In a recent interview with Charlotte McLeod of Investing News Network, JP Cortez, Executive Director of the Sound Money Defense League, shared insights into the organization’s progress, challenges, and goals.

Celebrating its 10th anniversary, the Sound Money Defense League, owned and funded by Money Metals Exchange, has made significant strides in advocating for the removal of barriers to owning and using gold and silver as both investments and currency.

Legislative Wins in 2024

Jp Cortez highlighted seven legislative victories in 2024, where states across the U.S. adopted policies to remove taxes on precious metals and reaffirm gold and silver as legal tender.

One of the most significant wins was Utah’s decision to allocate $180 million for physical gold reserves, underscoring a growing movement among states to seek alternatives to dollar-based reserves.

The implications of these victories are far-reaching, as even U.S. allies and adversarial nations are reconsidering the dollar’s dominance in global financial systems.

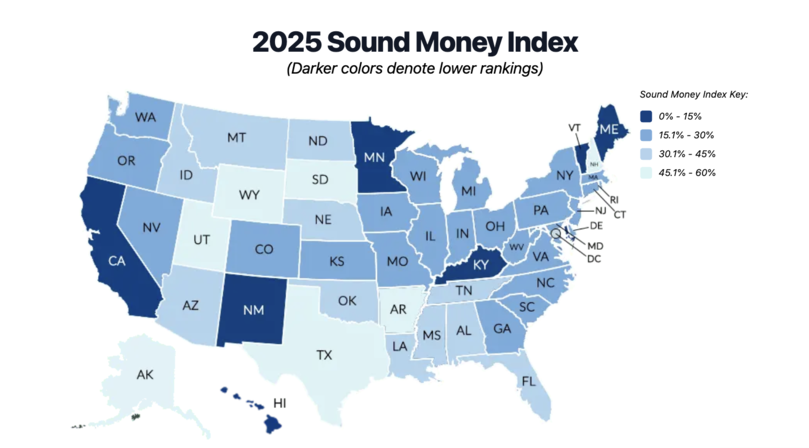

The 2025 Sound Money Index

The Sound Money Defense League’s recently released 2025 Sound Money Index measures how all 50 states treat gold and silver. The index evaluates criteria such as tax policies, legal tender status, and state investments in precious metals.

Wyoming topped the index for its sound-money-friendly policies, attracting businesses and investors in the precious metals sector.

In contrast, Kentucky faced criticism for vetoing a bill to eliminate taxes on precious metals, despite its conservative reputation.

“Politicians often view industries like precious metals as revenue streams,” Cortez explained, “but these policies harm local businesses and drive economic opportunities elsewhere.”

Bridging the Knowledge Gap Through Education

Cortez emphasized the role of education in overcoming skepticism toward sound money. The Sound Money Defense League offers two flagship programs: the Sound Money Scholarship and the newly launched Sound Money Fellowship.

Together, these initiatives have awarded over $100,000 to students and researchers, promoting deeper exploration of monetary policy and precious metals.

This year, the scholarship program drew over 200 applications from students worldwide, reflecting growing global interest in sound money principles. The fellowship targets advanced researchers and aims to fund impactful academic work in this space.

Legislative Priorities for 2025

As 2024 concludes, Cortez is optimistic about upcoming legislation. Of the 50 U.S. states, 45 states have eliminated sales taxes on precious metals. Efforts are now focused on removing these taxes in the remaining five states.

Additionally, 13 states have abolished capital gains taxes on gold and silver, and more states are expected to follow suit.

“When we started, we were pleading with legislators to introduce these policies,” Cortez said, reflecting on early challenges. “Now, states are reaching out to us.”

He also highlighted the potential for states to invest in gold as a reserve asset and build in-state depositories, reducing reliance on centralized storage facilities in locations like New York.

A Vision for the Next Decade

Looking ahead to the next decade, Cortez envisions a future where all tax barriers on precious metals are eliminated, empowering individuals to use gold and silver without penalties. This, he argued, could spur innovation in monetary systems, including fractional precious metals, blockchain-backed currencies, and new forms of financial entrepreneurship.

He quoted economist F.A. Hayek: “Money, when discovered, was captured by the government and frozen in its most primitive form.”

Cortez believes the sound money movement can unlock the true potential of financial systems.

Bullish on Gold and Silver

Cortez remains optimistic about precious metals, especially as the national debt surpasses $36 trillion. With Utah investing $180 million in gold and growing international interest, he predicts rising prices for gold and silver in the coming years.

“As long as the government continues to debase the currency and increase deficit spending, gold and silver will remain strong investments,” Cortez concluded.

The Sound Money Defense League’s achievements this year highlight a growing recognition of the value of precious metals. As more states adopt sound money policies, Cortez believes individuals, businesses, and governments alike will benefit from greater financial stability and sovereignty.

Key Questions & Answers

Here are the key questions and answers from JP Cortez’s interview with Charlotte McLeod of Investing News Network:

What is the Sound Money Defense League, and what is its mission?

JP Cortez explained that the Sound Money Defense League is a nonpartisan public policy group funded by Money Metals Exchange. Its mission is to eliminate barriers to owning and using gold and silver as money and investments. This includes advocating for the removal of taxes and regulations that create “friction” in buying, selling, or using precious metals. The organization also works to reaffirm gold and silver as legal tender.

What were the major accomplishments of the Sound Money Defense League in 2024?

The league celebrated seven legislative victories in 2024. Key achievements included several states passing laws to remove sales and capital gains taxes on precious metals and Utah allocating $180 million for gold reserves. This marked the first time a state invested such a significant amount in physical gold as a reserve asset, signaling broader interest in alternatives to dollar-based systems.

What is the Sound Money Index, and how does it work?

The Sound Money Index, updated annually, rates all 50 U.S. states based on their policies toward precious metals. Criteria include tax exemptions, legal tender recognition, and whether states invest in gold reserves. Cortez highlighted Wyoming as the top-ranked state in the 2025 index, while Kentucky faced criticism for vetoing a bill to remove taxes on precious metals.

What challenges do you face in advocating for sound money policies?

Cortez noted that a lack of education among policymakers is a significant obstacle. Many state legislators have never heard the term “sound money” or considered the principles behind it. Education initiatives are essential to overcoming skepticism and promoting policies that favor gold and silver as viable monetary options.

How is the Sound Money Defense League addressing the education gap?

The organization offers two flagship programs:

- Sound Money Scholarship – Targets high school and college students through essay contests, awarding over $100,000 to date.

- Sound Money Fellowship – Focuses on advanced researchers, providing paid opportunities to conduct in-depth studies on sound money principles.

These programs aim to build a stronger academic foundation for sound money advocacy.

What are the legislative priorities for 2025?

Cortez outlined efforts to eliminate sales taxes on precious metals in the remaining five states that still impose them. Additionally, the league is pushing for more states to abolish capital gains taxes, with 13 states having done so already. Future initiatives also include promoting state investments in gold reserves and building in-state bullion depositories.

What is your long-term vision for the sound money movement?

Cortez envisions a future where tax barriers on precious metals are completely eliminated, enabling individuals to use gold and silver freely as money. He predicts significant innovation in monetary systems, including fractional precious metals, asset-backed digital currencies, and blockchain technology. These changes could fundamentally reshape how people interact with money.

What is your outlook for gold and silver prices?

Cortez remains bullish on gold and silver, citing the U.S. national debt surpassing $36 trillion and ongoing deficit spending. He believes increasing state and international investment in gold will drive prices higher. Utah’s $180 million gold investment, alongside global trends, supports this optimistic outlook.

What advice do you have for investors?

Cortez emphasized that as long as the U.S. government continues to debase its currency, gold and silver will remain strong investments. He encouraged investors to consider the long-term stability and value of precious metals in light of growing global and state-level interest.

********