Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Key Takeaways:

- Transportation is the highest emissions segment in United States

- Of rail, water, and road, only freight trucking can readily decarbonize

- Electric trucks are cost-effective and rapidly advancing

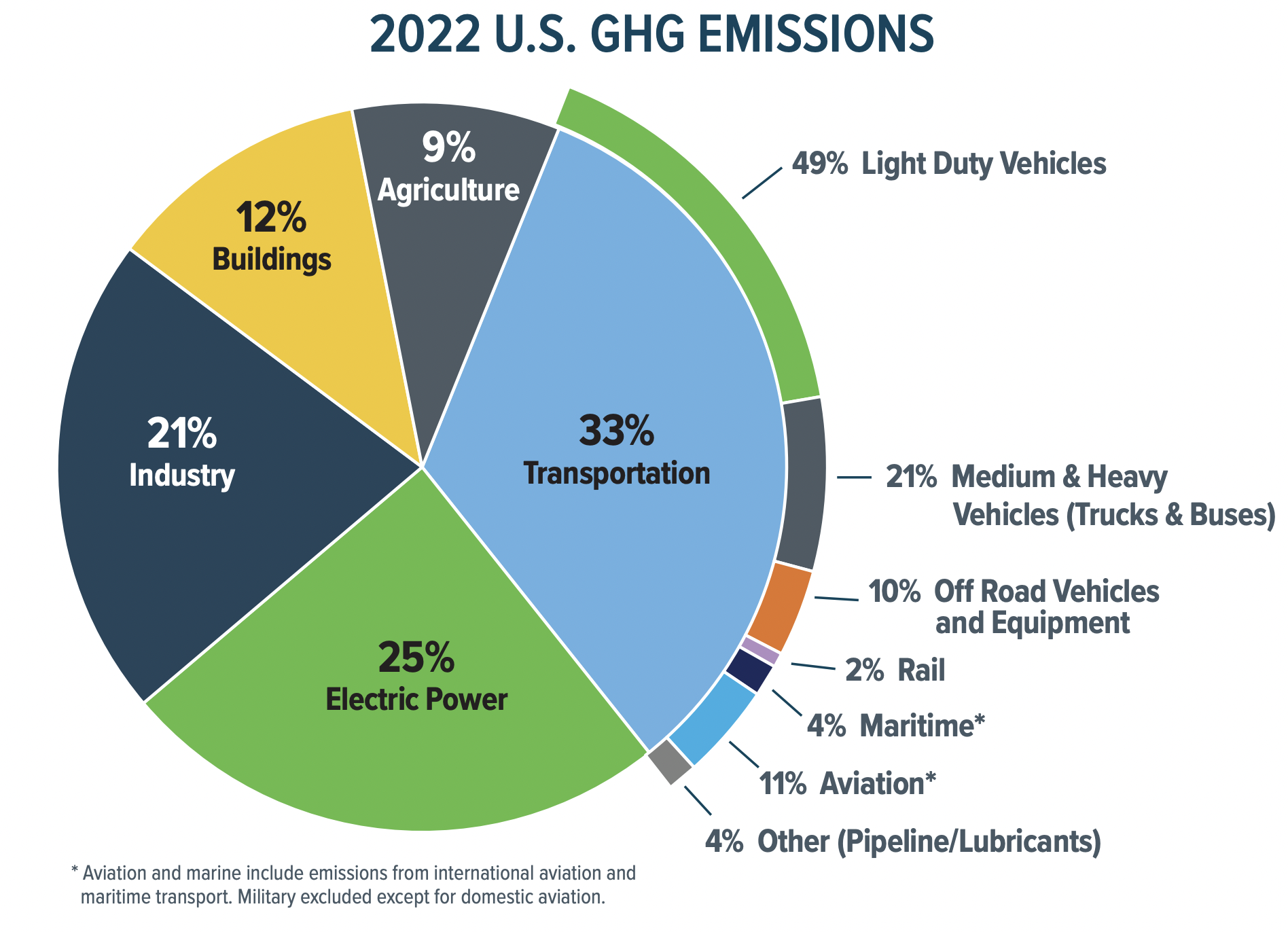

The United States has unintentionally made itself into the country with the hardest to decarbonize transportation sector, and it matters. Transportation produces a third of all greenhouse gas emissions for the country, more than electrical generation now, as well as contributing an outsized share of air pollution. The one segment of freight transportation with a potential for significant decarbonization in the near term, heavy-duty road trucking, faces headwinds despite contributing to 30% of total emissions of the transportation sector, and being only 5% of road vehicles. How can electrification of road trucking be accelerated so that this win can be realized quickly?

As the first article in this strategy series lays out, the authors’ intended audience is three-fold: 1) firms with major internal freight logistics and operations such as UPS, FedEx, and Amazon which operate many depots; 2) large firms that own and operate many existing highway truck stops and depots; and 3) turn-key engineering, procurement, and construction solution providers that can build all elements of charging at existing or new truck stops and depots. The reason is simple: these are the organizations with the ability to deliver repeatable, high-quality, low-cost truck charging solutions following the diagnosis and self-reinforcing actions contained in this series. Other stakeholders, such as policymakers, truck makers, manufacturers of battery, solar, and charging equipment, energy management companies, and more, should look at this material and determine how they can support the primary audiences.

The authors, Rish Ghatikar and Michael Barnard, are professionals with global careers in strategy, sustainability and transportation. They took it upon themselves to articulate over a series of articles what they consider a high-efficiency strategy, policies and action plans to address one of the the important challenges — to decarbonize heavy-duty road freight. They are available to guide firms which want to take up this strategy to assist with its refinement and adaptation for specific firms’ requirements.

The authors share the perspective that Richard Rumelt’s Good Strategy Bad Strategy: The Difference and Why It Matters is the best book on strategic planning for businesses and policy makers available today, and will use Rumelt’s framing to articulate their perspective.

At heart, Rumelt says a good strategy has a kernel consisting of three things. First, a diagnosis of what is going on here, a clear-eyed look at all relevant aspects of the situation. Second, a policy which simplifies and focuses actions, designed to maximize benefits and minimize risks. Third, a set of self-reinforcing actions aligned with the policy. That’s it: diagnosis, policy, actions. The book is a highly recommended read and provides example after example of bad strategies that don’t have this.

And so, to the diagnosis of freight decarbonization. As noted in the introduction, the United States has a challenge in decarbonizing the transportation sector. While this is true for the movement of people around the country in their daily rounds and trips, we’ll set this aside and focus on freight road transport.

Per earlier assessments Barnard has done of global freight mode variances across major economic blocs, the United States has a breakdown of roughly 2 trillion ton miles (TTM) of road freight, 1.5 TTM of rail freight, and 0.4 TTM of domestic water freight. Two of these modes face significant challenges in decarbonization in the coming two decades. Per the US’ own transportation blueprint, which Barnard analyzed upon its release, the intent is mode-shifting of freight from roads to rail and water. However, the reality is that the inverse that will happen, for better or worse.

Water freight in the US is heavily constrained for growth. The Jones Act, the most restrictive cabotage act in the world, which requires all domestic water freight vessels to be made in America, by American firms, owned by American firms, flagged in America, and crewed by Americans, was intended to preserve the merchant marine in the aftermath of World War One, where it was a vital logistics arm of the US military. However, as Barnard pointed out in his assessment of US water freight challenges, in combination with the deindustrialization of the US over the past four decades, American shipbuilding has dwindled. Now the country isn’t even in the top 15 of shipbuilding countries, outstripped by much smaller European countries.

However, it isn’t the European shipbuilders which are the challenge, although they will be running flat out to build the electrified ships of the future for that continent. It’s that China is now by far the biggest shipbuilder in the world, with 59% of all new ship orders flowing to Chinese shipyards. That’s followed by South Korea and Japan, both of which are also on the other side of the Pacific. While those two countries are US allies, having them build new, smaller domestic ships for the US market when they are building high-ticket large ships for global freight firms will be challenging. Of course, inland and short-sea ships often can’t cross oceans, so delivery of the vessels will be challenging as well.

Finally, inland and short sea shippings’ largest lever in the coming years is battery-electric propulsion, as that has the best economics and emissions savings. Per US Department of Energy Lawrence Berkeley National Laboratory studies in 2022 and 2024, 950-mile journeys break even economically with batteries that cost US$100 per kWh, and 1,900 mile journeys at $50 per kWh. The Chinese firm CATL, the market leader in electric vehicle batteries, delivers lithium iron phosphate (LFP) batteries at $56 per kWh today, however, the US has put significant tariffs on Chinese batteries and has very limited battery manufacturing capacity.

Batteries built in the US, with the possible exception of Tesla, will remain much more expensive, and cheaper batteries from China will be difficult to consider immediately. The authors recognize that the United States is pursuing domestic manufacturing policies and investments which have the potential to lower battery costs over the longer-term, but the recent failure of Northvolt, which Barnard analyzed, means that those initiatives are high risk.

The small and aging fleet of merchant marine vessels operating domestically — only 93 vessels over 100 tons currently qualify — will be difficult to retrofit and new vessels will be difficult to build. That’s true for dual fuel vessels for lower likelihood alternative fuels such as methanol and ammonia as well.

This leaves biodiesel repurposed from other parts of the US economy as likely the only lever available for the small number of ships. Growing the water freight segment, as the blueprint suggests, is heavily constrained, and it’s the smallest freight carrier today despite the excellent waterway and coastal resources the United States has.

Moving on to rail, the US, uniquely among major economic blocs, has no heavy freight electrification. India is at 97% electrification this year after 15 years of its program and will hit 100% soon, and rail is the dominant mode of domestic freight shipping. China is well over 70% electrified. Europe, while moving little freight by rail as it prioritizes passengers there, has a high degree of electrification.

The lack of rail electrification in the United States is due to the corporate structure of heavy rail and bordering countries, Canada and Mexico. All of the tracks are owned by operators, unlike other countries where they are national infrastructure or public-sector assets. In the US, investment in their maintenance, as well as strategic improvements, are the responsibilities of the operators. The operators are constrained under US fiduciary responsibility to only consider the requirements of their shareholders. Strategic investments that would impact quarterly profits, operations, dividends, and earnings calls this year for a benefit in five to ten years, are close to impossible to get approved. US rail operators are going to see seriously declining revenue in coming years as the full third of their tonnage which is coal and a bit of oil disappears as global demand diminishes. They will be operating under falling revenues and seeing an even lower ratio of freight tons per mile of track than they do today, when over the entire set of rails they are already at half of European levels and worse compared to India and China.

As a result of this situation, the official American Association of Railroads policy is that what every other major economy is just getting on with is impossible in the US. They are formally and vocally opposed to rail electrification. Further, while they could operate their trains on biodiesel, it would increase their operating expenses and decrease their profits, so it isn’t viable for them either.

The lack of a carbon price on fuels in the United States, with limited carbon pricing in only two states, means that rail operators have no economic incentive to purchase more expensive fuels. The Inflation Reduction Act, while it is subsidizing green hydrogen and synthetic fuels, still leaves resulting liquid fuels that are plug compatible with aging diesel electric locomotives far above the cost of diesel today.

The only lever is pressure from major logistics firms such as Amazon which are looking to decarbonize their supply chains, and while rail operators are listening, they aren’t acting.

The situation brings us to freight road trucks where diesel-powered trucks still dominate. At the North American Council for Freight Efficiency (NACFE) Run on Less test month in September of 2023, two Tesla Semis covered over 1,000 miles in a day of operation with two half-hour charging sessions. Other manufacturers had 500-mile days. The accomplishments show that the challenges of scaling electric technology in heavier and longer-distance trucks are addressable. However, the current share of electric trucks is statistically insignificant (<1%), relative to over 14 million freight trucks operating in the United States.

It is worth noting that the accomplishments use today’s battery technologies. CATL, the world’s largest EV battery manufacturer, is delivering batteries this year with double the energy density, hence double the range when put into a Tesla Semi. The trends of batteries continue to be much cheaper in cost and higher in energy density. Truck manufacturers will have battery-electric truck options with 1,000-mile ranges and lower prices in the coming years, making electric trucks a viable economic and environmental option.

Where weight is perceived as a concern, the allowances for heavier electric trucks carrying the same load will not harm roads. Michigan already allows trucks with double the weight of the Class 8 trucks that are the lowest commonly agreed on scale across North America, and hence the trucks used for most long-haul trucking.

Electric semi trucks and all lower scales are fit for purpose for the majority of trucking today, and all of trucking tomorrow.

Per Barnard’s earlier analysis, electric freight trucks are already lower carbon per ton-mile in eight United States states, including California, as well as 70% of neighboring Canada. As grids continue to decarbonize, more and more states will cross over that threshold, and carbon emissions reductions for electrified trucking will continue to drop.

Trucks running on electricity have a significant economic advantage over diesel trucks. Fuel costs for diesel are 20% to 30% of costs, depending on fluctuation in diesel prices. This equates to an average of $0.46 per mile. Due to the economic sensitivity, many truck operators adopt fuel-saving measures such as optimized routing, AI-driven logistics, and increasingly electric trucks. The electric semis, with their very efficient drivetrains, see in the range of $0.20 per mile or lower.

Approximately 9% of truck expenses are for maintenance. Global data from electric fleets shows that the predicted savings of 30% to 40% on this expense are being realized.

Coming soon are autonomous trucking solutions, with major existing truck suppliers such as Volvo and Daimler, as well as new entrants like Tesla and Nikola, working on technologies which will enable convoying, where trucks can follow each other in a formation, reducing the need for driver input and enhancing fuel efficiency, with some drivers taking their legislated breaks while on the road. The labor cost advantage that rail currently enjoys will be diminishing within the next decade as well. Labor is the biggest cost of trucking, approximately 43%, and could also see a cut of a third of that in coming years.

Electric trucking will immediately have operational margin increases sufficient to compete for more container traffic, and this margin will increase, even as rail costs stay the same or increase if they use biodiesel. This will shift container traffic from rail to roads, in addition to rail’s loss of coal and oil, compounding that mode’s challenges.

The massive logistical firms with strong decarbonization requirements such as Amazon and Walmart will move more containers to trucks and off rail in coming years due to this.

In the authors’ analysis, road freight has significant opportunity for near-term decarbonization, and further, a strong economic and equitable incentives to do so. This will result in a rebalancing of US domestic freight to road away from rail, and likely from water freight. This is far from ideal, but it’s the reality of the United States.

The next article in the series will assess the challenges facing electrification of road freight, once again diagnosing the situation and leveraging lessons from medium- and heavy-duty road electrification. This is the next step to creating a simple policy, or policies, to overcome those challenges and accelerate the electrification of road freight transportation.

About the authors:

Rish Ghatikar has an extensive background in decarbonization, specializing in electric vehicles (EVs), grid integration, and demand response (DR) technologies. At General Motors (GM), he advanced transportation electrification energy services, as part of a broader climate strategy. Previously, at Electric Power Research Institute (EPRI), he focused on digitalizing the electric sector, while at Greenlots, he commercialized EV-grid and energy storage solutions. His work at the DOE’s Lawrence Berkeley National Laboratory spearheaded DR automation to support dynamic utility pricing policies. An active climate advocate, Ghatikar advises on policies and technologies that align the grid with transportation and energy use for sustainable growth.

Michael Barnard, a climate futurist and chief strategist at The Future Is Electric (TFIE), advises executives, boards, and investors on long-term decarbonization strategies, projecting scenarios 40 to 80 years into the future. His work spans industries from transportation and agriculture to heavy industry, advocating for total electrification and renewable energy expansion. Barnard, also a co-founder of Trace Intercept and an Advisory Board member for electric aviation startup FLIMAX, contributes regularly to climate discourse as a writer and host of the Redefining Energy – Tech podcast. His perspectives emphasize practical solutions rooted in physics, economics, and human behavior, aiming to accelerate the transition to a sustainable future.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy