Many investors put gold and Bitcoin in the same category. Some people even call Bitcoin “digital gold.”

Is this a fair comparison?

There are certainly similarities between the two assets, but there are some significant differences as well.

Gold and Bitcoin have both provided solid returns this year. Gold prices have risen by over 22 percent, reflecting the weakening U.S. dollar and growing investor interest. Bitcoin has charted even bigger returns, up over 150 percent since January.

There are other more fundamental similarities. Both gold and Bitcoin can be used as a transactional currency as well as a store of value. Neither are controlled by governments and central banks. This being the case, both gold and Bitcoin come with significantly less counterparty risk than many other asset classes. Both assets also have a naturally limited supply.

But there are also significant differences between gold and Bitcoin.

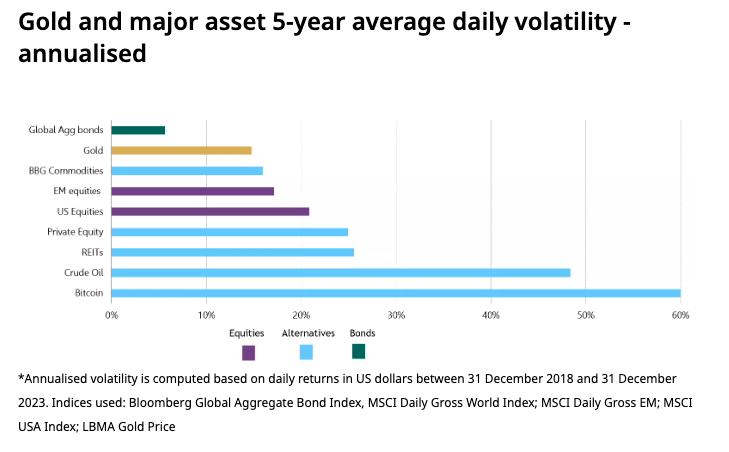

First, gold is much less volatile than Bitcoin. As the World Gold Council put it, “Gold and Bitcoin sit at the opposite ends of the volatility spectrum.“

In terms of volatility, Bitcoin behaves more like a tech stock. That’s because according to major asset managers, Bitcoin’s strongest use case is as an indicator of overall blockchain adoption.

Another difference between Bitcoin and gold is their correlation with other assets in a diversified portfolio. According to the World Gold Council, “The numbers demonstrate that Bitcoin and gold have different drivers and in times of increased stress in market conditions, gold provides a unique impact on a diversified portfolio.“

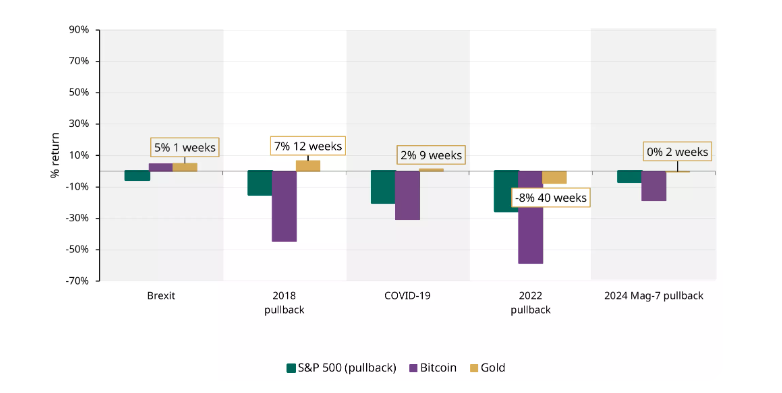

Comparing gold’s performance with Bitcoin during periods of significant economic turmoil demonstrates gold’s role as a safe haven distinct from Bitcoin.

As the World Gold Council summed it up, “What you can find is that once established, Bitcoin has not demonstrated the same characteristics as gold at those critical moments. When you expect protection against significant market moves, Bitcoin tracked risk assets.“

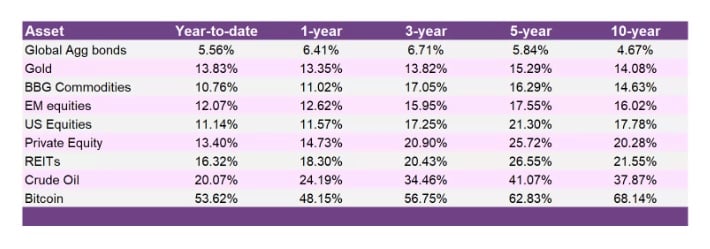

World Gold Council analysis found that adding gold to a portfolio “provides demonstrated diversification.” On the other hand, adding Bitcoin to a portfolio is more similar to increasing exposure to high-risk equities such as tech stocks.

“Allocating gold to the portfolio provides an increasing level of risk-adjusted return at any level of allocation. Holding it for the past decade (rebalancing as required) would have increased the risk-adjusted returns and lowered volatility.

“Allocating Bitcoin to a portfolio and holding it for the past decade (rebalancing) would have increased the risk-adjusted return at a certain level, in this case, 2.5 percent. However, beyond that allocation level, the portfolio volatility would have been higher; drawdowns greater; the risk-adjusted return would deteriorate.”

So, while gold and Bitcoin are similar in some ways, they are not the same investment. Each has unique characteristics and risks.

The World Gold Council summed it up this way:

“While Bitcoin may bring certain benefits to a diversified portfolio, the data shows that it is not an equivalent investment to gold or substitute for gold as it adds risk through increased volatility and returns comparable to high-risk equity assets.”

*********