Financial reporting segment performance

London, March 06, 2025, (Oilandgaspress) ––The profit for the year ended 31 December 2024 attributable to bp shareholders was $0.4 billion, compared with $15.2 billion in 2023. Adjusting for inventory holding losses, RC profit was $0.8 billion, compared with $16.2 billion in 2023. After adjusting RC profit for a net adverse impact of items, which bp has classified as adjusting (adjusting items) of $8.2 billion (on a post-tax basis), underlying RC profit for the year ended 31 December 2024 was $8.9 billion. The result reflected lower refining margins, lower realizations, a lower gas marketing and trading result and a lower oil trading contribution, partly offset by lower taxation.

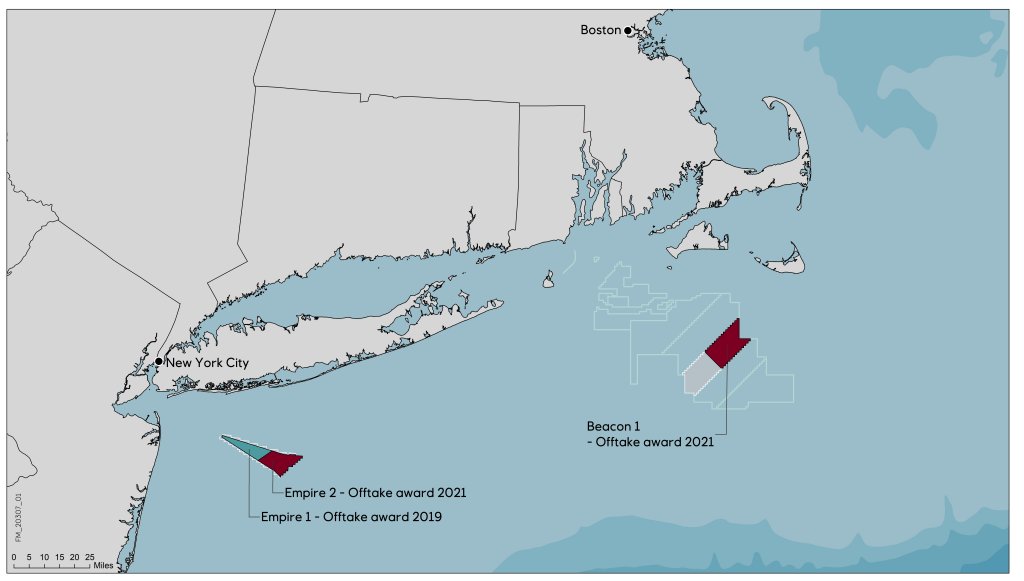

At 31 December 2024, the group’s reportable segments were gas & low carbon energy, oil production & operations and customers & products. Each is managed separately, with decisions taken for the segment as a whole, and represents a single operating segment that does not result from aggregating two or more segments. Gas & low carbon energy Comprises our gas & low carbon energy businesses. Our gas business includes regions with upstream activities that predominantly produce natural gas, integrated gas and power, and gas trading. Our low carbon business includes solar, offshore and onshore wind, hydrogen and carbon capture and storage (CCS), and power trading. Power trading includes trading of both renewable and non-renewable power.

Highlights :

$3.6bn replacement cost (RC) profit before interest and tax (2023 $14.1bn)

underlying RC profit before interest and tax« $6.8bn (2023 $8.7bn)

Oil production & operations

Comprises regions with upstream activities that predominantly produce crude oil, including bpx energy.

$10.8bn RC profit before interest and tax (2023 $11.2bn)

$11.9bn underlying RC profit before interest and tax (2023 $12.8bn)

Customers & products

Comprises customer-focused businesses, which include convenience and retail fuels, EV charging, as well as Castrol, aviation and B2B and

midstream. It also includes our products businesses, refining & oil trading, as well as our bioenergy businesses.

$(1.6)bn RC loss before interest and tax (2023 profit $4.2bn)

$2.5bn underlying RC profit before interest and tax (2023 $6.4bn)

Other businesses & corporate

Comprises technology; bp ventures; our corporate activities and functions; and any residual costs of the Gulf of America oil spill.

$(1.0)bn RC loss before interest and tax (2023 loss $(0.9)bn)

$(0.6)bn underlying RC loss before interest and tax (2023 loss $(0.9)bn)

2024 at a glance

As at 31 December 2024

Employees

100,500 (2023 87,800)

Countries of operation

61 (2023 61)

2.4 million barrels of oil equivalent (2023 2.3mmboe/d)

– upstream« production

39,000 electric vehicle charge points (2023 >29,000)

21,200 retail sites (2023 21,100)

Performance

$0.4bn profit for the year attributable to bp shareholders (2023 $15.2bn)

$8.9bn underlying replacement cost (RC) profit (2023 $13.8bn)

95.2% bp-operated upstream plant reliability (2023 95.0%)

94.3% bp-operated refining availability (2023 96.1%)

2,950 strategic convenience sites (2023 2,850)

8.2GW developed renewables to FID (net) (2023 6.2GW)

$6.17/boe upstream unit production costs (2023 $5.78/boe)

Safety and sustainability

38 tier 1 and 2 process safety events (2023 39)

33.6MtCO2e GHG emissions – operational control (2023 32.1MtCO2e).

Renewables & power: In April 2024 we announced that we took ownership of Equinor’s 50% stake in the Beacon Wind US offshore wind projects. In December we announced that bp and JERA Co., Inc will, subject to regulatory approvals and closing conditions being met, join forces to create a global wind joint venture

Information Source: . Read More

Oil and gas press covers, Energy Monitor, Climate, Gas,Renewable, Oil and Gas, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,