Ramelius Resources’ potential $2.4 billion acquisition of Spartan Resources has set the mining industry abuzz. But how will it shape the country’s gold sector?

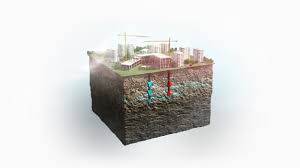

Spartan Resources is the sole owner of the Dalgaranga gold project in Western Australia, which comprises a fully developed gold mining operation, a carbon-in-leach processing facility, a camp and airstrip, and an extensive landholding with potential for new gold discoveries.

Dalgaranga currently has a total mineral resource estimate (MRE) of 15.9 million tonnes (Mt) at 5.6 grams per tonne (g/t) of gold for 2.9 million ounces (Moz), with the high-grade underground Never Never and Pepper MRE totalling 7.7Mt at 9.32g/t for 2.3Moz.

By acquiring Spartan, Ramelius’ portfolio of gold mines and projects is expected to hold a combined group MRE of 12.1Moz and an ore reserve of 2.6Moz.

The transaction also highlights geographical synergies between both companies.

Dalgaranga is located 65km north-west of Mt Magnet, the mining town in which Ramelius owns and operates a gold production hub.

To aid Mt Magnet in sustaining a long production life, Ramelius recently updated its mine plan for the operation, which will see 1.5Moz produced in the next 10.5 years.

Ramelius is working towards a final investment decisions for the Eridanus cut-back, which replaces an earlier underground option at Mt Magnet, and the Rebecca-Roe gold project.

Bringing Dalgaranga under Ramelius’ fold is expected to only further enhance the quality, scale and grade of the existing Mt Magnet operation.

“Ramelius is delighted to be combining with Spartan, which will see Ramelius’ Mt Magnet production hub supercharged by the integration of Spartan’s high-grade Dalgaranga mineral resource,” Ramelius managing director Mark Zeptner said.

“The combination will see Mt Magnet deliver higher ounces, at higher grade, with higher margins. With the Spartan effect, Ramelius has a vision for the combined group to be a (more than) 500,000oz (per annum) producer in FY30 (the 2029–30 financial year).

“In addition to the incredible production potential combining these two companies delivers, we are also excited to see what the ongoing exploration efforts at Dalgaranga can deliver for the benefit of the combined group’s shareholders.”

Once the scheme has been implemented, Spartan shareholders will own approximately 39.5 per cent of the combined entity and Ramelius shareholders will own the balance, with the combined group expected to have a pro-forma market capitalisation of $4.2 billion.

Other benefits of the acquisition for Spartan shareholders include:

- the accelerated and de-risked development of Dalgaranga

- access to Ramelius’ operational team and expertise

- operational diversification through access to Ramelius’ asset portfolio across WA

- exposure to Ramelius’ cash flow generation and track record of paying dividends

- access to Ramelius’ strong balance sheet, with over $500 million in net cash.

“This is a highly attractive and transformational combination which we believe represents a great outcome for Spartan shareholders,” Spartan executive chairman Simon Lawson said.

“The combined group will be positioned as a leading mid-tier ASX-listed gold producer with an enviable and robust growth pipeline including a significantly de-risked development pathway for Dalgaranga underpinned by Ramelius’ robust balance sheet, strong cash generation and development expertise.

“With the expected commencement of operations at Dalgaranga we expect the enlarged Mt Magnet-Dalgaranga hub to cement itself as a long-life and low-cost mining operation.”

The news of the transaction follows the gold price reaching an all-time high of $US2790.07 ($4406) in October 2024, with the price remaining steady between $US2500–$US3000 ever since.

The gold price has shown no signs of slowing down, making this the perfect opportunity for Ramelius to expand its Mt Magnet operation through a key acquisition.

A meeting to approve the scheme is expected to be held by Spartan shareholders in mid-July. If approved by Spartan shareholders and the court, the scheme will be implemented shortly thereafter.

The scheme has been unanimously recommended by the Spartan board.

Subscribe to Australian Mining and receive the latest news on product announcements, industry developments, commodities and more.