Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

This morning, a senior representative at the International Energy Agency posted something on LinkedIn that triggered my statistics radar.

I’ve been tracking the ascent of Chinese wind manufacturers up the leaderboard for years, so the assertion that China wasn’t on the podium was perplexing. My first hypothesis was that it was based on revenue, as western manufacturers are much more costly than their Chinese counterparts. That’s due to China’s purchasing power parity and Wright’s Law advantages. Basically, their domestic supply chains are 40% cheaper than the West’s and their massive domestic and export market means that they typically build more of everything than the West’s manufacturers, so have doubled production and dropped costs more.

However, when I looked more closely, the game with statistics being played was historical. This is a bad basis for an Olympic podium metaphor. It’s like averaging all of the 100 meter times of the sprinters involved over the previous decade and declaring a winner based on the result. That’s not how the Olympics work.

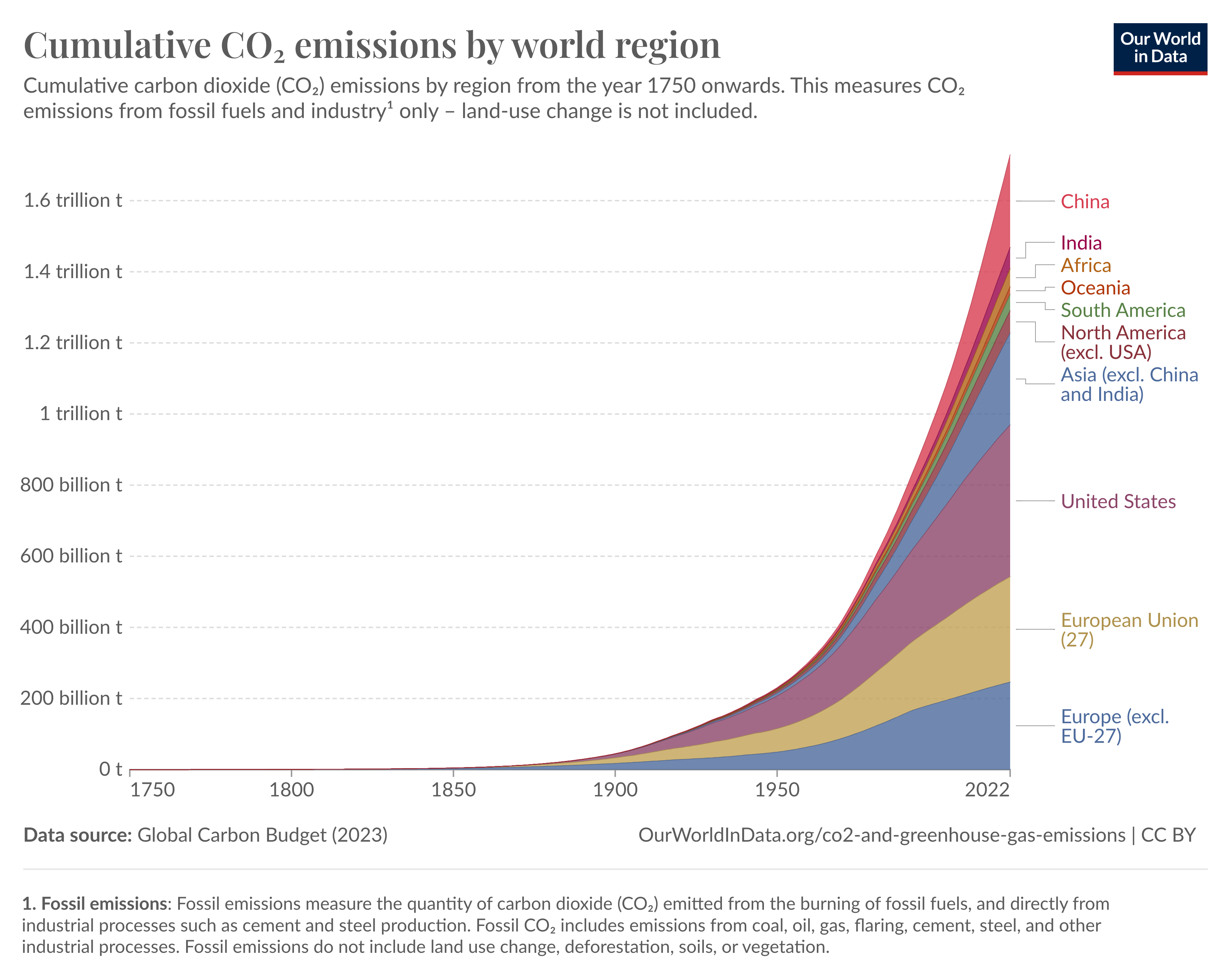

To be clear, I suspect I’m possibly correct about revenue ratios, but that’s not what the IEA representative was asserting. This is one of those Western things where often the best possible period for the West that is also the worst possible period for China is used as the basis of comparison. For example, many in the West like to point at China’s current emissions and pretend that historical emissions aren’t important.

Have a look at the combined emissions of Europe and the United States. Well over half of all greenhouse gas emissions historically are from those sources. China’s current emissions are the largest, but that’s only recent history. And to be clear, China is at peak emissions this year. With its massive deployment of low-carbon generation, transmission and storage, and its massive electrification of transportation, heat and industry — it’s leading the world by far in both categories — as well as the end of its massive infrastructure and city building spree, it’s going to see rapidly declining emissions in the coming years while North America especially continues merrily along a high-emissions pathway.

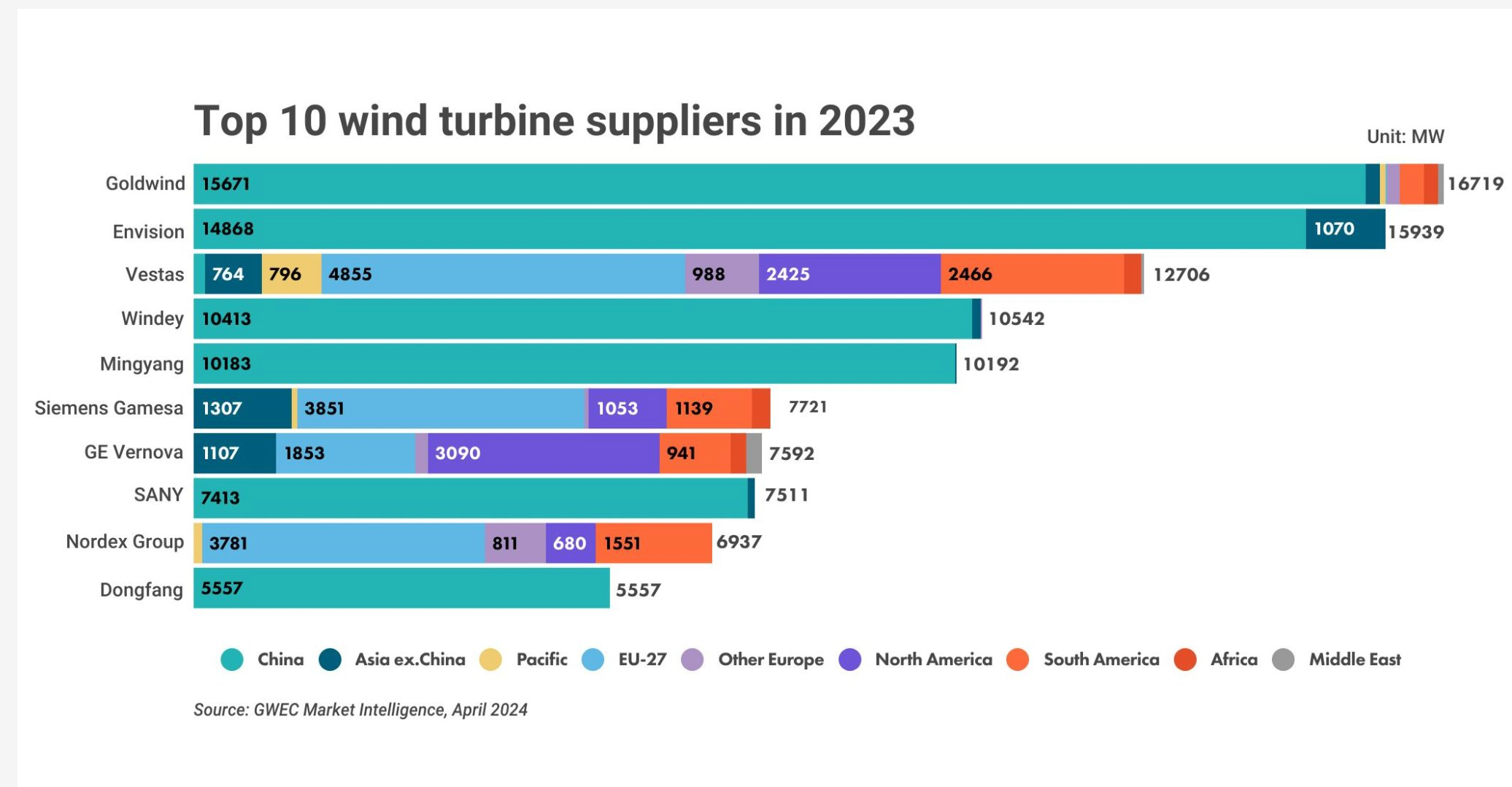

A more appropriate Olympics analogy is 2023 deployments. What’s the order of firms by GW of capacity installed in 2023?

That’s a slightly different picture, isn’t it. You’ll note the massive turquoise bars of Chinese domestic deployment. The ones that combined vastly outstrip the rest of the world combined. While Vestas, GE and Siemens have a lot more deployment in Europe and the Americas — for now —, China has vastly more deployments in total.

If you had to give a gold, silver and bronze medal out for 2023, it would be China, China and Denmark, not Denmark, Spain/Germany, United States, as the IEA representative asserted. The Olympics aren’t graded on the total scores of all international sporting competitions, they are graded on what-have-you-done-for-me-lately.

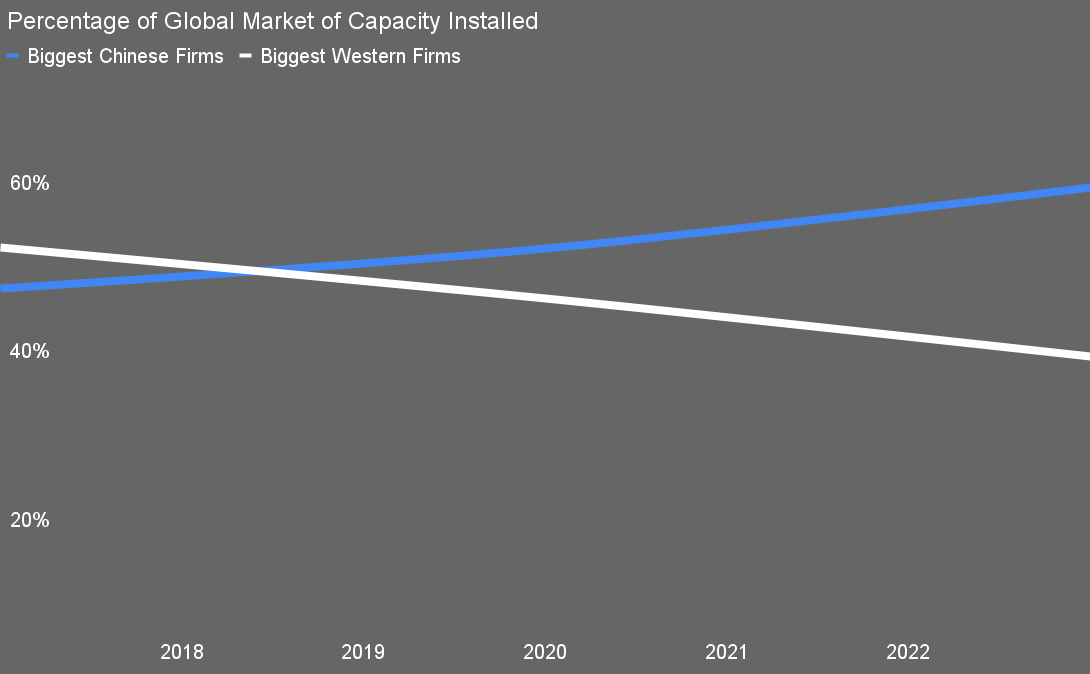

Another way to look at it is market share. This is this year’s top 10 firms by capacity looking backward to 2017, when Siemens and Gamesa tied the knot. Even then, China’s wind generation capacity deployment was very high, it’s just that their firms weren’t in the top three spots. Does this look like the podium is all people of European descent? With that significant a decline in global market share, does it even look like they are in the top tier anymore?

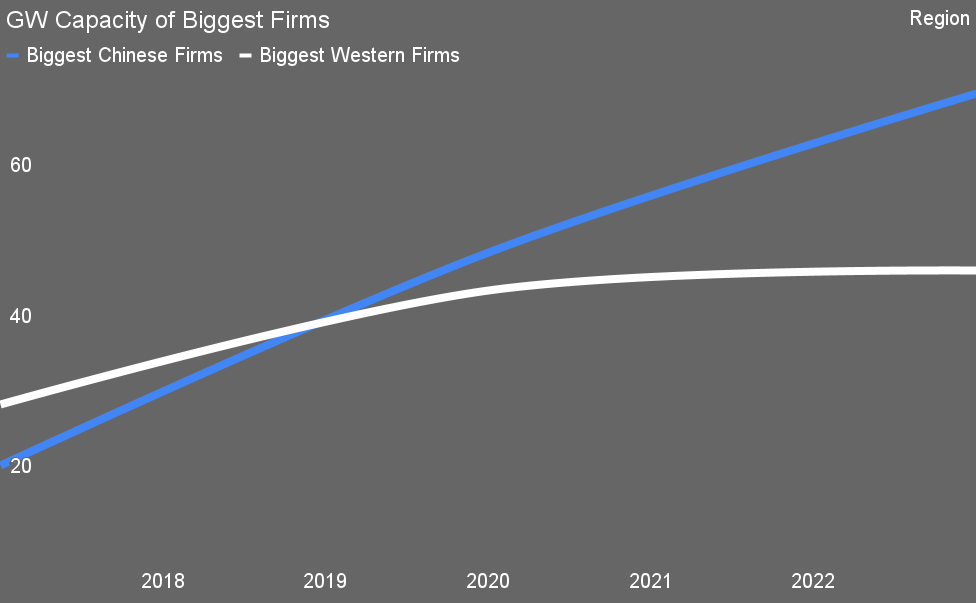

Maybe it’s a lot different in terms of absolute GW of capacity deployed?

That doesn’t look good either. From 2020 to 2023 — note that I sampled 2017, 2020 and 2023, so the curves aren’t perfect — Western firms were relatively flat in terms of total GW of capacity delivered, while Chinese firms shot up substantially. It’s worth pointing out also that while the sample is of ten firms, it’s six Chinese firms vs four Western firms, and excludes India’s Suzlon, which has 20 GW of capacity installed to date, off the bottom of the chart, but growing.

By podium ranking, China has the gold and silver locked up. By total GW installed in 2023 — the equivalent of total medal haul at the Olympics — China is far out in front. By percentage of market share — perhaps the equivalent of most viral clips — China is far out in front. If wind energy is the Olympics, China is emperor of the sport, and the former leader, Denmark, is liable to be kicked off the podium entirely in the next year or two.

That’s why the IEA leader’s take on it made my eyebrows go up this morning. I commented as such on LinkedIn. Someone tried to say that China’s domestic market shouldn’t count because China didn’t let Western firms sell in the country. Western firms can’t compete inside China. They are just too expensive. China is manufacturing equivalent or greater quality and size turbines for 40% less cost.

It’s the West that’s a walled garden of tariffs and chauvinism, increasing the cost and likely decreasing the overall quality of wind energy deployed in the West.

Siemens Gamesa has faced significant quality issues in recent years, particularly with its onshore wind turbines. The company has reported challenges related to component failures and production defects, leading to substantial financial losses and project delays. These issues have prompted a comprehensive review of their manufacturing processes and intensified efforts to improve product reliability.

While it’s a bit of a tempest in a teapot, the failure of a GE blade in the Vineyard 1 offshore wind farm on the USA’s northeast coast didn’t surprise me in the least. It’s been vastly over-amplified as part of affluent coastal vacationers’ efforts to prevent their view of Europe being obstructed by wind turbines peaking over the wave tops. However, it’s not alone. A turbine in the North Sea Doggers’ bank offshore wind farm and several onshore wind turbines in Germany and Sweden have also broken in recent years.

It’s part and parcel of GE’s failure of engineering and quality. Jack Welch took an American engineering giant, stripped it of engineers, rammed in finance types, gamed quarterly results with financialization — pro tip: if you see the term financialization, read it as cooking the books — and destroyed the firm. It’s off the New York Stock Exchange now, split into three splinters of its former redwood scale, and it had been on the market as GE since the 1890s.

Europeans and Americans have told me seriously that Chinese wind turbines just aren’t at the same standard of quality as Western ones a few times in the past couple of years. I hear chauvinism, not reality. I hear denial and fear, not acceptance and fixing things. It’s not just wind energy, of course. The litany of “they just make copies” and “their PhDs aren’t as good as our PhDs” and “their patents are really low quality” is a constant refrain as Western firms and policy makers try to come to terms with the inversion of the way the world is “supposed” to be.

The West’s denial of the clean tech ascendance of China across the board comes at the same time as this CarbonBrief headline:

China’s CO2 falls 1% in Q2 2024 in first quarterly drop since Covid-19

Yes, China’s emissions have peaked, six years ahead of target, and are falling. Of course, many in the West are asserting that it’s because their economy is collapsing.

“The quarter-on-quarter growth of GDP in 2023 and in the first and the second quarters of 2024 are 1.8 percent, 0.8 percent, 1.5 percent, 1.2 percent, and 0.7 percent respectively.” Yes, these results out of China are definitely indicative of collapse and failure (note: that’s sarcasm, just to avoid Poe’s Law).

The West would love to have this kind of failure. Slowing as their infrastructure and city-building boom draws to an end, yes, but far from failing. There’s a list of headlines, several per year from 2000 onward, floating around the internet culled from The Economist, the Wall Street Journal and other respected Western media outlets that claim China’s about to fail. There’s even one guy who makes that claim every two to three years and gets invited on talking head shows to explain it as if he hasn’t been wrong every time since the late 1990s and has the credibility of particularly oily used car salesperson.

China has decoupled its growth from emissions. It’s putting in vastly more wind, solar, water, storage and transmission than the rest of the world combined. It’s electrified transportation more than the rest of the world combined. It’s electrified industry more than the rest of the world. It’s continuing to do so at a tremendous rate. China’s emissions are going to be falling while the West’s only slowly decline. But those historical numbers for cumulative carbon emissions aren’t going to be taken off the West’s score card.

Unlike the odd take by the IEA representative regarding wind energy, China’s at the top of the leader board in climate action across almost every event. The West’s chauvinism and protectionism are slowing their climate action because they refuse to take advantage of China’s long term industrial policy to drop the price of most cleantech categories.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy