Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

As shared recently in an article on the largest ever electric mobility parade on the African continent, held last week in Nairobi, Kenya, a lot of progress has been made of the last 7 or so years in Kenya’s electric mobility sector. After several years of intensive research and development, including several iterations of their products following multiple pilot phases, a lot of the startups involved in the development and local assembly of electric motorcycles as well as 3-wheelers are starting to scale up full commercial production of their products. But as we all know, and as famously stated by Elon Musk several times, prototypes are easy, but ramping up production is hard! Working capital and other funding constraints are some of the main issues holding back the growth of the sector.

To help catalyze the ramp-up of production and penetration of electric vehicles, starting in East Africa, US-based GreenMax Capital Group Ltd., a specialized advisory and fund management firm focused exclusively on the clean energy sector in emerging markets, and Tradeable, which is focused on promoting trade into Africa, trade out of Africa, intra-Africa trade and structured trade finance, have announced the launch of their partnership to launch GreenShift Africa, a trade facilitation platform designed to accelerate the penetration of EVs in Africa. The announcement was made at the Africa Climate Summit Deal Room last week.

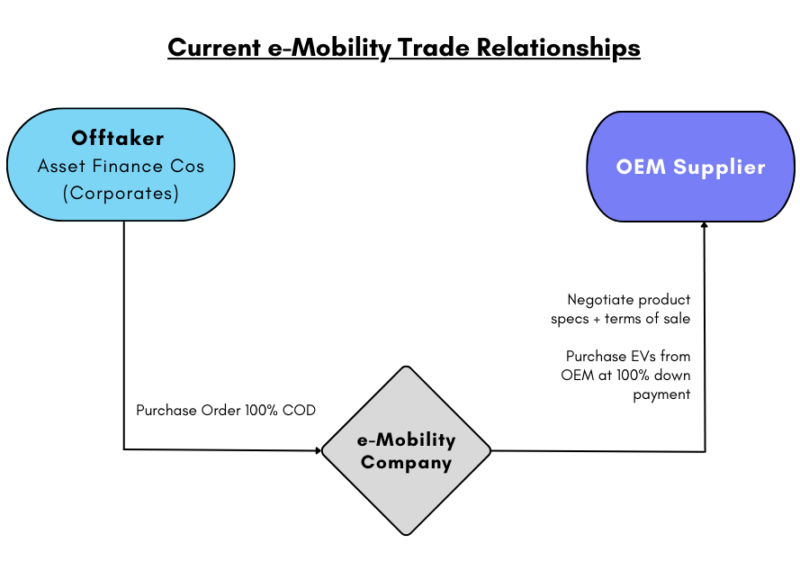

GreenShift Africa offers a trade facilitation program to address a common challenge among most e-mobility companies in Africa. Right now, the most frequent approach of these companies to deliver 2- and 3-wheeler bicycles, motorbikes, and scooters, as well as buses to the market is through a sale to an offtaker. GreenMax says that this offtaker can be an AssetFinCo, such as Watu, Mogo, M-KOPA, BBOXX, etc., that then offers the EVs to individuals or corporate buyers under an extended payment plan, a direct corporate buyer, or a bus company/SACCO.

GreenMax says that unfortunately, at this early stage of market development, these offtakers have sufficient leverage to insist on paying only 100% COD. “The e-Mobility company’s OEM suppliers, however, generally require 100% down payment prior to shipping. With limited equity raised (and most of that capital deployed to support ongoing product development and operations), e-Mobility companies have little cash available as working capital to purchase an inventory of EVs and batteries. This severely constrains growth potential at this critical time where all companies are vying for early market share.”

Therefore, GreenShift has been set up to help solve this problem. Through GreenShift Africa, a standard trading arrangement can be delivered to leverage on the e-mobility company’s limited working capital and offtaker relationships to substantially increase the number of EVs and components they can import.

Therefore, GreenShift has been set up to help solve this problem. Through GreenShift Africa, a standard trading arrangement can be delivered to leverage on the e-mobility company’s limited working capital and offtaker relationships to substantially increase the number of EVs and components they can import.

GreenShift Africa deploys Tradeable’s trade facilitation platform to pay the e-mobility companies’ OEMs up-front as required, while selling to the local resellers on differed payment terms that will be on a Delivered Duty Paid basis. The trade facilitation program takes the e-mobility company’s available cash as a down payment covering a portion (10-30% based on assessment of risk) of the order value.

GreenShift Africa deploys its own capital to multiply the purchasing power of the transaction. “We earn a margin on transaction which is determined depending on the size and metrics of the deal. While we prefer deal sizes of at least $1M in value, to help kick-start the e-mobility business, we are prepared to do transactions as low as $200-300K, particularly to support African-owned companies to compete and become first movers. GreenShift Africa’s engagement in each transaction is underwritten by a Letter of Credit issued by a local bank which backs the payment from the e-mobility company to Tradeable on the agreed upon terms.”

Using the resources of GreenMax and Tradeable, GreenShift Africa’s pilot phase expects to support the importation of $5M worth of EVs and batteries to East Africa across the next 6 months. “Our goal is to secure $50 million in blended capital over the next 24 months (2023-2025) to support expansion of the program and decrease financing costs opportunities faced by each e-mobility enterprise.”

They add that GreenShift Africa’s planned $50 million investment in the e-mobility sector in East Africa is set to make a significant positive impact on several United Nations Sustainable Development Goals (SDGs 7, 8, 11 and 13), bringing tangible benefits to people in the region.

They expect to support the accelerated adoption of EV solutions to result in:

- 75,000 EVs imported and sold in East Africa

- $150 million of green trade facilitation funding to e-mobility companies

- 150,000 direct and indirect jobs supported (direct: riders, and indirect: assembly lines)

- 438,000 tons of C02 avoided

GreenMax adds that as the e-mobility space is a high-priority area for banks to fulfill their green finance goals, there is a strong willingness to engage. While of course each presented transaction will be reviewed on its own merits, banks indicate that they will require third party guarantees. GSA will work with Third Party Partial Credit Guarantee Providers in order to unlock the Letter of Credits required by Tradeable. Banks that Tradeable typically works with in East Africa include ABSA, Cooperative Bank, Credit Bank, Equity Bank, Ecobank, I&M Bank, Family Bank, Middle East Bank and NCBA.

Images courtesy of GreenMax

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

EV Obsession Daily!

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

Tesla Sales in 2023, 2024, and 2030

CleanTechnica uses affiliate links. See our policy here.