Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

When someone asks me about my EV, they always bring up battery issues. It soon becomes clear that they don’t understand battery recycling. The conversations begin this way and swiftly break down into battery waste: “Well, oil comes out of the ground and so do the minerals for batteries…” or “Where do batteries go after they don’t work anymore?” You should have no trouble answering these kinds of questions if you read CleanTechnica.

One of the numerous companies that can tell you the answer is Ace Green Recycling. Now, the global leader in battery recycling technology will become a public company. Ace’s modular battery recycling platform is intended to reduce battery waste while preserving vital battery materials of strategic relevance.

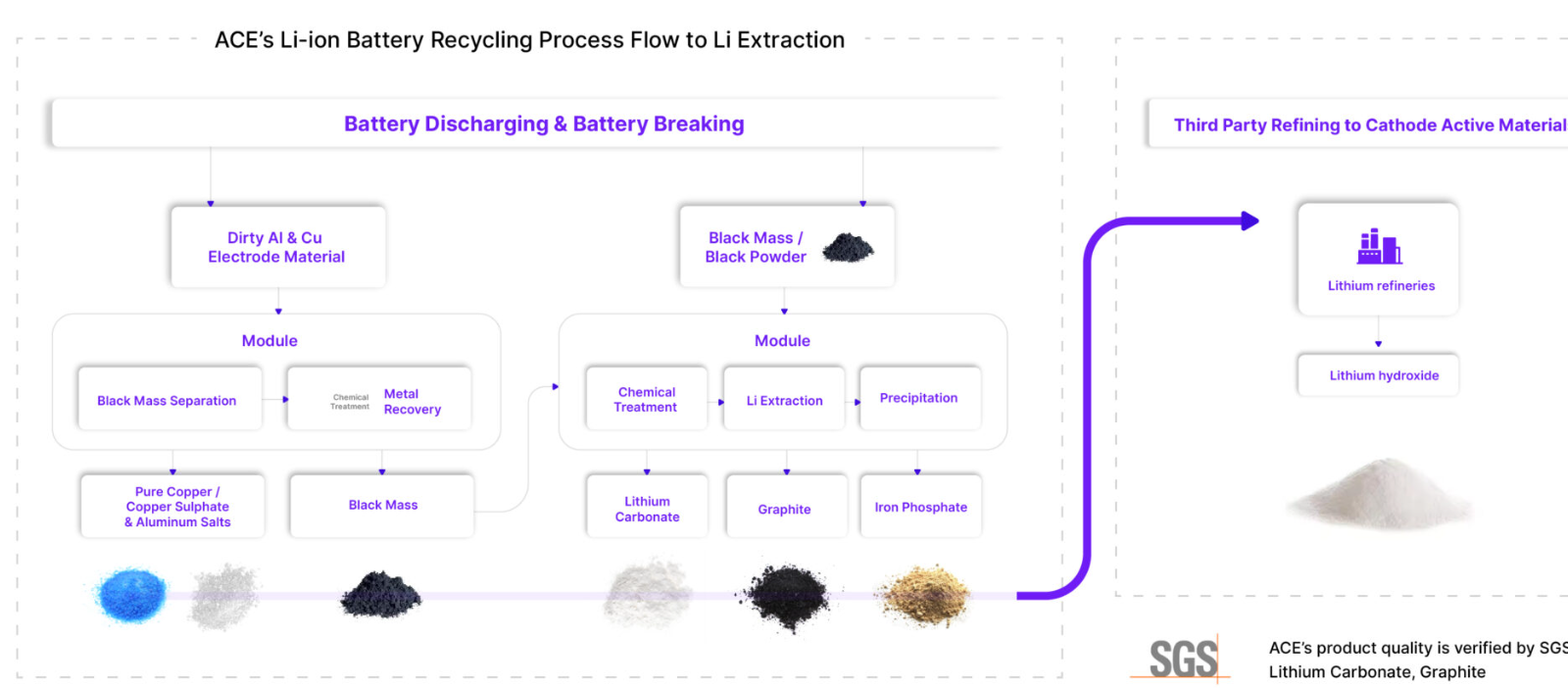

Ace’s advanced battery recycling method recovers key battery materials from both lead and lithium-ion batteries. The company’s revolutionary and flexible technologies are completely electrified, resulting in zero Scope 1 emissions, hazardous water, or solid waste. Ace’s method is expected to enable a more efficient permitting process and is intended to replace legacy smelting methods, which are harmful to the environment and human health because of the potential for lead poisoning.

More Jobs with a Sustainable Future

Driving domestic job creation, the transition will create high-quality manufacturing employment in the United States, boosting local economies and strengthening America’s workforce.

Ace has a wonderful response to the question about where the batteries go. The company maintains it is in a unique position to recycle lead and lithium-ion batteries economically.

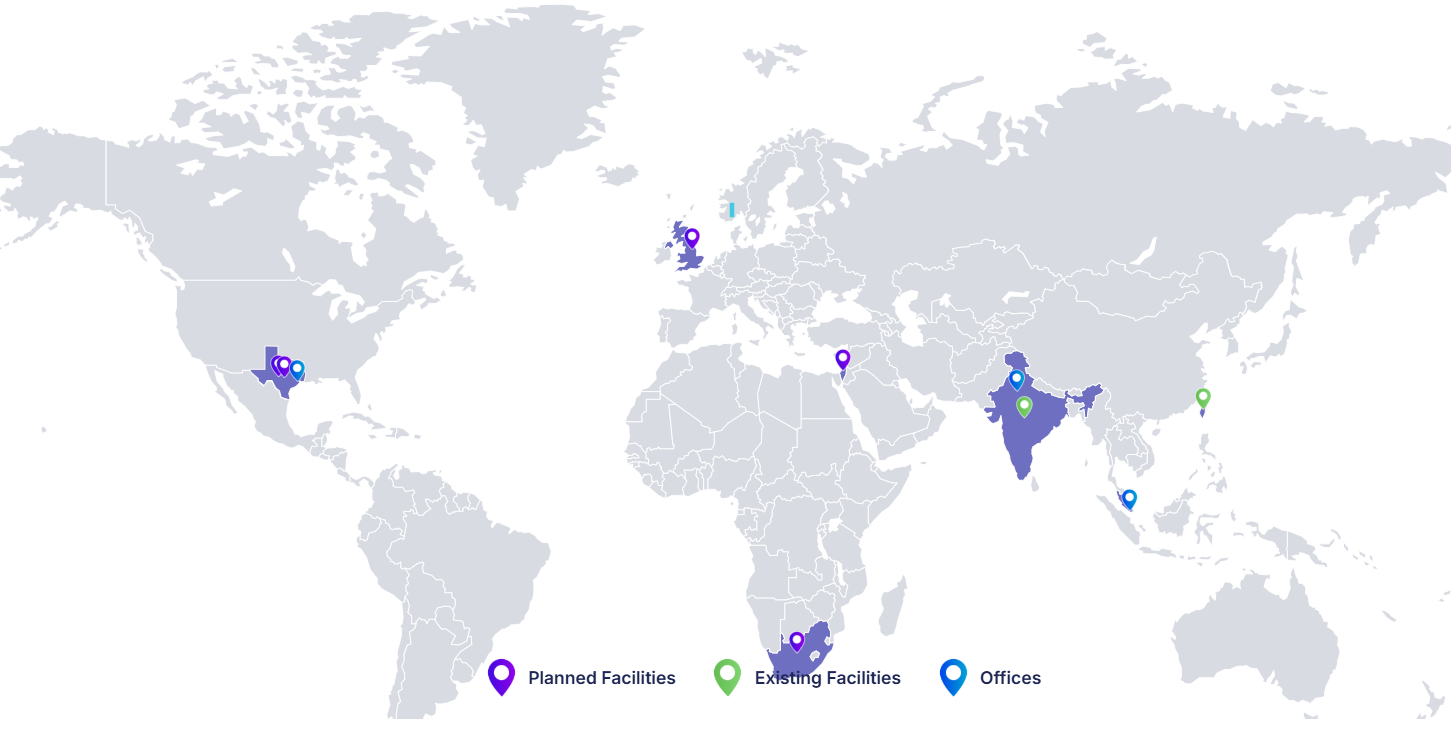

Ace, which has commercial operations in Asia, is focused on worldwide expansion and intends to build a flagship battery recycling plant in Texas for lead and lithium-ion batteries.

A press release today about the transition starts this way: “Ace Green Recycling, Inc. (“Ace” or the “Company”), a leading provider of sustainable battery recycling technology solutions, and Athena Technology Acquisition Corp. II (“ATAC II”) (NYSE: ATEK), a special purpose acquisition company, announced that they have entered into a definitive business combination agreement, pursuant to which a wholly owned subsidiary of ATAC II will merge with and into Ace, with Ace becoming a wholly owned subsidiary of ATAC II and Ace’s operation.”

The company’s LithiumFirst technology can recover up to 75% pure lithium from lithium-iron-phosphate (LFP) and nickel-manganese-cobalt (NMC) batteries. In addition to recovering lithium, the company’s LithiumFirst technology recovers NMC salts, graphite, iron phosphate, and other materials such as plastics, steel, aluminum, and copper through a closed-loop hydrometallurgical process that eliminates pyrometallurgical operations and produces no liquid waste or Scope 1 carbon emissions.

Ace now owns and operates commercial lithium-ion facilities in India (since 2023) and has licensed its technology to ACME Metal in Taiwan (since 2024). Now it also has advanced plans to deploy its technology here by developing its own factory in the United States. The company has proved its technology’s commercial credentials by enabling the processing of more than three million pounds of lead and lithium batteries.

In order to create centralized hubs for the sustainable recovery of valuable materials from end-of-life batteries, Ace’s expansion strategy focuses on building multiple battery recycling facilities in the United States. These plants are anticipated to drive domestic job creation, enhance critical battery material security, and promote renewable energy partnerships.

With key highlights such as the following, the work of clean technology continues positively amidst political downturns (that are reflecting gross error in terms of sustainability).

Key Investment Highlights

- Commercial Stage/Revenue Generating: Ace operates commercial facilities in India (since 2023) and Taiwan (since 2024), with planned project development in the U.S. (Texas), Europe, and Israel, along with complimentary supply chain operations. The Company is currently generating approximately $23 million in annual revenue.

- Large Target Markets: Ace’s market strategy targets immense opportunities across two core sectors: the mature lead battery recycling market, valued at over $20 billion in 2024, and the rapidly growing lithium-ion battery recycling market, projected to exceed $35 billion by 2040.

- Anticipated Profitability in 2026: Unique modular, cost-effective deployment strategy allows for high margins and an efficient CapEx and OpEx model.

- Diversified Business Model: The Company monetizes considerable opportunities in battery recycling through owned and operated facilities, joint venture and licensing agreements, and supply chain and services contracts.

- Differentiated and Superior Proprietary Green Technology: Already approved by regulators in key global markets, Ace’s electrified process eliminates the typical toxic waste and carbon emissions that have forced the shutdown of peer facilities. Additionally, Ace is differentiated in its ability to process both lead and lithium batteries, including LFP, as its competitors are generally unable to process LFP batteries and are able to process either lead or lithium batteries, but not both.

- Superior Supply-Chain Expertise: Ace believes that it is poised for global expansion, supported by a robust network of supply chain partners across the U.S., Europe, Asia and Africa.

- Anchored by Marquee Customers: Global offtake agreement with Glencore, one of the world’s largest global diversified natural resource companies and a leading company in the recycling industry, underpins the high demand for low-cost feedstock to enable the electrification of vehicles, solar energy and the transition to green energy solutions.

- Supportive Global Tailwinds: National security, economic and sustainability initiatives have globalized the refining of feedstock and battery production away from traditional sources.

- U.S. Focus: We believe that Ace’s planned facility in Texas and anticipated U.S. footprint will support the U.S. in safeguarding its critical battery metals supply chain.

- Additionally, Ace is collaborating with the U.S. Department of Energy’s National Renewable Energy Laboratory for advanced research on the recycling of LFP batteries and upcycling of spent graphite to battery grade.

- Leading IP Portfolio: Executing customized IP strategies in the lithium and lead recycling spaces, Ace has developed an industry-leading IP portfolio consisting of utility patents, stealth patents and trade secrets supported by more than a decade of research and development (“R&D”). Ace also collaborates with R&D institutions such as the Indian Institute of Technology and Singapore Polytechnic on battery recycling topics.

- Management Expertise: Ace’s team of industry leaders brings together diverse expertise in battery recycling, green energy, business development and global strategy.

- Backed by Seasoned Industry Investors: Ace’s current investors have deep expertise in the metals and recycling sectors, including Claude Dauphin Family Office, former executives at Trafigura, Circulate Capital, and the Francis Family Fund ApS.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy