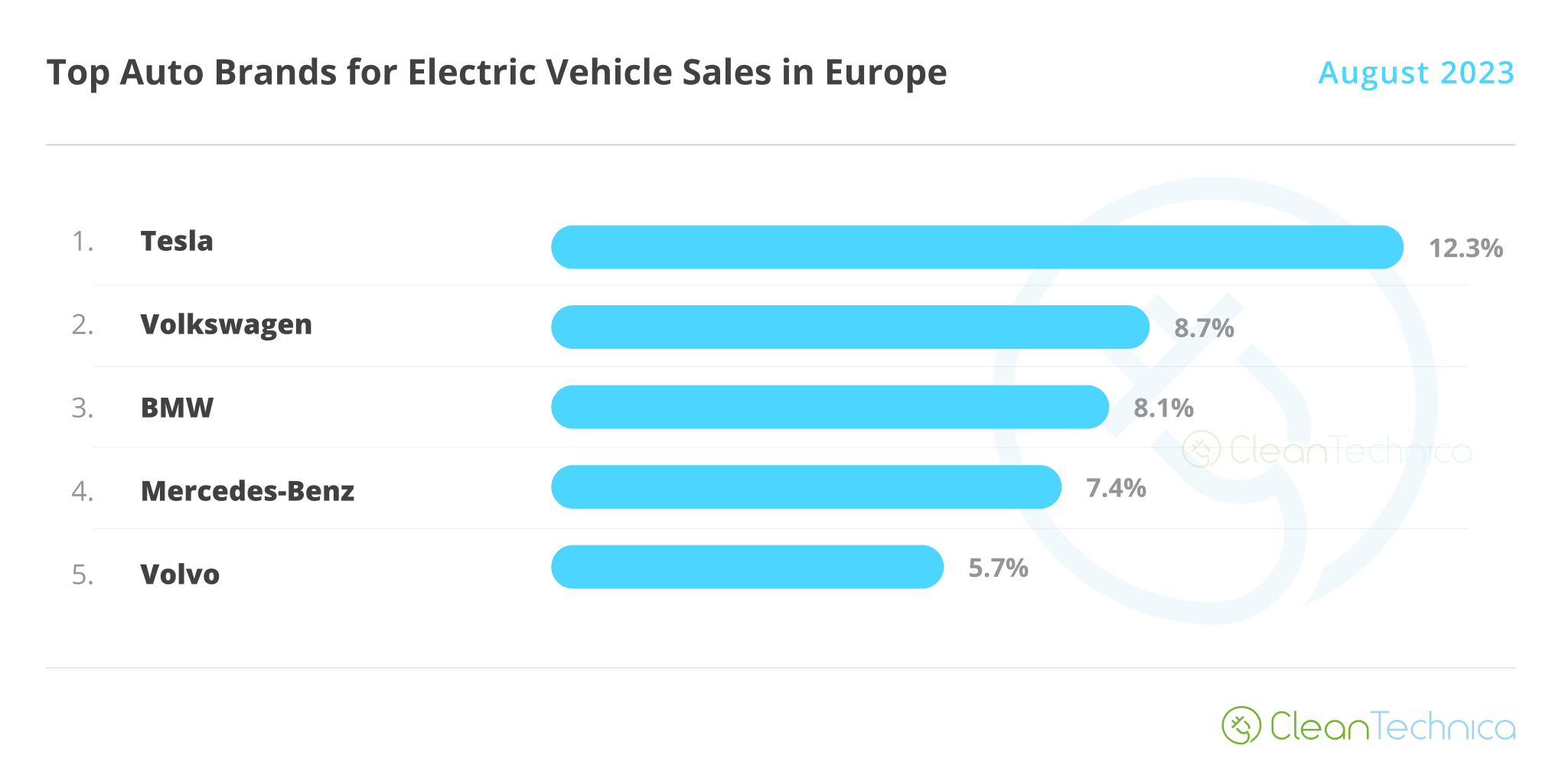

In the auto brand ranking, Tesla is leading with a comfortable 12.3% share of the plugin market. Volkswagen is in the runner-up position with 8.7%, up 0.1% compared to the previous month.

3rd placed BMW (8.1%, up from 8%) has increased its lead over Mercedes (7.4%, down from 7.5%), but with only 0.7% share separating the two, a lot can still happen.

Finally, Volvo (5.7%, down from 6.1%) is still in 5th but is losing share by the day. So, we might see #6 Audi (5.3%) surpass it sometime in the future.

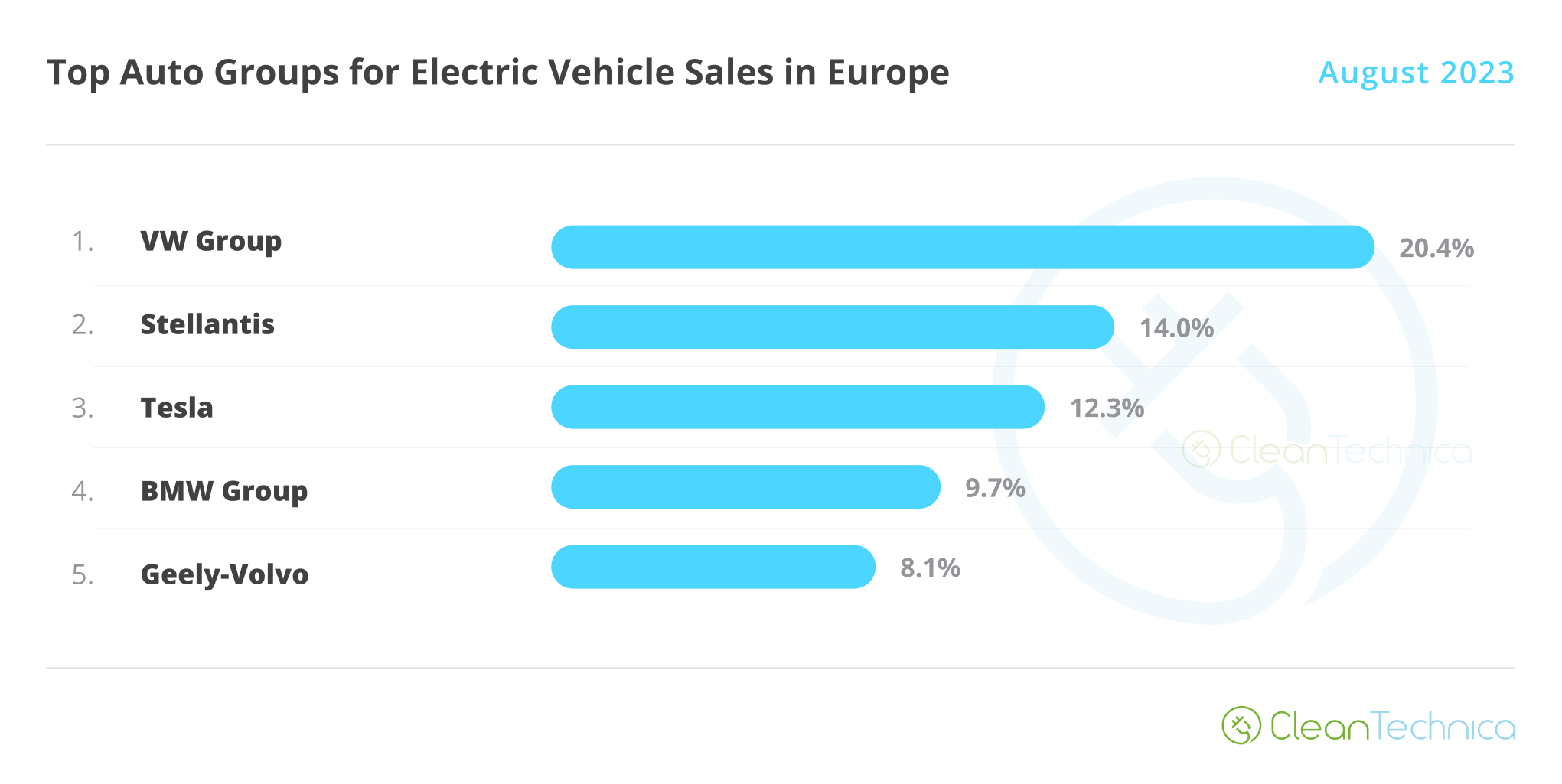

Arranging things by automotive group, Volkswagen Group was up to 20.4%, from 20.3% in July, keeping a comfortable lead over runner-up Stellantis (14%, down 0.1% from the previous month).

Off-peak Tesla stayed at 12.3%, but expect the US automaker to try and go after the #2 position in September, looking to profit from Stellantis’ apparent weakness.

Off the podium, #4 BMW Group was up to 9.7%, while former 5th placed Geely–Volvo suffered from the collective poor performances of its brands, particularly Volvo, and dropped by 0.6% to 8.1%.

This steep drop allowed both Mercedes-Benz Group (8.3%, down from 8.4%) and Hyundai–Kia (8.5%, up from 8.3%) to surpass it, sinking Geely down two positions in one month to the #7 spot. At the same time, that pulled Hyundai–Kia upwards, by two positions, into the 5th position in the table.

With battery constraints apparently resolved across its lineup, and a new Hyundai Kona EV pushing forward sales, expect the Korean OEM to continue increasing its share during the next few months.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

EV Obsession Daily!

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

Tesla Sales in 2023, 2024, and 2030

CleanTechnica uses affiliate links. See our policy here.