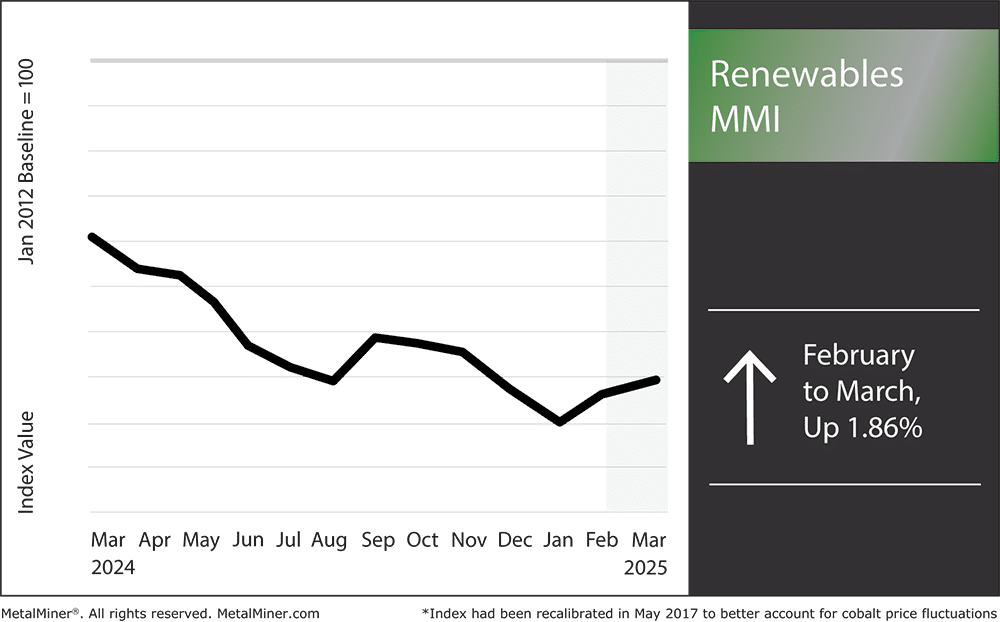

The Renewables MMI (Monthly Metals Index) moved sideways month over month, increasing a slight 1.86%. Meanwhile, renewable energy projects could face some challenges from a combination of tariffs and changing Federal policies.

Trump Administration’s Energy Policies Reshape the Renewable Sector

Since taking power in January, the Trump administration has reshaped the U.S. renewable energy landscape by introducing some significant policy changes. So far, the White House has declared a national energy emergency, imposed tariffs on critical metals and rolled back environmental regulations.

Get valuable market trends, price alerts and commodity news, supporting your business in mitigating the impact of fluctuating metal prices. Register for MetalMiner’s free weekly newsletter.

Trump Declares National Energy Emergency

On January 20, 2025, President Trump signed an executive order declaring a national energy emergency. The move aims to accelerate fossil fuel development and eliminate regulatory barriers that slow energy infrastructure projects.

Supporters claim this move strengthens U.S. energy exports and creates jobs in the oil, gas and coal industries. However, critics argue that the decision prioritizes fossil fuels over renewables and undermines environmental protections.

Impress your executive team. Decode how renewable energy market volatility can impact earnings by utilizing metals price indexes to your advantage. Learn how here.

New Tariffs Drive Up Renewable Energy Costs

The administration also implemented a 25% tariff on imported steel and aluminum to protect domestic producers. While the policy aims to boost U.S. manufacturing, it has raised some costs for industries that rely on these metals, including the renewable energy sector. For instance, wind turbine and solar panel manufacturers now face higher material expenses, which could slow renewable energy expansion.

The Trump administration also revoked pollution control rules that limited soot emissions from coal-fired power plants. By reversing these restrictions, the White House ensured older, high-emission plants can remain operational without costly upgrades. Industry advocates claim the decision supports the coal sector, but environmental groups warn that increased emissions could harm public health.

Take control of metal price volatility with customized forecasts—pay only for the metals that impact your bottom line with MetalMiner Select. Learn more.

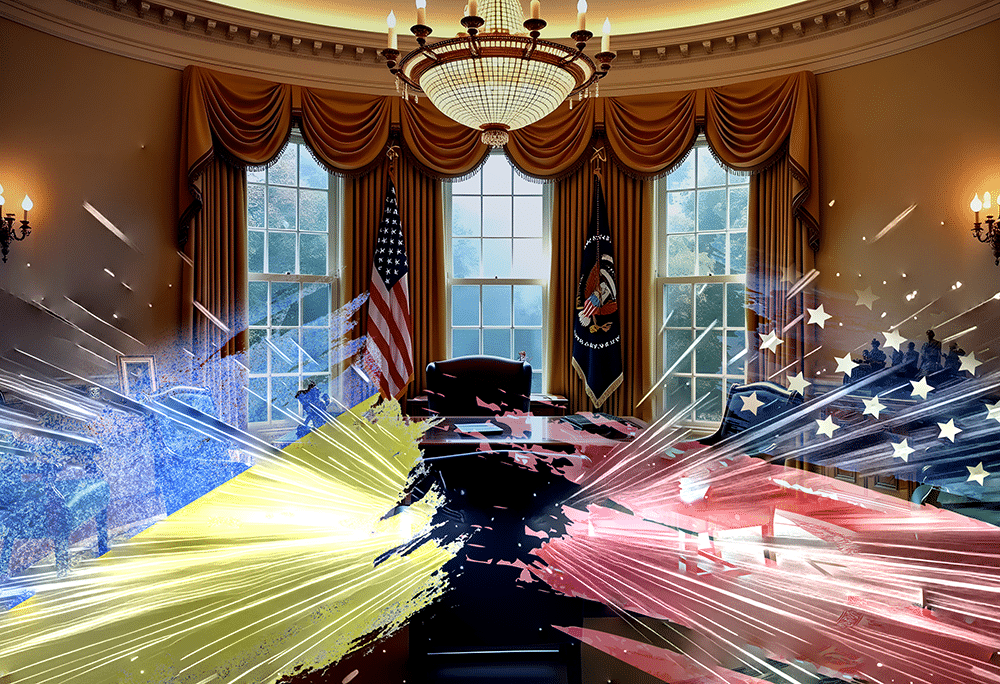

High-Stakes Negotiations Over Ukraine’s Mineral Reserves

In February 2025, U.S. President Donald Trump and Ukrainian President Volodymyr Zelenskyy engaged in critical discussions at the Oval Office in Washington, D.C. The meeting primarily focused on a potential deal that would allow the U.S. to tap into Ukraine’s vast critical mineral wealth. In exchange, Ukraine sought continued U.S. military aid amid its ongoing conflict with Russia.

Ukraine holds significant reserves of rare earth elements and lithium, with estimates valuing these untapped resources at approximately $500 billion.

Tensions Rise in Oval Office Talks

The negotiations took a bad turn during the televised meeting between the two leaders. As discussions progressed, Trump pressed for broader U.S. access to Ukraine’s mineral deposits.

Zelenskyy pushed back, stressing the need for fair terms and expressing concerns over the implications for Ukraine’s sovereignty. The talks ultimately collapsed without a formal agreement, prompting the temporary suspension of U.S. military aid to Ukraine.

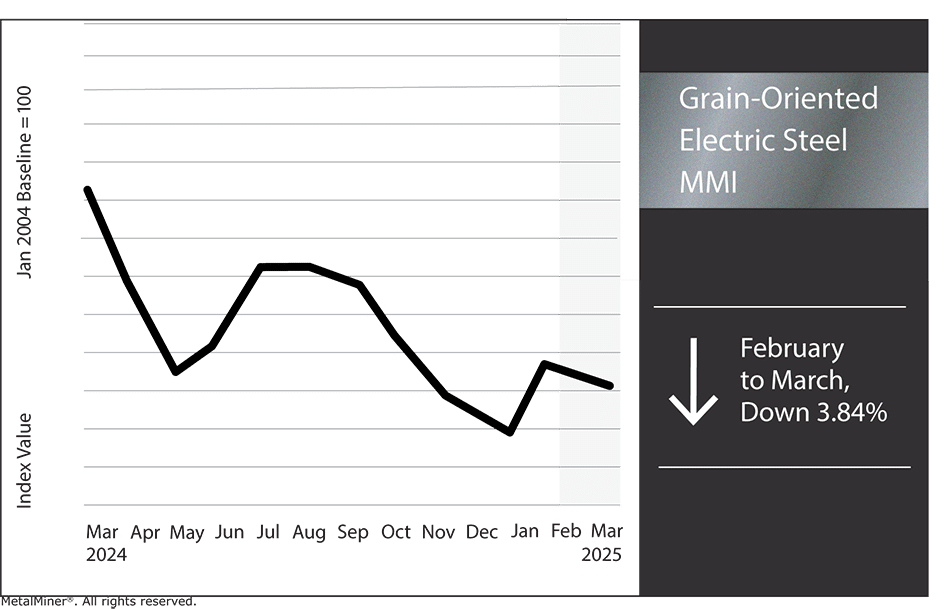

Grain-Oriented Electrical Steel MMI

Grain-Oriented Electrical Steel (GOES MMI) dropped slightly month-over-month. In total, prices fell by 3.84%.

Renewables MMI: Noteworthy Prices Shifts

Enjoy this article? MetalMiner’s monthly MMI report gives you price updates, market trends and industry insight for renewables, GOES and 8 other metal industries. Sign up for free.

- Chinese cobalt prices rose by 3.15% to $21.39 per kilogram.

- Silicon prices moved sideways, dropping 2.84% to $1,482.82 per metric ton.

- U.S. steel plate prices rose by 8.31% to $938 per short ton.

- Lastly, neodymium prices rose by 7.04% to $75,231.26 per metric ton.