Including this case, Evergy’s Kansas electric rates have only increased 1% since 2017

KANSAS CITY, Mo.–(BUSINESS WIRE)–Evergy, Inc. (NASDAQ: EVRG) today announced that a unanimous agreement has been reached with parties to its Kansas rate case. The agreement was filed Friday with the Kansas Corporation Commission and must be approved by the state’s Commissioners, who are scheduled to issue an order in December.

“This settlement is a very strong result for our customers,” said David Campbell, Evergy president and chief executive. “As a result of this settlement, average retail rates in Kansas will have increased just one percent, cumulatively, since 2017. And Evergy will recover investments made to improve the electric grid and build a cleaner, more reliable energy future for our Kansas customers, all while improving our record of regional rate competitiveness.”

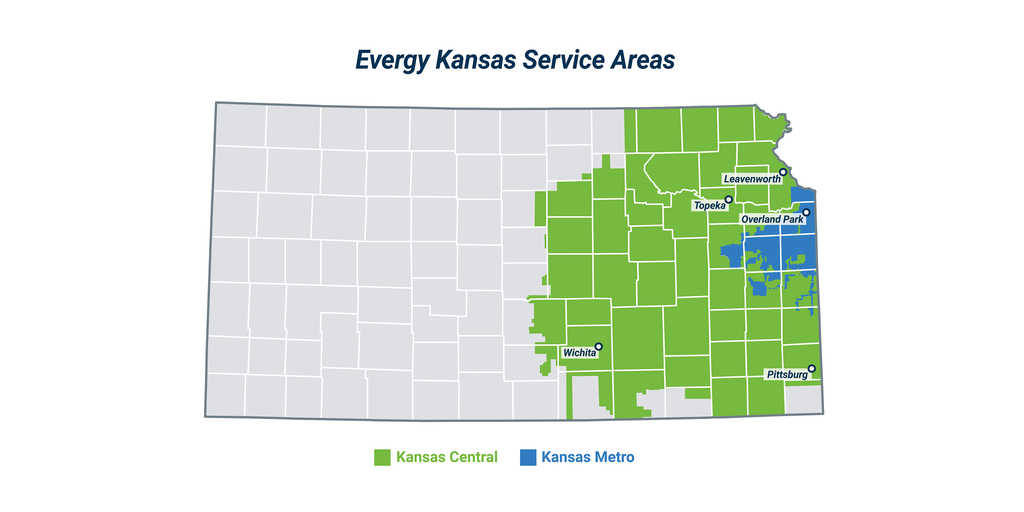

If the agreement is approved, Evergy Kansas Central will implement a net increase of $74.0 million and Evergy Kansas Metro will have a net decrease of $32.9 million. Costs for residential customers in Evergy Kansas Central, which includes Topeka, Pittsburg, Wichita, Hutchinson and other communities in the eastern third of the state, will increase about 4.05%, which translates to an increase of approximately $4.64 per month for the average residential customer. For Evergy Kansas Metro, which includes Lenexa, Overland Park and other communities near the Kansas City metro area, rates for residential customers will decrease about 4.75%, and the average residential customer will pay about $6.07 less per month.

Significant Improvement of Regional Electric Rate Competitiveness

Five years ago, regional utilities Westar Energy and KCP&L merged to form Evergy with the commitment to become a more efficient energy company, sharing those benefits with customers and continuing to provide reliable and affordable electrical service to the communities we serve in Kansas and Missouri. By combining companies, Evergy has saved more than $1 billion in operating costs in the first five years since the merger. These savings have allowed the company to offset steep inflationary pressures in the broader economy while at the same time undertaking significant investments to enhance electrical system reliability.

Kansas customers have received significant benefits from the merger, as more than $232 million in merger credits were returned to customers. And despite record U.S. inflation of more than 21.5% since 2017, Evergy’s Kansas rates have remained well under inflation and steady over the same period. Including today’s rate settlement, Evergy’s Kansas rates have increased only 1% since 2017. That is in contrast with neighboring states, where during the same period regional rates increased 12.7%.

Competitive Rates Bolster Economic Development in Kansas

Economic development is vitally important to Evergy. Our business is local. If Kansas does not thrive and grow, Evergy does not thrive and grow. Evergy is focused on having competitive electric rates to enable economic investment and development in Kansas. This settlement advances regional rate competitiveness and will bolster the already strong economic development efforts over the last six years.

Since 2019, Evergy has played a role in attracting 73 major economic development projects to our service territory in Kansas and Missouri. Of those projects, 47 of them (or approximately 64%) chose to invest in Kansas. This represents more than 12,000 jobs created, $7.3 billion in investment and major successes in attracting businesses in emerging market segments including new energy technologies, re-shored and advanced manufacturing, as well as major data centers. These projects are energy-intensive users where electric rates, cost competitiveness and reliability are primary considerations in choosing where to locate.

About Evergy

Evergy, Inc. (NASDAQ: EVRG), serves 1.7 million customers in Kansas and Missouri. Evergy’s mission is to empower a better future. Our focus remains on producing, transmitting and delivering reliable, affordable, and sustainable energy for the benefit of our stakeholders. Today, about half of Evergy’s power comes from carbon-free sources, creating more reliable energy with less impact to the environment. We value innovation and adaptability to give our customers better ways to manage their energy use, to create a safe, diverse and inclusive workplace for our employees, and to add value for our investors. Headquartered in Kansas City, our employees are active members of the communities we serve.

For more information about Evergy, visit us at www.evergy.com.

Forward Looking Statements

Statements made in this document that are not based on historical facts are forward-looking, may involve risks and uncertainties, and are intended to be as of the date when made. Forward-looking statements include, but are not limited to, statements relating to Evergy’s strategic plan, including, without limitation, those related to earnings per share, dividend, operating and maintenance expense and capital investment goals; the outcome of legislative efforts and regulatory and legal proceedings; future energy demand; future power prices; plans with respect to existing and potential future generation resources; the availability and cost of generation resources and energy storage; target emissions reductions; and other matters relating to expected financial performance or affecting future operations. Forward-looking statements are often accompanied by forward-looking words such as “anticipates,” “believes,” “expects,” “estimates,” “forecasts,” “should,” “could,” “may,” “seeks,” “intends,” “proposed,” “projects,” “planned,” “target,” “outlook,” “remain confident,” “goal,” “will” or other words of similar meaning. Forward-looking statements involve risks, uncertainties and other factors that could cause actual results to differ materially from the forward-looking information.

In connection with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the Evergy, Inc., Evergy Kansas Central, Inc. and Evergy Metro, Inc. (collectively the Evergy Companies) are providing a number of risks, uncertainties and other factors that could cause actual results to differ from the forward-looking information. These risks, uncertainties and other factors include, but are not limited to: economic and weather conditions and any impact on sales, prices and costs; changes in business strategy or operations; the impact of federal, state and local political, legislative, judicial and regulatory actions or developments, including deregulation, re-regulation, securitization and restructuring of the electric utility industry; decisions of regulators regarding, among other things, customer rates and the prudency of operational decisions such as capital expenditures and asset retirements; changes in applicable laws, regulations, rules, principles or practices, or the interpretations thereof, governing tax, accounting and environmental matters, including air and water quality and waste management and disposal; the impact of climate change, including increased frequency and severity of significant weather events and the extent to which counterparties are willing to do business with, finance the operations of or purchase energy from the Evergy Companies due to the fact that the Evergy Companies operate coal-fired generation; prices and availability of electricity and natural gas in wholesale markets; market perception of the energy industry and the Evergy Companies; the impact of future Coronavirus (COVID-19) variants on, among other things, sales, results of operations, financial condition, liquidity and cash flows, and also on operational issues, such as supply chain issues and the availability and ability of the Evergy Companies’ employees and suppliers to perform the functions that are necessary to operate the Evergy Companies; changes in the energy trading markets in which the Evergy Companies participate, including retroactive repricing of transactions by regional transmission organizations (RTO) and independent system operators; financial market conditions and performance, current disruptions in the banking industry, including changes in interest rates and credit spreads and in availability and cost of capital and the effects on derivatives and hedges, nuclear decommissioning trust and pension plan assets and costs; impairments of long-lived assets or goodwill; credit ratings; inflation rates; effectiveness of risk management policies and procedures and the ability of counterparties to satisfy their contractual commitments; impact of physical and cybersecurity breaches, criminal activity, terrorist attacks, acts of war and other disruptions to the Evergy Companies’ facilities or information technology infrastructure or the facilities and infrastructure of third-party service providers on which the Evergy Companies rely; impact of the Russian, Ukrainian conflict on the global energy market, ability to carry out marketing and sales plans; cost, availability, quality and timely provision of equipment, supplies, labor and fuel; ability to achieve generation goals and the occurrence and duration of planned and unplanned generation outages; delays and cost increases of generation, transmission, distribution or other projects; the Evergy Companies’ ability to manage their transmission and distribution development plans and transmission joint ventures; the inherent risks associated with the ownership and operation of a nuclear facility, including environmental, health, safety, regulatory and financial risks; workforce risks, including those related to the Evergy Companies’ ability to attract and retain qualified personnel, maintain satisfactory relationships with their labor unions and manage costs of, or changes in, wages, retirement, health care and other benefits; disruption, costs and uncertainties caused by or related to the actions of individuals or entities, such as activist shareholders or special interest groups, that seek to influence Evergy’s strategic plan, financial results or operations; the impact of changing expectations and demands of the Evergy Companies’ customers, regulators, investors and stakeholders, including heightened emphasis on environmental, social and governance concerns; the possibility that strategic initiatives, including mergers, acquisitions and divestitures, and long-term financial plans, may not create the value that they are expected to achieve in a timely manner or at all; difficulties in maintaining relationships with customers, employees, regulators or suppliers; and other risks and uncertainties.

This list of factors is not all-inclusive because it is not possible to predict all factors. You should also carefully consider the information contained in the Evergy Companies’ other filings with the Securities and Exchange Commission (SEC). Additional risks and uncertainties are discussed from time to time in current, quarterly and annual reports filed by the Evergy Companies with the SEC. Each forward-looking statement speaks only as of the date of the particular statement. The Evergy Companies undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

Contacts

Investor Contact:

Pete Flynn

Director, Investor Relations

Phone: 816-652-1060

Media Contact:

Gina Penzig

Director, Corporate Communications

Phone: 785-508-2410

[email protected]

Media line: 888-613-0003