Ben Franklin once noted that “we are all born ignorant, but one must work hard to remain stupid.” Yet, the ignorance presented by the financial media never ceases to amaze me.

When gold rallied recently without any seeming catalyst to which the media was able to point, the following title to a gold article was actually published in Barron’s:

“Gold Rises in Delayed Reaction to Attempted Trump Assassination”

When I read that, my jaw dropped. I really do have to wonder if they wrote that as a joke, or if they were just so devoid of any reasonable cause they could not come up with anything better.

Then it led me to the following article on Seeking Alpha:

“Gold Hits Record High Of $2465/Oz Despite Positive U.S. Retail Sales Data”

It made me question whether gold is supposed to go down when we see positive US retail sales data? And based upon market history, the answer is no. Sometimes it does. Sometimes it does not. And, sometimes it does not even react. Then I read the article, wherein the author noted the following:

“Gold prices continue to ride the wave of post-CPI and rate cut optimism as the precious metal nears its previous all-time high around the $2450/oz mark.

This surge comes despite a resurgent US Dollar index, bolstered by recent events and positive US retail sales data. Initially, the strength in the US Dollar index seemed poised to cap gold prices, but this pressure failed to materialize. Gold briefly dipped to a low of $2429.45 before rallying to fresh daily highs at $2458.05.

June’s US retail sales numbers remained unchanged, but an upward revision of May’s figure to 0.3% temporarily paused gold’s rally. Nonetheless, the report did little to alter market expectations regarding Fed rate cuts, even as the US Dollar gained some strength.”

It certainly seemed as though the author may have possibly understood the driver of gold when he noted that it rallied on optimism. But when he tied that optimism to being based only upon rate cuts, well, it also left me scratching my head at the ultimate inconsistency in his views on gold. I thought rising rates and inflation are supposed to be positive for the price of gold?

Moreover, it seems the author was baffled by the rally in gold occurring alongside a rally in the US dollar. Yet, do you think the author would even question the soundness of his confused proposition?

At the end of the day, the author presented us with his confusion about what drives gold, yet offers no insight into why his views of what really drives gold may be wrong. Intellectual honesty has left the building.

After reading all of this, I really felt as though I took a trip to Bizzaro-world, where everything is backwards.

It again brings me to the wise words of Robert Prechter, wherein he noted in his seminal book The Socionomic Theory of Finance (a book I strongly recommend):

“Observers’ job, as they see it, is simply to identify which external events caused whatever price changes occur. When news seems to coincide sensibly with market movement, they presume a causal relationship. When news doesn’t fit, they attempt to devise a cause-and-effect structure to make it fit. When they cannot even devise a plausible way to twist the news into justifying market action, they chalk up the market moves to “psychology,” which means that, despite a plethora of news and numerous inventive ways to interpret it, their imaginations aren’t prodigious enough to concoct a credible causal story.

Most of the time it is easy for observers to believe in news causality. Financial markets fluctuate constantly, and news comes out constantly, and sometimes the two elements coincide well enough to reinforce commentators’ mental bias towards mechanical cause and effect. When news and the market fail to coincide, they shrug and disregard the inconsistency. Those operating under the mechanics paradigm in finance never seem to see or care that these glaring anomalies exist.”

Now, when the first article title noted above went so far as to claim that the market acted in “delayed” fashion to some news event, well, this should highlight the outright “stupidity” (as per Franklin) of the mechanics paradigm utilized by our financial media.

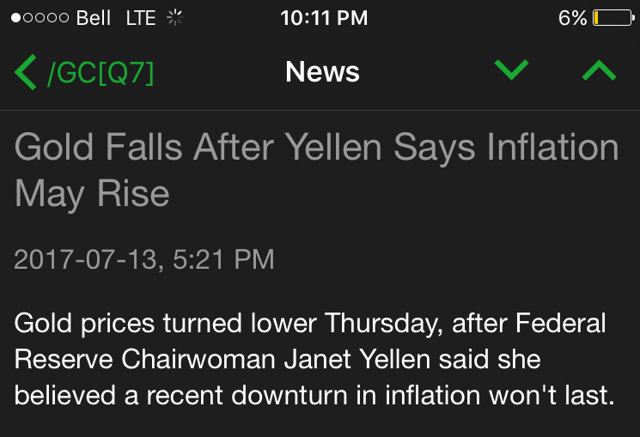

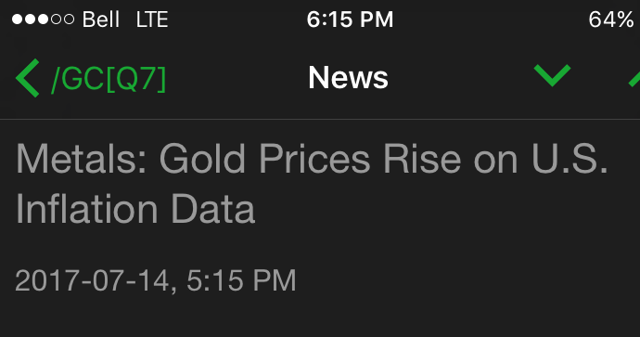

Moreover, in reference to the second article, I can no longer count how many times I have seen the metals rally and decline within 48 hours, yet the exact same reason was suggested for both the rally and the decline. Here is just one example that I saved:

Folks, do you really think any of this is going to help you in divining the next move in the metals market? Yet, almost all of you continue to read such articles, without even questioning the soundness of the underlying propositions.

You see, we all love narratives when it comes to the market because when we believe we understand what is going on from a “logical” perspective, then we believe we are in control. Yet, anyone who truly understands the stock market or life in general understands that this is pure folly.

I actually ran across this comment in an article which evidences what I just said so well:

“When a pull back contradicts the fundamentals, it simply means people feel that even after taxes the have made enough money and are happy with their gains, and they sell.

Then what happens next is quite interesting. They let that cash sit in their account. After a few days they feel an urge to put that money back to work, and ask themselves: “heck, now what to do with this cash to make it even bigger?”!

Most often , what they do is to put it back into the very same stocks they sold (but just a tiny bit below the price they sold) and get their ego satisfied that “yeah baby, I am smart!”, because they are buying back at 5% to 6% below what they had sold!! (But far higher than what they had originally bought).This has and will continue to be the characteristic of a typical bull market!

Of course there are those that invest the cash into completely different stocks (but very much in the same sector(s) as they sold their stock).”

This commenter basically said that the market and investors are wrong for allowing a pullback to occur because it “contradicts the fundamentals.” Then he provides us with a beautiful narrative as to his “logic” in coming to this determination. So, consider these two quotes to challenge what this commenter noted:

“So convenient a thing it is to be a reasonable creature, since it enables one to find or to make a reason for everything one has a mind to do.” – Ben Franklin

This next quote was taken from Professor Hernan Cortes Douglas, former Luksic Scholar at Harvard University, former Deputy Research Administrator at the World Bank, and former Senior Economist at the IMF, who addressed the problems regarding utilizing “fundamental” analysis for predictive purposes:

“The historical data say that they cannot succeed; financial markets never collapse when things look bad. In fact, quite the contrary is true. Before contractions begin, macroeconomic flows always look fine. That is why the vast majority of economists always proclaim the economy to be in excellent health just before it swoons. Despite these failures, indeed despite repeating almost precisely those failures, economists have continued to pore over the same macroeconomic fundamentals for clues to the future. If the conventional macroeconomic approach is useless even in retrospect, if it cannot explain or understand an outcome when we know what it is, has it a prayer of doing so when the goal is assessing the future?”

Furthermore, consider what Daniel Crosby, the author of The Behavioral Investor, wrote:

“Storytelling bypasses many of the critical filters we apply to other forms of information gathering . . . For this reason, stories are the enemy of the behavioral investor . . . trusting in common myths is what makes you human. But learning not to is what will make you a successful investor.”

At some point, you must come to the realization that much of what you may believe about the market is wrong, especially when the market does the exact opposite of what you expect time and again. But, most investors just shrug it off and move on to the next expectation based upon news, earnings or economic reports.

Ultimately, and unfortunately, most investors believe exogenous factors drive market direction despite much evidence to the contrary.

For example, in a 1988 study conducted by Cutler, Poterba, and Summers entitled “What Moves Stock Prices,” they reviewed stock market price action after major economic or other type of news (including major political events) in order to develop a model through which one would be able to predict market moves RETROSPECTIVELY. Yes, you heard me right. They were not even at the stage yet of developing a prospective prediction model.

However, the study concluded that “[m]acroeconomic news . . . explains only about one fifth of the movements in stock market prices.” In fact, they even noted that “many of the largest market movements in recent years have occurred on days when there were no major news events.” They also concluded that “[t]here is surprisingly small effect [from] big news [of] political developments . . . and international events.” They also suggest that:

“The relatively small market responses to such news, along with evidence that large market moves often occur on days without any identifiable major news releases casts doubt on the view that stock price movements are fully explicable by news. . . “

For another example, in a paper entitled “Large Financial Crashes,” published in 1997 in Physica A., a publication of the European Physical Society, the authors, within their conclusions, present a nice summation for the overall herding phenomena within financial markets:

“Stock markets are fascinating structures with analogies to what is arguably the most complex dynamical system found in natural sciences, i.e., the human mind. Instead of the usual interpretation of the Efficient Market Hypothesis in which traders extract and incorporate consciously (by their action) all information contained in market prices, we propose that the market as a whole can exhibit an “emergent” behavior not shared by any of its constituents. In other words, we have in mind the process of the emergence of intelligent behavior at a macroscopic scale that individuals at the microscopic scales have no idea of. This process has been discussed in biology for instance in the animal populations such as ant colonies or in connection with the emergence of consciousness.”

If you have not read my work before, I will state affirmatively that it is market sentiment which drives the price of gold. And, in tracking market sentiment, we were able to call the high for gold back in 2011, the low at the end of 2015, and I was even pounding the table at the end of last year regarding what I saw as an upcoming major rally phase in the metals complex.

As you can see from this chart I presented to my subscribers in October of 2023, I was looking for a major rally to take hold in 2024.

And, thus far, it has not disappointed. In fact, the metals complex has outperformed the SPX in 2024. Moreover, I think it is going to continue.

As it stands today, I am expecting to see a major rally across the metals complex, wherein silver and mining stocks can begin to outperform gold itself. But, gold will not be left behind by much.

When you look at the 2023 chart I posted above, I will tell you that we are in wave v of [3]. However, due to the manner in which this is setting up, I am actually raising my targets for that wave degree. In fact, my minimum target for GLD is 263, but I think we can easily extend up to the 273-288 region – again, depending upon how the extensions take shape in the next rally.

*********