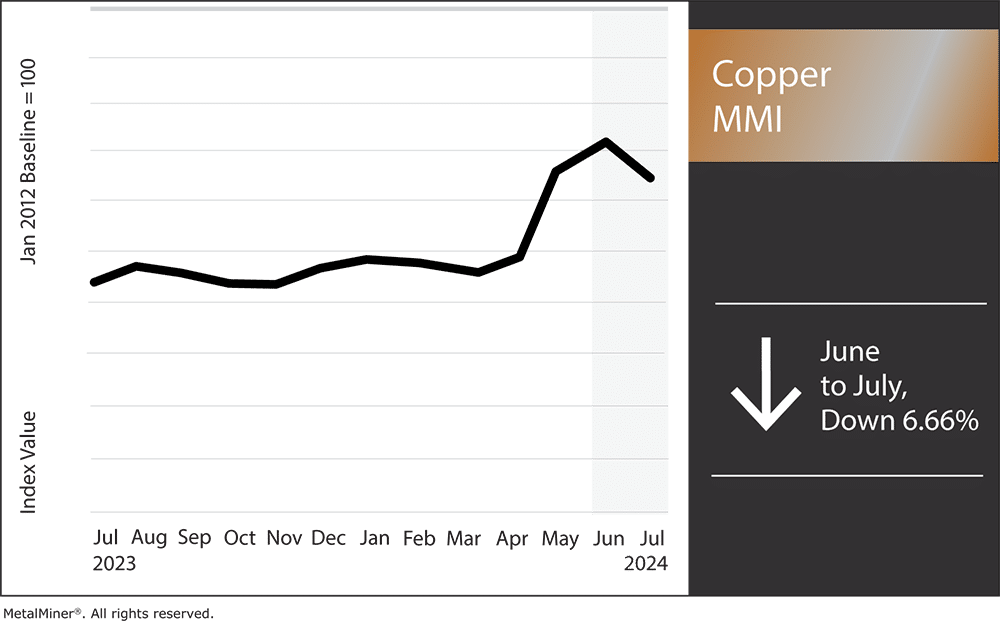

Overall, the Copper Monthly Metals Index (MMI) fell 6.66% from June to July. Following a nearly 5% decline throughout June, copper prices found an at least temporary bottom at the end of the month. Prices rose 4.35% during the first week of July as market signals improved.

There are numerous factors affecting copper prices today. Get all of the latest updates with MetalMiner’s weekly newsletter.

Chinese Import Premium Briefly Returns to Growth

Copper demand in China has shown a slight improvement in recent days. The Yangshan Copper Premium, a leading indicator for Chinese copper demand, saw a brief return to positive territory on July 5. The import premium plunged below zero in mid-May as Chinese demand for copper slumped. Meanwhile, higher copper prices throughout Q2 saw Chinese consumers pull back, which translated to a negative premium that reached -20 at its lowest point. However, the rise proved short-lived, as the premium dipped back to zero on July 7.

It remains difficult to determine whether the recent rise in the premium results from lower copper prices or better conditions in China. Still, the former seems more probable than the latter. Since emerging from lock downs, the Chinese economy has largely disappointed markets, particularly regarding consumer demand. The ongoing downturn of its property sector offered no support to copper demand, leaving China’s renewable efforts to pick up the slack.

Meanwhile, protectionist measures against China continued accumulating over recent months as Western nations fended off the threat of Chinese overcapacity. In fact, export demand from China remains its leading growth driver. However, the manufacturing PMI from China’s National Bureau of Statistics dipped into contraction in both May and June at 49.5, which is hardly a sign of an economic rebound.

MetalMiner Insights covers price points, correlation charts, and price forecasting for copper. See our full metals catalog.

U.S. Demand Offers Support to Copper Prices Today

It remains unclear whether China can hold onto recent improvements in copper demand and gain momentum. Weakness in China has largely helped fend off higher copper prices amid global renewable efforts. However, copper demand in the U.S. continues to appear strong relative to the rest of the world. CME inventories looked depleted compared to both the LME and SHFE.

The May copper squeeze, which saw prices hurtle to a new all-time high, left traders scrambling for material to cover their positions. Meanwhile, CME prices have yet to emerge from backwardation, unlike LME prices. This indicates that supply remains tight.

Some of this demand comes from infrastructure and renewable efforts. The Census Bureau’s most recent construction spending report showed that while overall construction spending fell month over month, public construction spending rose during May. Notably, spending related to power rose 28.1% year over year as grid improvements remain ongoing. Looking ahead, this will further benefit from the White House’s efforts to accelerate grid improvements.

Other signals have also started to improve, which could lead to further support for copper demand and, thus, prices. After dipping into contraction in May, the Electroindustry Business Conditions Index (EBCI) accelerated growth in June, rising from 50 in May to 57.7 in June. While most respondents reported unchanged conditions, 23% saw conditions improve. Macroeconomic trends like this are covered weekly in MetalMiner’s newsletter.

Meanwhile, respondents continued to report uncertainty, which likely tempered June’s reading. However, 69% expected better conditions in the next six months. This expectation mainly stems from the U.S. moving beyond the upcoming presidential election and a possible rate cut from the Fed in H2 2024.

Investors See Hope For A Rate Cut

Those surprised by the end of the last rally missed a cardinal rule of investing: Don’t fight the Fed. It seems over-optimism regarding when the Federal Reserve would cut rates saw investors pile on bets during Q2, only for sticky inflation to add to repeated delays to the eventual pivot.

However, recent months have suggested progress in the Fed’s hunt for a 2% target inflation rate, as May marked the second consecutive decline in the Consumer Price Index (CPI). The reading fell from 3.5% in March to 3.4% in April and 3.3% in May. However, unless the Fed shifts its target rate or the slowdown in inflation accelerates, the agency might still dash hopes for a cut by September. That said, the trend continues in the right direction, which boosted market optimism in recent weeks.

The job market also showed signs of cooling in June. While it remains near historic lows, the unemployment rate increased last month. The pickup in unemployment may increase downside pressure on inflation, forcing more people to hold off spending. The respective directions of the two indicators (down for CPI, up for unemployment) demonstrate the slowdown the Fed has been hoping for.

Still, those trends must remain sustained for the foreseeable future before officials feel confident in cutting rates. The longstanding fear for the Fed remains the possibility of a resurgence in inflation, especially as the higher costs of nearshoring efforts and geopolitical conflicts remain a fixture within markets.

As the Fed made headway, the overall impact on copper prices appeared to be bullish. By July 5, LME Commitment of Trading Reports showed investment funds increased their total long positions to the highest level in almost a month.

Biggest Copper Price Moves

Read what’s next for copper prices in this month’s Monthly Metals Outlook. The report provides both short-term and long-term forecasts as well as buying strategies, giving you the edge to navigate market volatility. Secure a free sample report and opt into a subscription.

- Korean copper strip prices saw the only increase of the overall index, with a 5.13% rise to $12.08 per kilogram as of July 1.

- Meanwhile, LME primary three month copper prices fell 5.12% to $9,625 per metric ton.

- Chinese copper wire prices experienced a 5.35% decline to $10,706 per metric ton.

- Chinese copper scrap prices fell 8.38% to $976 per metric ton.

- Chinese copper wire scrap fell 8.42% to $10,157 per metric ton.