Oil:

Analysis:

Wave i ended at the 103.65 high and we are now falling in a lengthy and complex wave ii correction.

It looks like wave ii has become a double 3 wave corrective pattern. Our first 3 wave pattern ended at the 63.57 low, which was followed by a wave x rally ending at the 95.03 high.

We are now falling in our second 3 wave pattern, with our second wave a ending at 67.71. We are now still rallying in our second wave b. Within our second wave b it looks like it has the following internal wave structure:

-a- = 76.18.

-b- = 70.06.

-c- = 87.67, to complete all of our second wave b.

After our second wave b ends, we expect another drop in wave c. We will provide our projected endpoint for our second wave c, when we believe that our second wave b has ended, as follows:

c = a = 60.35.

Our retracement levels for all of wave ii are:

50% = 68.50.

61.8% = 53.87.

In our last Weekly Post, we introduced an alternate internal wave count for wave ii, that suggests that all of wave a ended at 63.57 and that wave b has become a bearish triangle formation with wave -a- ending at 95.03 and wave -b- at 67.71.

In this case, we are still rallying in wave -c-, which cannot move above the wave -a- high of 95.03.

After wave ii ends, we expect a very sharp rally in wave iii.

Trading Recommendation: Long crude with a put as a stop. Long Suncor.

Active Positions: Long crude with puts as a stop! Long Suncor!

Bitcoin:

Analysis:

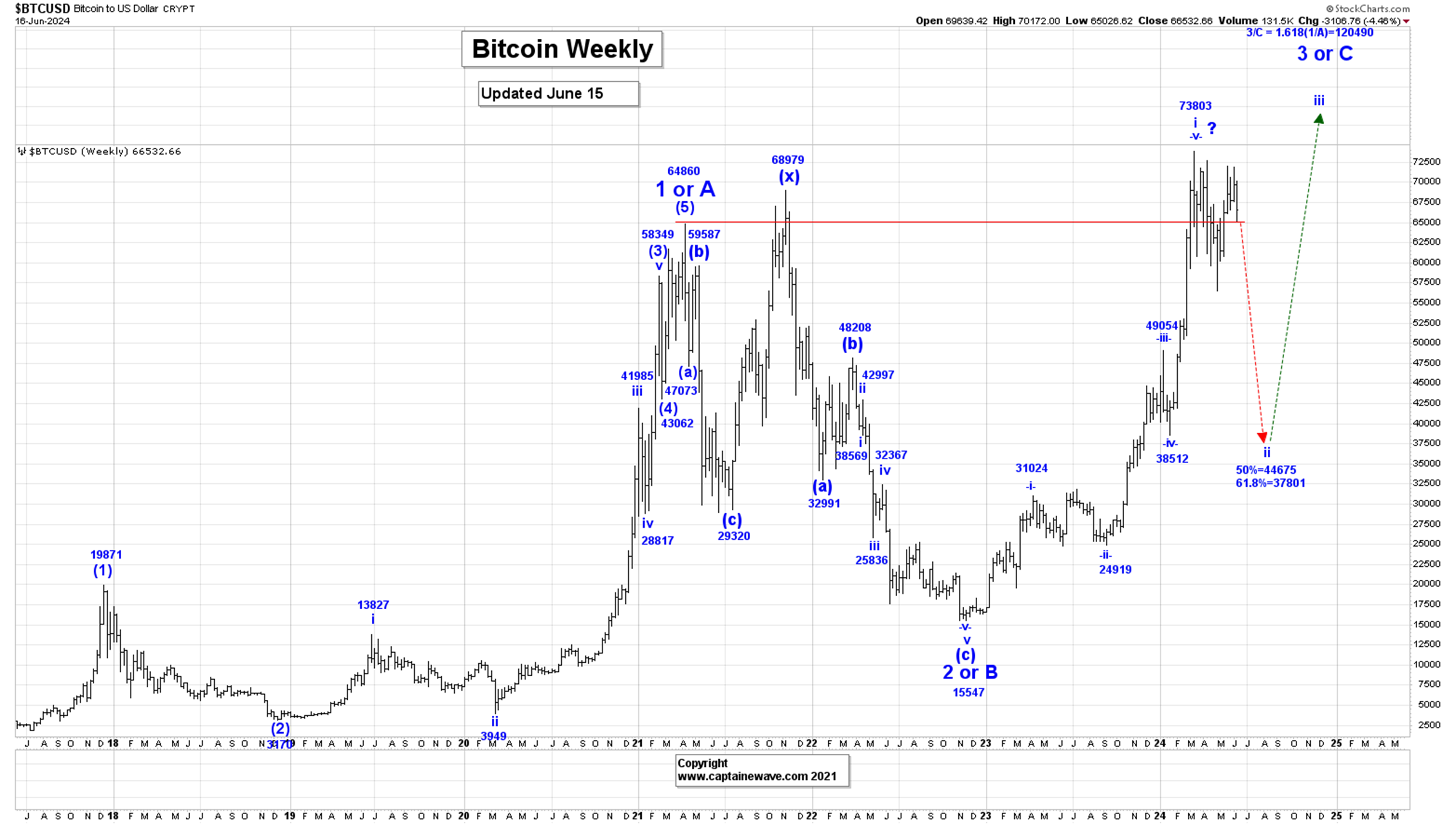

All of wave 1 or A is now complete at the 64860 high and wave 2 or B at the 15547 low.

Within wave C, we are now rallying in wave i and within wave i, we completed wave -i- at 31024, wave -ii- at 24919, wave -iii- at 49054 and wave -iv- at 38512.

We likely completed all of wave -v- and wave i at the 73803 high and if that is the case then we are now starting to fall in wave ii, which has the following retracement levels:

50% = 44675.

61.8% = 37801

We expect lower prices in the weeks ahead as wave ii develops.

Longer term our initial target for the completion of wave 3 or C is:

3/C = 1.618(1/A) = 120,490.

Active Positions: Flat!

Special Subscription Offer For Ewave Enthusiasts: At $99/mth the Captain Ewave newsletter value is superb. The Captain takes all the money making trades himself. We have a special $399/6 months offer this week. Investors get 6 updates a week from the captain! Send us an email at [email protected] or click this link and we’ll get you on board. Thank-you!

Gold:

Analysis:

Our very large wave .iv. bullish triangle pattern is complete at the 1810.10 low and that we are thrusting higher in wave .v. of -iii-.

Within wave .v. it looks like wave *i* ended at the 1997.20 high and all of wave *ii* ended at the 1929.50 low. We are now rallying in wave *iii*, which has a projected endpoint of:

iii* = 4.236*i* = 2682.20.

With wave *iii*, wave ^i^ ended 2151.00, and wave ^ii^ at 1923.50. We are now rallying in wave ^iii^, which a projected endpoint of:

^iii^ =- 2.618^i^ = 2568.70.

Within wave ^iii^, wave !i! ended at 2088.50, wave !ii! at the 1984.30, wave !iii! at the 2431.50 and it now looks like wave !iv! is becoming more complex and likely an incomplete bullish triangle formation.

For this formation to remain valid we cannot trade below the 2277.60 low, otherwise wave !iv! is becoming a flat type correction.

After our wave !iv! bullish triangle ends we expect another thrust higher in wave !v!.

Our current projected endpoint for the end of wave -iii- is:

-iii- = 4.236-i- = 2531.10.

After wave -iii- ends we expect a wave -iv- correction that retraces between 23.6 to 38.2% of the entire wave -iii- rally.

Trading Recommendation: Long gold. Use puts as stops.

Active Positions: Long gold, with puts as stops!

Free Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you our free “Silver: Nested Bull Waves In Play!” report. We highlight key (and bullish!) wave count action for silver, on the daily and weekly charts. Key buy and sell tactics are including in this important report.

Thank-you!

Captain Ewave & Crew

Email: [email protected]

Website: www.captainewave.com

*********