By Ian Foreman

The mining industry is ingrained into the fabric of Bolivia. From the inception of the pre-Inca empire, through the Spanish colonial era and throughout the country’s existence mining has been at the core of the country’s history. The cornerstone of Bolivian mining, the world-class Cerro Rico deposit, has been producing silver for over 400 years.

Historically, Bolivia’s mining industry was focused on the extraction of tin, silver, and zinc with the production of tin reaching its zenith in the 20th century. However, production has fluctuated due to market dynamics, environmental concerns, and government policies.

Historically, Bolivia’s mining industry was focused on the extraction of tin, silver, and zinc with the production of tin reaching its zenith in the 20th century. However, production has fluctuated due to market dynamics, environmental concerns, and government policies.

The country went through a tenuous relationship with the mining sector in the early 2000’s as the mining industry faced challenges related to infrastructure, safety, and sustainability, which combined to impact its competitiveness. But that appears to be gradually changing for the better since the enactment of their new Mining Law in 2014.

These changes are apparently making an impact as there are a surprising number of very large projects either underway or planned.

Bolivia’s sprawling salt flats are recognized as having the largest known lithium deposits in the world. Although the country has yet to host any commercial-scale production, the long-delayed extraction of lithium in Bolivia will change in the coming years. A consortium led by Chinese battery giant CATL is set to launch a historic industrialisation of lithium in Bolivia with more than $US 1 billion to be invested. A second mega-project led by the Russian nuclear monopoly Rosatom plans to invest US $600 million to build an industrial complex for the extraction and production of lithium carbonate.

But it is not just Bolivia’s lithium industry that is getting a huge influx of foreign capital. The US$ 546 million Mutún steel complex, which is located in Santa Cruz Department, is reportedly 67 percent complete with operations scheduled to start in 2024.

But it is not just Bolivia’s lithium industry that is getting a huge influx of foreign capital. The US$ 546 million Mutún steel complex, which is located in Santa Cruz Department, is reportedly 67 percent complete with operations scheduled to start in 2024.

In addition to that, the government has commissioned a new zinc refinery in Oruro Department with a $US 350 million loan from China. The plant, with processing capacity of 150,000 tonnes per year of zinc concentrates, will increase the added value of zinc concentrates for export and recover the value of other metals such as gallium, germanium or indium, which are in high demand in the international market. And per recent reports, the government expects that China will approve the financing of another zinc refining plant that will be located in Potosi Department.

Potosi and Oruro Departments, which cover the southwestern portion of the country that borders Chile, make up the epicentre of Bolivia’s mining industry. This region is host to the ‘cinturon estanifero boliviano’ or the Bolivian tin belt. This belt stretches for some 900 kilometres and is broken into northern and southern sections. The southern portion, or the South Mineral Belt, contains a number of world-class gold, silver, iron, zinc, tin, and lead deposits such as Cerro Rico de Potosí, San Vicente, Chorolque, Tasna and Tatasi.

Eloro Resources Ltd. [TSX: ELO; OTCQX: ELRRF; FSE: P2QM] controls a highly prospective land package totalling 483.75 square kilometres within the South Mineral Belt. The company has advanced its Iska Iska project from discovery to a maiden mineral resource estimate in just two years.

Eloro Resources Ltd. [TSX: ELO; OTCQX: ELRRF; FSE: P2QM] controls a highly prospective land package totalling 483.75 square kilometres within the South Mineral Belt. The company has advanced its Iska Iska project from discovery to a maiden mineral resource estimate in just two years.

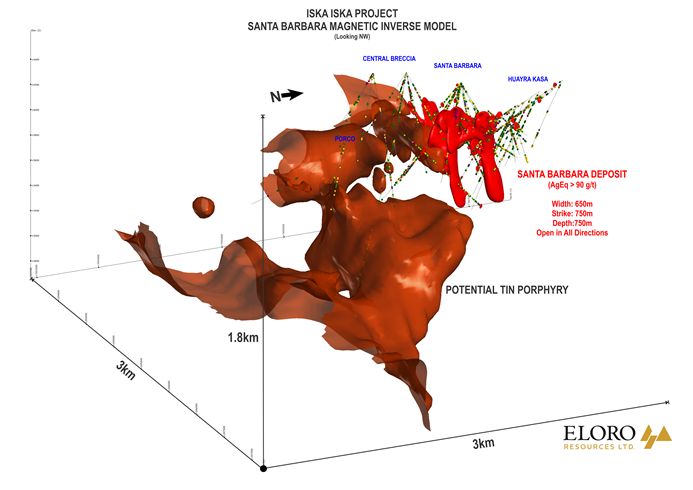

The Iska Iska project contains a major silver-tin polymetallic porphyry-epithermal complex associated with a Miocene age collapsed/resurgent caldera that was emplaced on Ordovician age rocks in conjunction with large breccia pipes, dacitic domes and hydrothermal breccias. The mineralized complex extends along strike for at least 4 kilometres with a known width of at least 2 kilometres.

Eloro focused their initial exploration on the areas surrounding artisanal mines that exploited high-grade tin veins. The first drilling was conducted in late 2020 and subsequent step-out drilling discovered two significant breccia pipes, the Santa Barbara Breccia Pipe, or SBBP, and the Central Breccia Pipe, or CBP, which are collectively called the Santa Barbara deposit. The discovery drill hole, DHK-15, returned 129.60 grams per tonne silver equivalent over an impressive 257.5 metres.

The two breccia pipes of Santa Barbara deposit are emplaced within a widespread polymetallic signature that is made up of vein sets, subsidiary vein swarms, veinlets, stockworks as well as disseminations. The main metallic minerals of economic interest are pyrite, galena, sphalerite, complex silver-rich phases, argentite electrum, native gold, chalcopyrite and cassiterite.

Eloro has released a significant number of impressive drill results from within the SBBP, CBP and the surrounding mineralized envelope, that have successfully extended the strike length of the Santa Barbara deposit to over 1,400 metres. And the deposit remains open in all directions.

Eloro has released a significant number of impressive drill results from within the SBBP, CBP and the surrounding mineralized envelope, that have successfully extended the strike length of the Santa Barbara deposit to over 1,400 metres. And the deposit remains open in all directions.

In the two years since the discovery of the SBBP and CBP, the company has completed 84,495 metres of drilling in 122 holes in the Santa Barbara target area. This significant amount of drilling allowed the company to calculate an initial resource estimate in record time. The current inferred resources at Iska Iska stand at a combined 560 million tonnes grading 0.73% zinc, 0.28% lead and 13.8 g/t silver as well as an additional 110 million tonnes grading 0.12% tin, 0.14% lead and 14.2 g/t silver.

This initial resource envisions a potential pit that is 1.4 kilometres in diameter and extends to a depth of 750 metres below the Santa Barbara hill with an overall stripping ratio of 1:1.

Preliminary tests on samples from the polymetallic and tin domains of the deposit indicate that the mineralization is amenable to ore sorting, which would remove at least 40 percent of the waste in the polymetallic domain and up to 80 percent in the tin domain. This is projected to substantially increase concentrator feed grades as well as reduce future operating costs, which would, in turn, lower the cut-off grades for the pending mineral resource estimate.

With the resource and metallurgical studies completed, Eloro plans to rapidly move toward a preliminary economic assessment.

“We are delighted to commence the PEA study on Iska Iska just 3 years after we began our initial exploration drill program. This is another major step in moving the development of Iska Iska forward”, stated Tom Larsen, CEO of Eloro. He further noted that “the overall in situ value based on the net NSR values stated [in initial mineral resource estimate] is approximately US$ 6.8 billion of which US$ 3.3 billion is in the shallower high-grade zone in the potential open pit. This augers well for the potential for early payback on the project.”

In conjunction with the PEA they are planning additional definition drilling to further expand the higher-grade zones of the breccia pipes and recent induced polarization/resistivity surveys have outlined several promising drill targets west of Santa Barbara.

But they won’t be slowing down with their exploration either as they are building a resource at Casiterita, located only 2 kilometres south of the Santa Barbara deposit, and they have identified a number of other enticing targets within the property, which on their own, could keep the company busy for years.