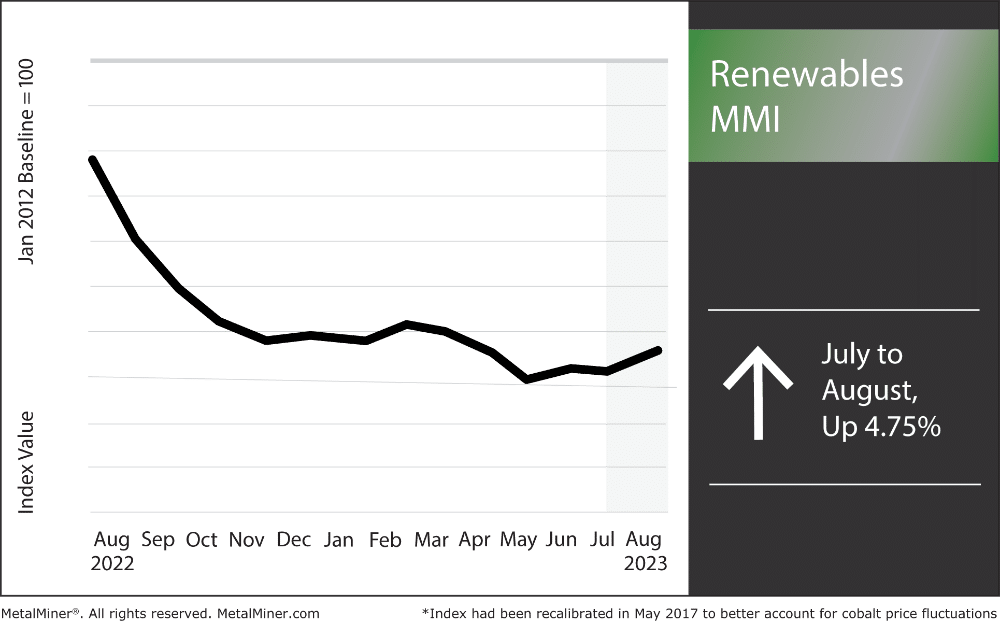

Since April, the Renewables MMI (Monthly Metals Index) has been in a tight sideways trend. Falling demand and slumping material production for battery metals in China, as well as an oversupply of materials continue to exert bearish pressure on the index. However, month-over-month, the index finally broke its sideways trend, rising by 4.75%. Chinese stimulus efforts provided the index with significant bullish sentiment. Additionally, renewable projects within the U.S. remain productive thanks to some new provisions to the Inflation Reduction Act released on May 31. The ramifications of these factors on 2024 metal prices will be released in MetalMiner’s Annual 2024 Outlook, releasing next month.

However, the index continues to battle with some bearish sentiment for the time being. Silicon, in particular, remains in high supply, exerting some long-term bearish pressure on the index. Battery metals continue to flow out places like Indonesia and China due to the ongoing green energy transition. Finally, steel plate remains robust for the moment, and cobalt is on the rise, having perhaps found a bottom close to its five-year low.

Setbacks in the U.S. Clean Energy Transition

The U.S. continues to transition to clean energy, but there are challenges and setbacks to consider. One challenge is the long permitting process for renewable energy projects. Indeed, Lawrence Berkeley National Laboratory data shows a backlog of renewable operations awaiting funding. This backlog continues to cause delays and roadblocks in constructing sustainable energy infrastructure. As noted on MetalMiner Insights, this could contribute to falling demand and price drops for metals like steel and aluminum. To accelerate the adoption of sustainable energy projects, we need to streamline the approval process and remove regulatory obstacles.

Another challenge is the potential environmental impact of hydrogen production. For example, studies show that hydrogen leaking into the atmosphere could contribute to climate change. Therefore, it’s crucial that the U.S. carefully consider the ecological impact of producing hydrogen on a large scale. Specifically, we must manufacture hydrogen-driven systems correctly, securely, and with high-quality materials to avoid any negative impacts on the atmosphere.

Hurdles to “Going Green”

New legislation mandates that the Interior Department make public lands available for oil and gas drilling. Clearly, this could have detrimental effects on the ecosystem and contribute to climate change. In fact, many scientists are concerned about the potential for exploiting so much land.

This highlights how the United States’ shift to sustainable energy requires juggling competing goals and interests. Indeed, building clean energy infrastructure takes on different faces depending on which political party is in power. It can also be difficult to strike a balance between the requirement for interstate power lines, the building of power plants, and the development of renewable energy, particularly when it comes to appeasing all political parties. It is, therefore, crucial to establish bipartisan support for renewable energy measures.

If you regularly purchase metals used to construct renewable energy sources, make sure to time your purchases with expert sourcing advice from the Monthly Metals Outlook report. View a free sample and subscribe.

A recent Wall Street Journal article highlighted an intriguing topic: many Western nations are sourcing battery metals, a key element in the shift to green energy, from locations other than China. According to the WSJ, there is a race among these nations to control electric vehicle supply chains that lead to Africa. The Democratic Republic of the Congo already serves as the primary global source of cobalt. However, metals like silicon primarily come from China through imports. Nevertheless, the U.S. continues to explore alternatives beyond China to source metals critical to its transition to renewable energy.

For example, Indonesia produces much of the world’s nickel, a versatile mineral used in many sustainable energy technologies and battery metals. Indonesia also hosts a significant portion of the world’s nickel reserves, which is sure to put the country at the forefront of the renewable market in the coming years.

When sourcing nickel and other battery metals, make sure to follow the top 5 cost-saving sourcing tactics.

Some countries, including Vietnam and Myanmar, possess high reserves of rare earths. Despite this, most global rare earth element production remains concentrated in China. Nonetheless, these Asian countries have substantial sourcing potential for countries looking to acquire rare earth elements.

As MetalMiner previously reported, Australia holds a 52% market share of lithium production. Lithium is crucial for manufacturing rechargeable batteries for smartphones, laptops, and electric vehicles. As a result, Australia, along with Chile, continues to be a dependable source of raw lithium for countries around the world. Additionally, there are expectations that mines for elements like neodymium, used in wind turbines, will commence operations in both North Carolina and Canada.

It’s important to note that only a few nations produce a significant amount of energy transition minerals and battery metals. As a result, any changes to their institutions, rules, or policies could significantly complicate supply expansion.

MetalMiner covers macroeconomic shifts, political obstacles, and other factors directly impacting metal prices in its free weekly newsletter.

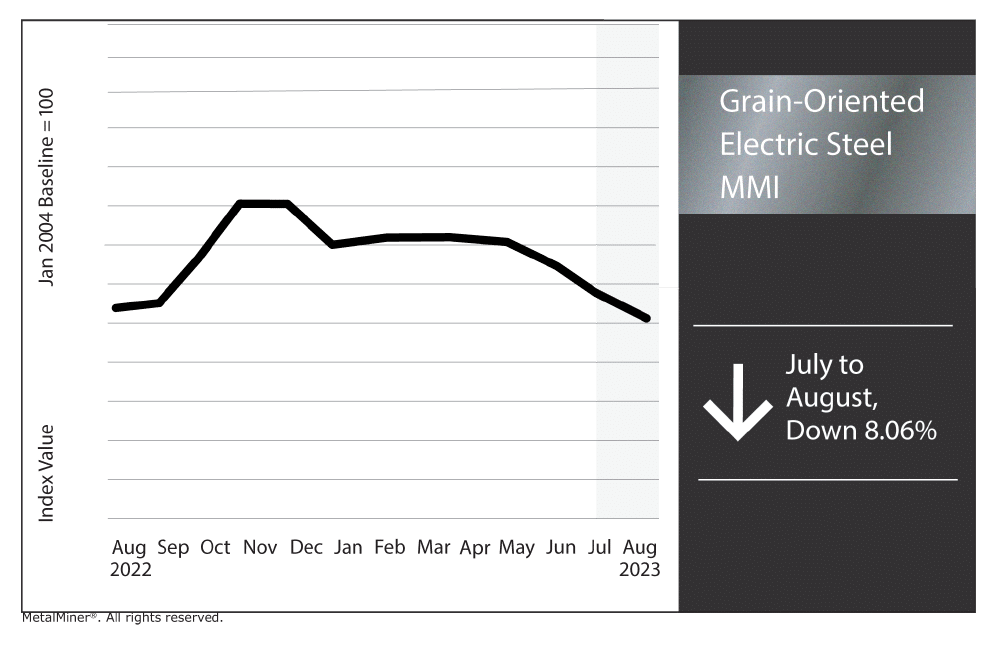

Grain-Oriented Electrical Steel MMI

The GOES MMI experienced a significant drop month-over-month, falling by 8.06%. Indeed, weaker steel demand continues to have significant impacts on GOES. Meanwhile, low Chinese demand and stagnant infrastructure remain a problem, especially on GOES specifically sourced/manufactured within China. Ultimately, weaker commodity prices over the past year continue to weigh heavily on the index. That said, GOES still faces long-term bullish pressure, especially with the green energy movement and the expansion of electrical grids to and from places like solar and wind fields.

Renewables/GOES MMI: Notable Price Shifts

- Grain-oriented electrical steel prices witnessed a 8.06% decrease, falling to $4,165 per metric ton.

- Steel plate prices moved sideways, dropping by just 1.13%. As of August 1, prices were at $1575 per short ton.

- Chinese silicon prices moved sideways, increasing by a modest 0.61%. This brought prices to $1805.15 per metric ton.

- Finally, Chinese cobalt prices broke their downtrend and rose by 5.91%, bringing prices to $46,838.73 per metric ton.