Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

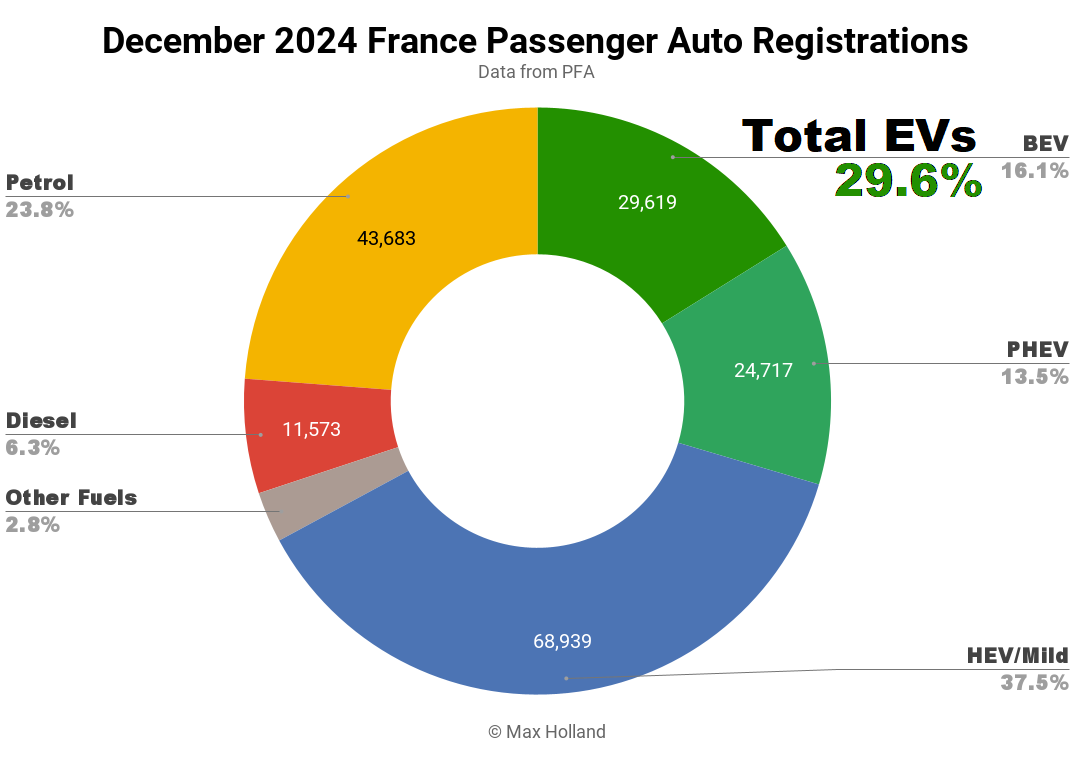

December’s auto market saw plugin EVs at 29.6% share in France, down from 30.1% year on year. BEVs lost volume YoY, in a hold-back ahead of tougher emissions requirements in 2025. PHEVs and plugless HEVs both saw YoY growth. Overall auto volume was 183,661 units, up 1.5% YoY. The Tesla Model Y was France’s best selling BEV in December.

December saw combined EVs at 29.6% share in France, with full battery electrics (BEVs) at 16.1%, and plugin hybrids (PHEVs) at a new record 13.5%. These compare with YoY figures of 30.1% combined, 20.6% BEV, and 9.4% PHEV.

December’s fall in BEV share is not too surprising since 2025 will see the start of tighter fleet emissions regulations. Thus manufacturers were motivated to hold-back some BEV deliveries until January, to get a head-start on meeting the tougher 2025 requirements.

2024 Full Year Trends

The full year 2024 results saw France’s cumulative plugin EV share at 25.4%, with 16.9% BEVs and 8.5% PHEVs. This was lower than 2023’s 26.0% plugin EVs, with 16.8% BEVs and 9.2% PHEVs. Total 2024 BEV sales were 290,614 units, down 2.5% from 298,216 in 2023. Overall auto volume was 1,718,417 units, down 3.2% from 1,774,728 in 2023.

In the larger European auto markets of France and Germany, the pace of the EV transition is unfortunately still mostly shaped by regulations, with most legacy auto manufacturers still only doing “the minimum required by law” in terms of BEV sales. These manufacturers are still clinging on to their past ICE-powertrain investments, and not in a rush to dive into the new era of BEVs.

The 2024 regulations were barely stricter than those in 2021, with a headline fleet target of 95 grams/kilometer CO₂ on average. Whilst there has been some tightening between 2021 and 2024 in the way the 95 gram figure was calculated (particularly moving from the old NEDC calculation to the newer WLTP), there was no change of the actual headline “95 gram” target. The flexible calculation methods initially allowed “phase‐in provisions”, “eco‐innovation credits”, “niche exceptions”, “super‐credits”, and pooling, which were tightened over time.

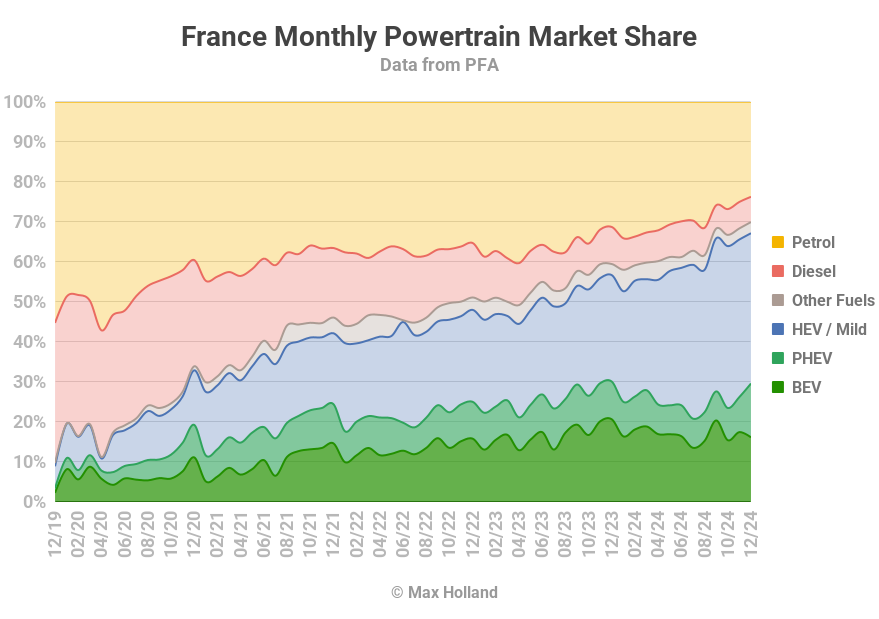

Overall, the rate of progress in the EV transition has been slow over the past 3 or 4 years, compared to the relative progress that we saw in 2020 and 2021 (see the timeline graph for France below).

This should change in 2025 with the headline target tightening by 15% compared to 2021, equating to approximately ~81 grams/km CO₂ on a fleet-wide basis. Again, as in 2020 and 2021, some “flexible counting” mechanisms are initially allowed to sugar the pill, which will tighten over time, as we head towards the next step change in the headline target in 2030. That year the target will jump to a much more stringent 55% less than 2021 (sometimes called “Fit for 55”) and equating to ~43 g/km CO₂. It will effectively mean that BEVs have to account for the majority of auto sales in 2030. The final target is a 100% reduction in emissions, and is planned to come into effect in 2035.

Of course we might hope that the dynamics of consumer demand will accelerate the transition far faster than these minimum requirements, but based on what we have seen in the European market up to now, holding one’s breath for that to happen is probably not wise.

The Chinese auto market, by contrast, led by domestic auto brands who are pushing ahead with BEVs and NEVs (and not weighed down by legacy players milking their past ICE investments), has now pulled very far ahead of Europe. The 2024 total market share for plugins in China ended very close to 50%, around twice the share in France (25.4%), even though France was ahead of China in mid 2020. BEVs are now at price parity with ICE cars in many segments of the Chinese auto market, something European consumers can still only dream of.

Best Selling BEVs

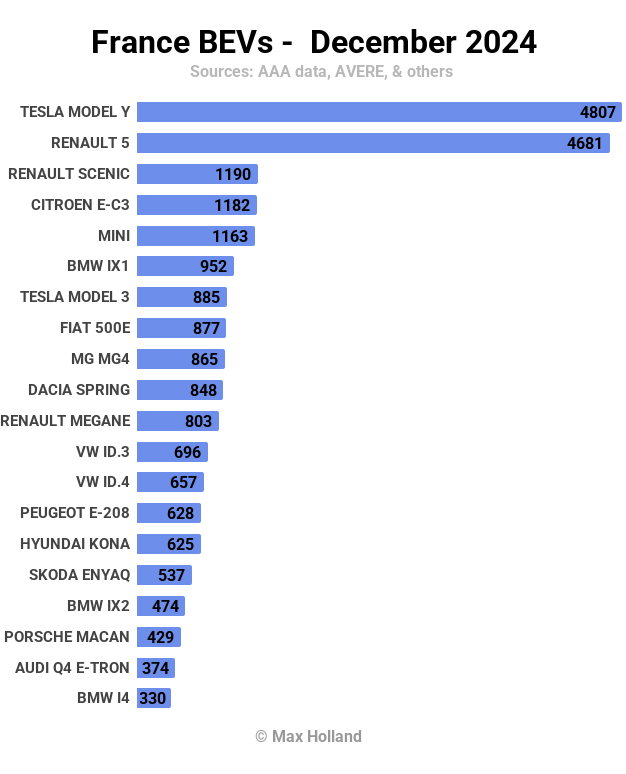

With their habitual end-of-year push of sales, the Tesla Model Y was the best selling BEV in December, though only just ahead of the new Renault 5.

A very long way back in third place was the Renault Scenic, a hair’s breadth ahead of the new Citroen e-C4 in 4th, and the Mini in 5th.

The BMW iX1 had its best ever result, taking 6th spot, with 952 units. Indeed, BMW had three models in the top 20, which has only happened a couple of times previously in the French market.

While we’re on the premium brands, the new Porsche Macan spent its third consecutive month inside the top 20, now up to 18th spot. This is an incredible performance given the high starting price of €82,959 and the overall market’s strong preference for small-and-affordable vehicles. Is the Macan still benefiting from a backlog of pent-up demand? Let us know if you have data on this.

It is good to see the Renault 5 now hitting very high volumes in France after just 4 months on sale. Will we see the Citroen e-C3 join it consistently at the front in 2025? I hope so.

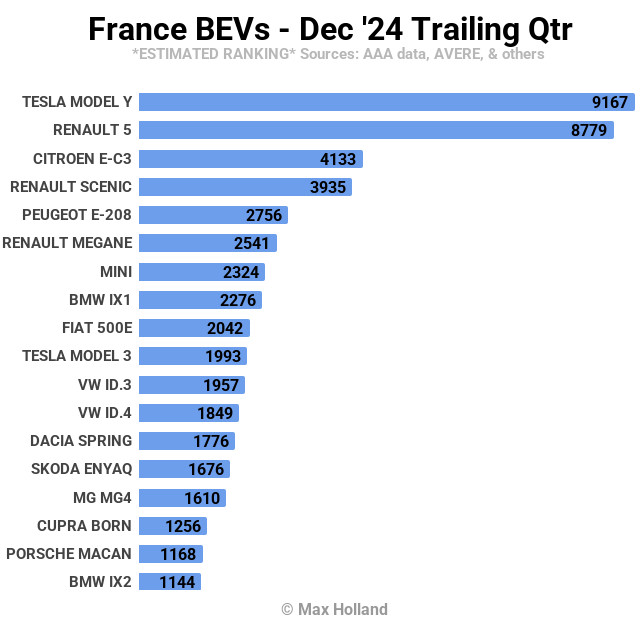

Here’s a look at the Q4 rankings:

It’s rare to see the Tesla Model Y being challenged in the final quarter of a year in most European markets (though does happen in Germany) but the Renault 5 is now at the Tesla’s heels in France.

I’ve read reports that Renault’s overall BEV capacity in France is already around 400,000 units per year, and potentially able to expand to 600,000. One has to imagine that at least half of these could be the Renault 5, which means potentially 200,000+ units per year in the near-to-mid term, if the demand across Europe is there.

Given that the Tesla Model Y reduced to well under 200,000 units in Europe in 2024 (and may continue a downward trend), it is at least feasible in principle that the little Renault could perhaps take the crown as soon as this year already. One caveat is that Renault really should offer DC charging (as at least an option) on the ~€25,000 entry model if they plan to get to huge volumes. Please jump into the comments if you have thoughts on any of this (and give me a sanity check).

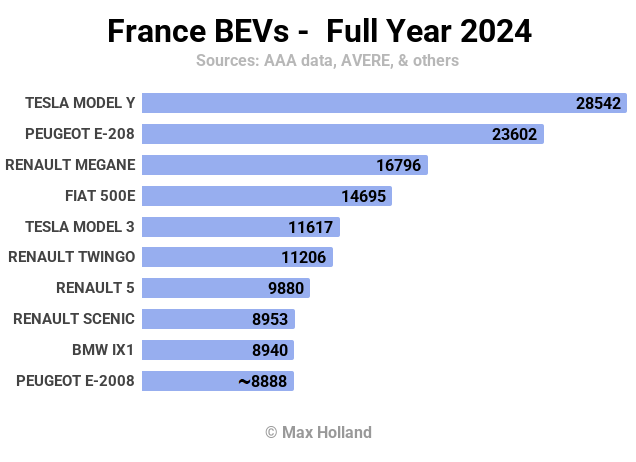

For the full year ranking, we only have enough data right now to know the top 10 models:

The Tesla Model Y still has a decent lead in the full year French BEV market, as it did in 2023. This past year however, its lead narrowed to 20.9% more volume than the runner up, from 24.8% more in 2023. And we saw earlier that – in the latest 3-month ranking – its lead is quickly eroding.

After just 3 months on sale, the Renault 5 is already in 7th place in the full year chart. How are Stellantis going to respond – are they just going to throw many minions at it (Citroen e-C3, Fiat Panda, etc) and hope that will slow it down? Or do they have another update to the e-208 in the works?

A good sign is that the range of BEV models on offer are diversifying, the “strength in depth” is growing, and the market is seeing a more normal distribution. This is a sign of maturity, which will only continue in 2025.

If you have predictions for the likely winners in the year ahead, “place your bets” in the comments below.

Outlook

We will hopefully look back on 2024 similarly to how we have looked back on 2019 – as the quiet spell before the storm breaks. Certainly the slack regulations have allowed the legacy auto makers to take their foot off the accelerator of the EV transition. I believe the higher import tariffs on compelling and affordable Chinese EVs, and France’s cancellation of the eco-bonus for made-outside-Europe BEVs after 15th March, were part of this broader privileging of Europe’s legacy players.

France’s wider economy is doing okay relative to neighbours, at 1.2% GDP growth YoY in Q3 (latest data). Inflation was flat in December at 1.3% and interest rates dipped to 3.15%. Manufacturing PMI, however, fell to the lowest point of the year, at 41.9 points in December, from 43.1 in November, although this is not unusual for the end of the year.

What do you expect to see happen in France’s EV transition in 2025? Will the Renault 5 overtake the Tesla Model Y? What other models might surprise us? Please share your perspective in the comments below.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy