Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Plugin vehicles in China once again ended the year with a record month, growing by 46% year over year (YoY) in the last month of the year to a record 980,000 units. Interestingly, full electric vehicles (BEVs) grew at a slower pace, growing just 31% to 618,000 units. They were responsible for 63% of the plugin market in December, below the 66% average of 2023, which itself is some 8% below the 2022 final result (74%).

This is explained by the fact that range-extended vehicles have become trendy in China, and with most of them packing 40 kWh-ish battery packs and fast charging capabilities, one can say that the Chevrolet Volt formula has found success in China and is at the forefront of the electrification process in this market. [Editor’s note: More than a decade after the Chevy Volt was introduced! Also, this is often being done in larger vehicles, SUVs, like many argued GM should do a decade ago.]

Looking back, the plugin share progression is nothing less than astonishing. At the end of 2020, we were celebrating a record 6.3% (5.1% BEV) market share, followed by 15% (12% BEV) in 2021 and 30% (22% BEV) in 2022. Now, we’re at 37% (25% BEV).

With the plugin share already at 37% in 2023, and with full electrics (BEVs) alone accounting for 25%, a slowdown in the growth rate is bound to happen, but even with slower rates, expect the Chinese automotive market, the largest in the world, to cross the 50% mark by 2026. By then, BEVs should be responsible for over a third of the sales of the overall market.

If Chinese OEMs wish to continue doubling their sales, as many have been aiming to do, there is one way to do it: exports.

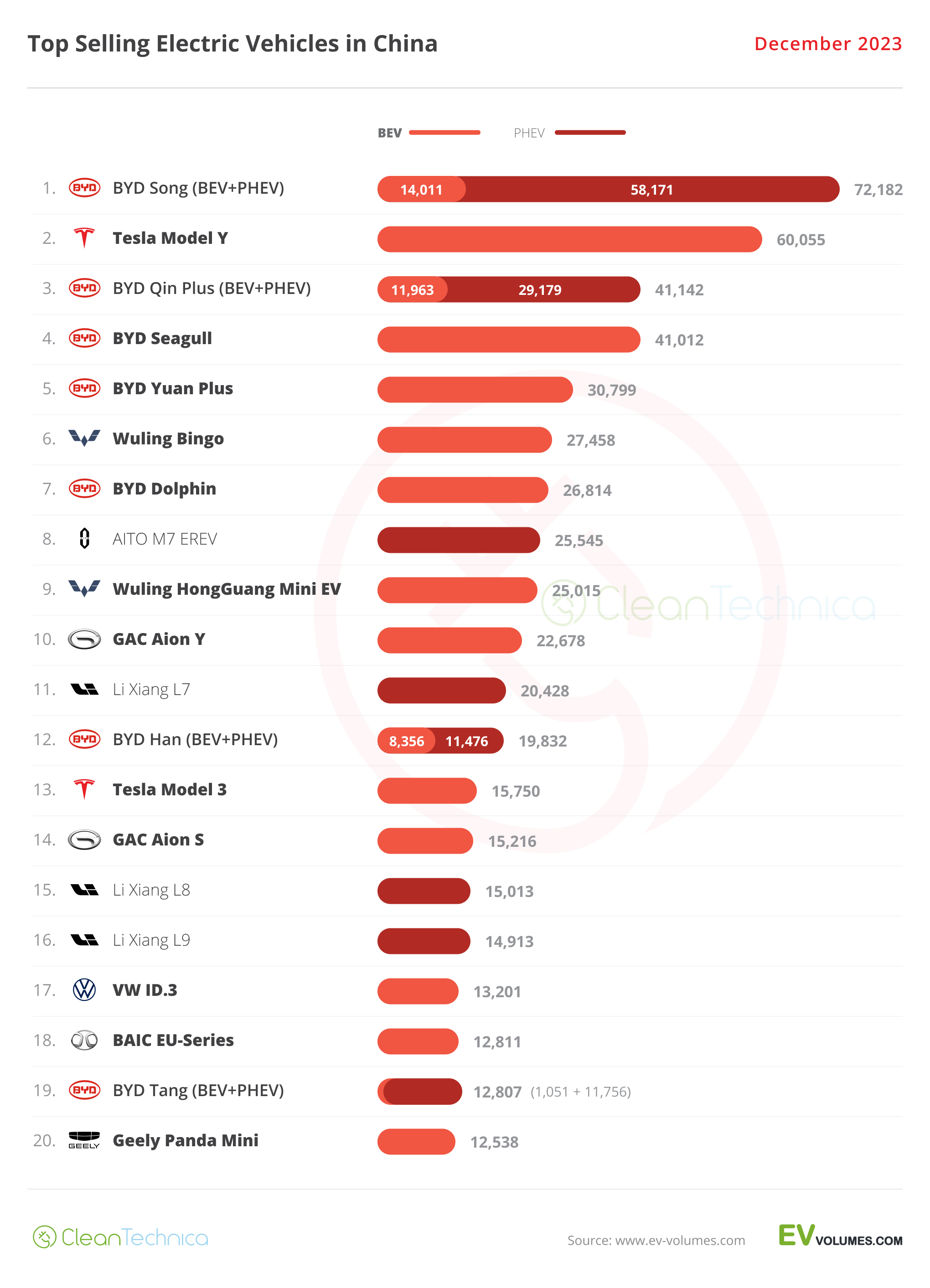

Regarding December 2023, there were no real surprises in the best sellers list. The BYD Song (BEV+PHEV) won another best seller title, followed by its arch rival, the Tesla Model Y, and the BYD Qin Plus sedan. Here’s more on December’s top 5 best selling models:

#1 — BYD Song Pro/Plus (PHEV+BEV)

The rise and rise of BYD’s midsize SUV is remarkable, with constant record performances from both versions, and December was no exception. The BEV version reached a record 14,011 registrations (of 72,182 total registrations), thus proving that production is tilting towards BEVs. Was December peak Song? Depends. For the current generation, it probably is. First of all, the Song was the best selling model in the overall market in December, so the natural laws of the market will start to play against it. Additionally, the internal competition — namely, the all new Song L and upcoming Sea Lion — will likely steal significant volumes from the standard versions. These are meant to be BYD’s real Tesla Model Y competitors, but will also make a dent in Song customer demand.

#2 — Tesla Model Y

The bread and butter model of the Tesla family had 60,055 registrations last month, a new record performance. This is an especially impressive result considering the context — not only is the external competition said to be increasing, but the refreshed Model 3 could had stolen some clients from it. It seems that wasn’t the case, though, so expect the crossover to continue posting strong results in China, especially after the announced refresh said to arrive in April. With the standard BYD Song being cannibalized by its siblings, the Song L and Sea Lion, expect Tesla’s crossover to feature regularly at #1 in 2024, even if its sales won’t grow significantly.

#3 — BYD Qin Plus (BEV+PHEV)

A lasting player in the BYD lineup, the Qin Plus scored 41,142 registrations last month. Expect the midsize model to continue competing for top 5 positions throughout 2024, at least until the new and improved Qin L arrives sometime in 2024. The Shenzhen model is leading its vehicle class (midsize sedans), solidly ahead of GAC’s Aion S and the Tesla Model 3, thanks to constant updates (the current Qin Plus was launched in 2021 and BYD is set to launch the updated Qin L three years later). This is one of the secrets of the Chinese EV industry, and of BYD in particular.

#4 — BYD Seagull

BYD’s youngest star model had 41,012 registrations in December, and that was NOT a record month, which seems to imply that the delivery ramp-up seems to be slowing down, at least for now. With exports said to start soon, the biggest impact of this baby Lambo is going to be in export markets, where many markets are hungry for small and affordable EVs. One of the most competitive small EVs on the market, the little BYD hatchback is set to become a regular in this top 5 thanks to competitive pricing and specs.

#5 — BYD Yuan Plus

BYD’s electric crossover was 5th in the table, with 30,799 registrations last month. Looking at the whole-year sales performance, with deliveries north of the 300,000 unit mark, it got a respectable score. That might be difficult to repeat in 2024, mostly because of internal competition. (Where have I heard this before?) With the cheaper Yuan Up landing in the first half of 2024, expect part of the Yuan Plus volume to be taken by its slightly smaller sibling. However, BYD’s domestic market isn’t really the crossover’s main mission. The focus targets will be export markets, especially those in Southeast Asia and Europe.

Looking at the rest of the December best seller table, in a record month, it would be natural that several models hit best ever scores, and so they did. Besides the ones already mentioned, we should also highlight the #6 Wuling Bingo small hatchback. The Wuling EV has created a niche within the Chinese market, and we might even see it joint the top 5 soon. The #8 AITO M7 (25,545 registrations) also deserves a callout, with the full size model continuing to ramp up production. The Huawei-backed make aims to replicate Li Auto’s success story.

Speaking of Li Auto, all three of its current models hit record scores. (Remember that the Mega CyberVan will only land in March.) The 11th placed L7 had 20,428 sales, the L8 had 15,013 sales, and the flagship L9 had 14,913 sales. So, basically, they scored over 50,000 units in December. … And they are only present in the full size category.

Elsewhere, VW’s ID.3 hatchback continues on the rise, having reached a record 13,201 sales. That allowed it to reach the 17th position in December. Highlighting Wuling’s good month, we had the tiny Mini EV ending the month in 9th with 25,015 sales, a year best. It seems the basic Wuling Mini EV is here to stay….

Outside the top 20, there were a few surprises last month, like the refreshed Buick Velite 6 — a compact(!) station wagon(!!), coming from the US brand(!!!) — which scored a record 8,614 sales. So, it seems General Motors has found a much needed star player for his lineup in this market. And what about exporting it, GM? Now, THAT would be commitment to EVs!

Still talking foreign OEMs, VW’s ID.4 registered a year-best result, 8,130 sales. Add this to the ID.3’s record performance and it is now visible that Volkswagen is finally trying to get out of the hole it got itself into, in its largest market.

Regarding the Geely Mothership, the highlight is the Lynk & Co 08 midsize SUV. In only its 4th month on the market, it has crossed the 10,000 sales mark for the first time, scoring 10,055 deliveries.

Changan had good results across its lineup (12,480 units for the small Lumin and 6,978 for the SL03 midsize sedan), but the highlight was the S7 SUV, which scored 11,360 sales. That included 3,250 units coming from the BEV version, a new record for the midsize model.

BYD also celebrated the first full sales month of its new upmarket brands, Fangchengbao and Yangwang, with their respective first models, the Bao 5 and the U8, hitting 4,388 and 1,593 sales each. Expect these new brands to fatten the OEM’s profit margins, which could serve as a pillow for BYD in the country’s current price wars.

But the highlight of the month comes from SAIC. Besides the aforementioned good results from the Wuling Bingo and Mini EV, we should highlight that Wuling’s first sedan, the Starlight, is starting its career with a bang. It already reached 11,453 sales in only its 3rd month on the market, a major milestone for a brand previously known for small and/or utilitarian vehicles. Moving upmarket in the SAIC stable, Roewe’s take on the BYD Qin Plus formula, the recent D7, is also on the rise. It had 7,285 registrations. On top of Shanghai Auto’s “food chain,” the IM LS6 SUV hit 9,878 deliveries in only its 4th month on the market — but, in this case, it seems the demand ceiling is already being hit. In January, IM (SAIC’s poshest brand, which is also backed by Alibaba) started to discount its star player….

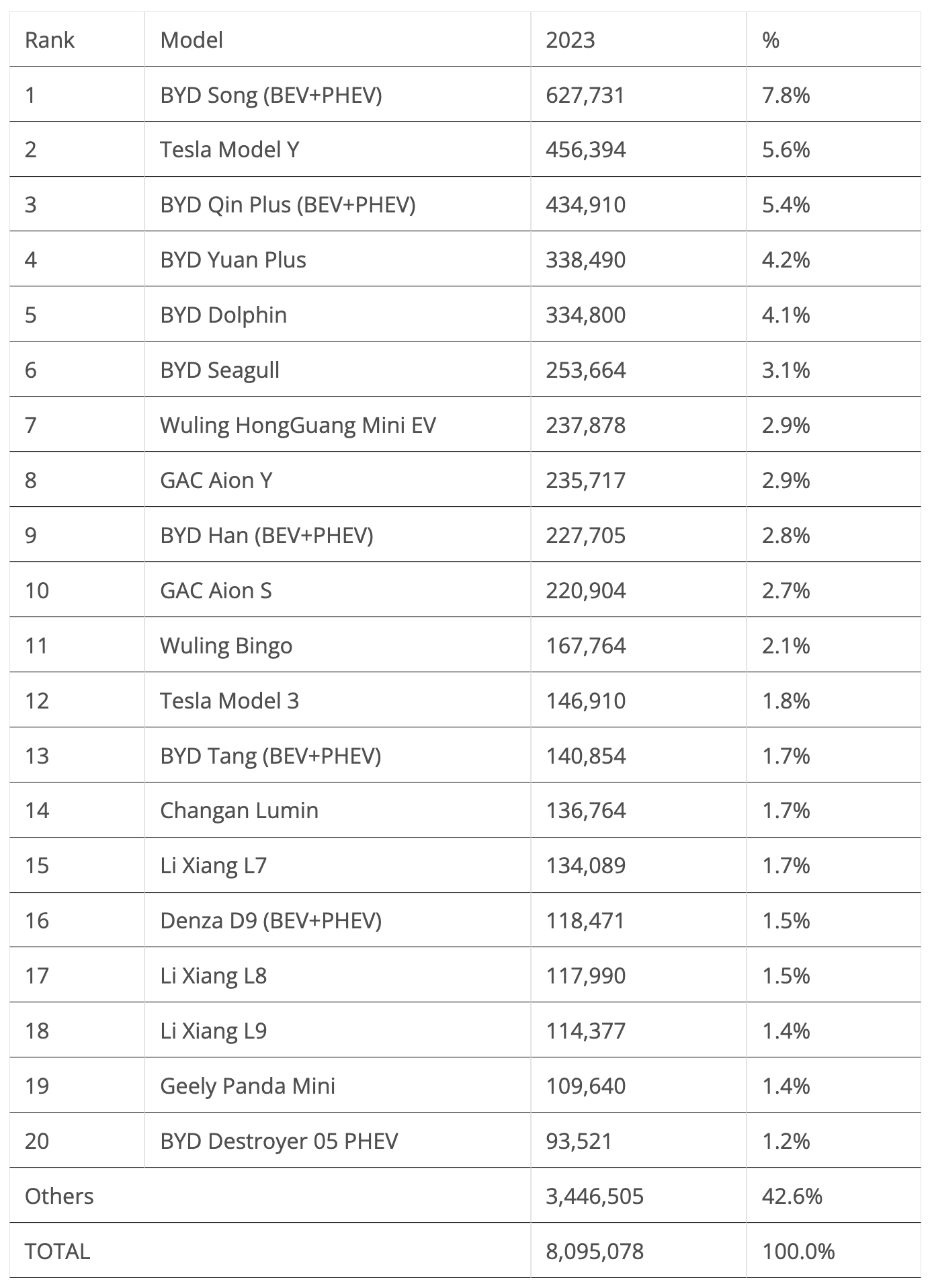

Top Selling EVs in China — January–December 2023

Looking at the 2023 ranking, the BYD Song is the 2023 best seller, repeating last year’s success. The Song ended with more than 100,000 units above the runner-up, the Tesla Model Y. The Tesla Model Y surpassed the BYD Qin Plus in the last stage of the 2023 race, allowing the Tesla crossover to win its second silver medal, after the one in 2021 and the bronze it won in 2022.

Still, with five models in the top six positions, BYD had a lot of reasons to open the champagne. It won every size category, including the city car category, where the Wuling Mini EV was surpassed in December by the BYD Seagull. The BYD Dolphin won the B-segment/subcompact category, the Yuan Plus took the C-segment/compact prize, the Song won the D-segment/midsize, and the Han won the higher level full-size category.

Yep, domination was complete in 2023, and 2024 should see it also on top in many categories, but there will be more competition. Not only will the Li Xiang L7 or AITO M7 (or both) likely remove the BYD Han from the full size leadership spot, but the Tesla Model Y will have a good chance to beat the BYD midsize armada due to their internal cannibalization. The same story is likely to repeat in the compact category with GAC’s Aion Y and BYD’s Yuan (Plus and Up), all while in the B-segment/subcompacts, the Wuling Bingo could grow to become a strong contender for the category title.

Elsewhere, there wasn’t much to talk about, with no position changes. Comparing the 2023 table with the one for 2022, the highlights are: the 5-position drop of the Wuling Mini EV, to 7th, from a 44% drop in sales (due to the competition increase in the smaller category). The BYD Tang also dropped from 8th in 2022 to its current position of 13th, which highlights that BYD’s large SUV is getting old. Meanwhile, it is interesting to see that a number of small EVs were pushed out of the table this year, like the Changan Benni EV, Chery eQ1, and QQ Ice Cream. While Changan could compensate with the rise of the cutesy Lumin, #14 in 2023, Chery lost its two representatives in the table without any replacement. Hmmm…

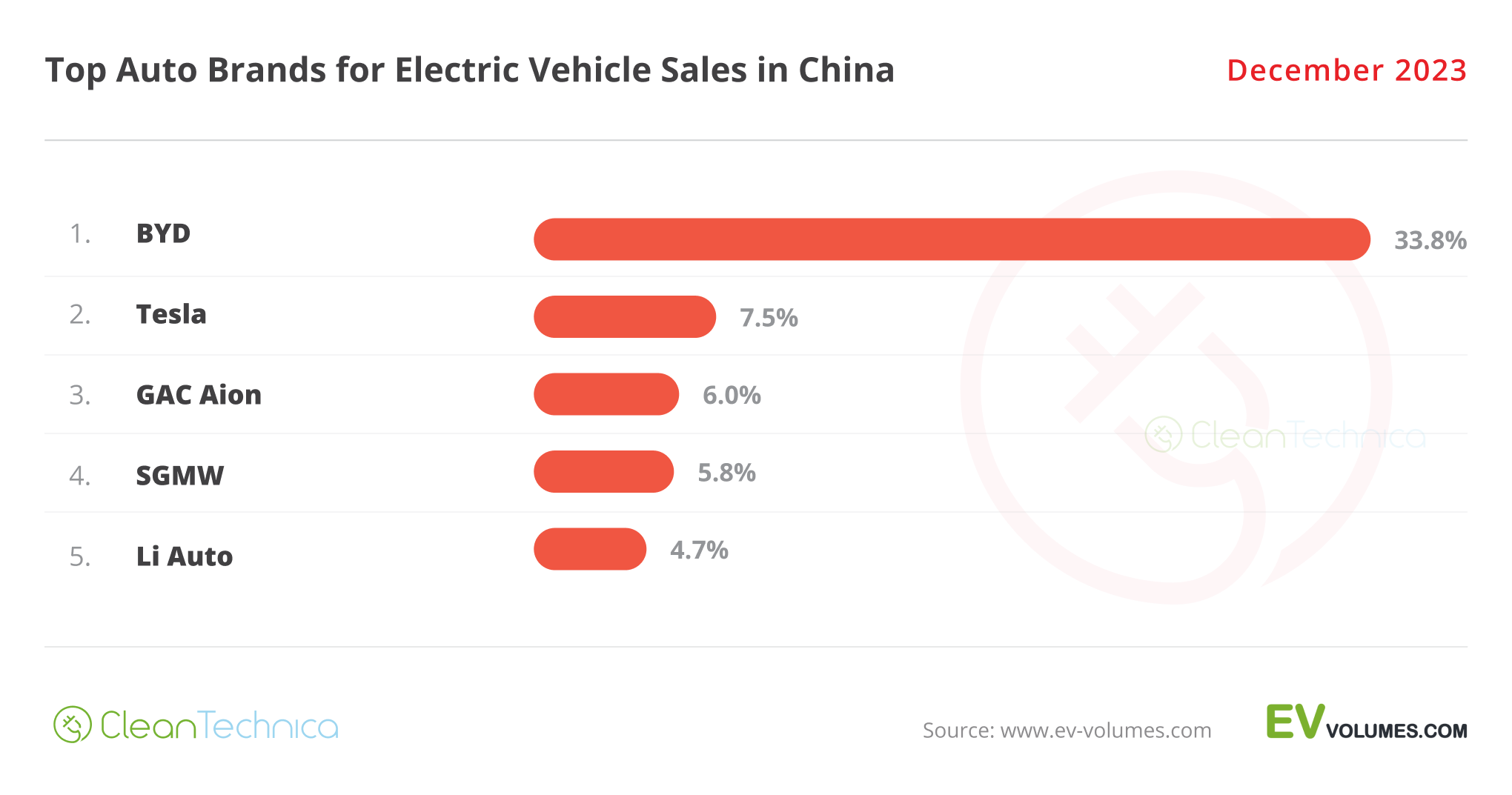

Looking at the brand ranking, BYD revalidated its 2022 title in 2023, making this its 3rd title in a row. Winning its 10th title comfortably, it even had a higher market share this year than last (33.8% in 2023 vs. 30.9% in 2022). Are we witnessing peak BYD? Interestingly, ever since it started making plugins, waaay back in 2008, the Shenzhen make always ended among the top two positions in the top manufacturers table in China, which says a lot about its importance regarding the EV Revolution in China.

Meanwhile, Tesla won its first silver medal in 2023, after three bronzes, thanks to 7.5% share. It had a slight increase of 0.1% over 2022.

Still on the podium, GAC Aion won its first medal, ending in 3rd with 6% share. That’s a positive result compared to the 4th place finish and 4.6% share of 2022, and it’s much thanks to the success of its dynamic duo, the Aion S and Y.

The loser of 2023 was the SGMW joint venture. Despite the success of the Wuling Bingo, that wasn’t enough to balance the significant volume loss (about 200,000 units) of the Wuling Mini EV. The joint venture ended 2023 with 5.8% share, against the 8% it had in 2022.

In 5th, we have a new sheriff in town, with the rising startup Li Auto (4.7% share, up from 4.6% in November) replacing Changan (4.3%) as the last brand on the table. Still, that wasn’t too bad for the Chongqing-based brand, as it dropped just one position compared to the previous year (6th vs. 5th), and it increased its share of the growing market, from 3.0% in 2022 to 4.3%.

Worthy of notice is that Geely was again in the 7th spot, yet ended the year with 4.1% rather than the 3.7% of 2022. 2024 could be the breakout year for the make.

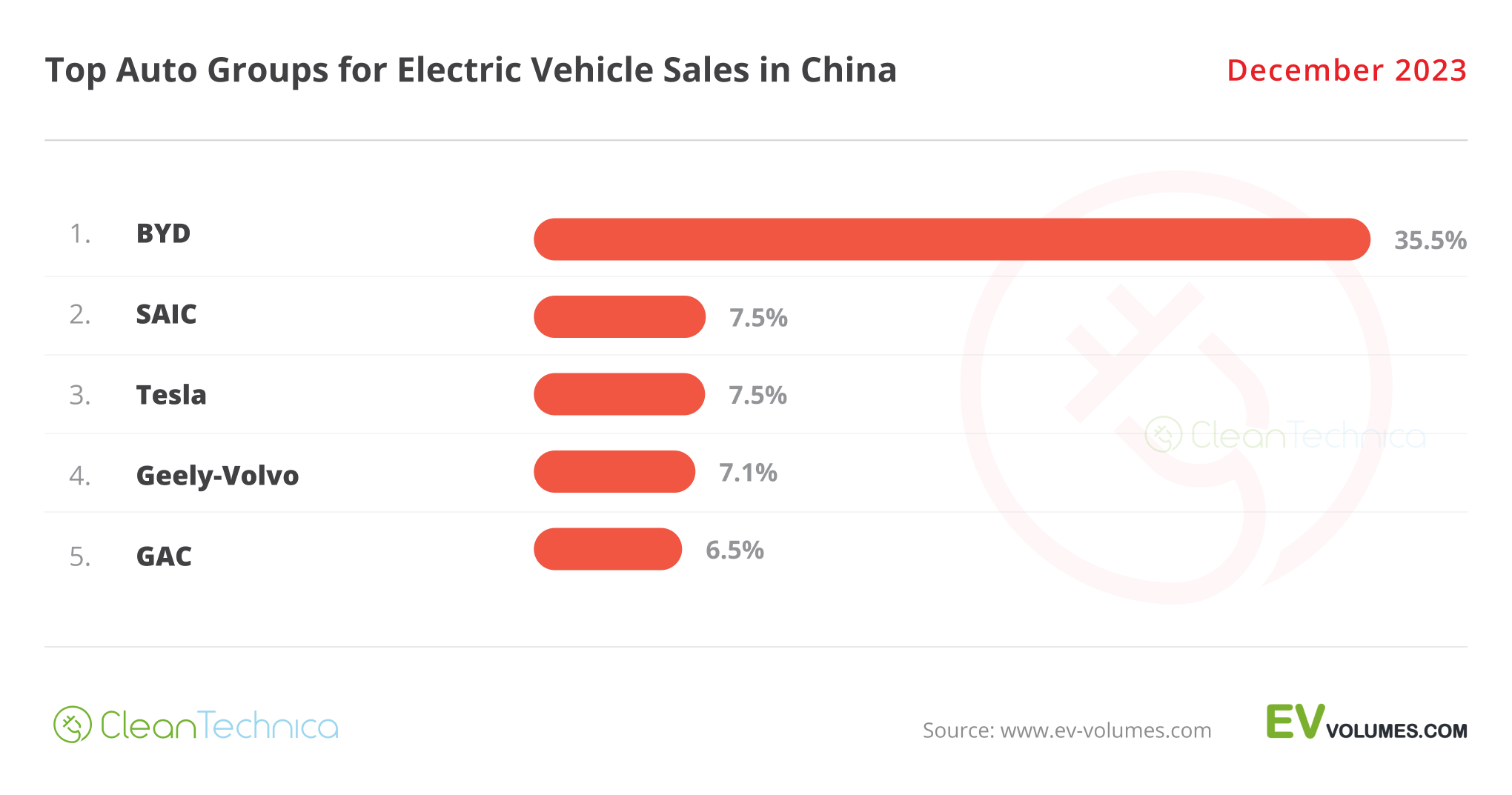

By automotive group, the big winner was BYD (35.5%), repeating last year’s #1 title. Expect the following years to be the same story, such is BYD’s domination here.

Having been also #1 in the overall market, the demand ceiling is starting to come close, leaving little room for significant growth in China. The Shenzhen automaker is now more worried about going upmarket domestically and conquering overseas markets.

As for SAIC’s runner-up spot, with 7.5% share, it can be said that this one was literally won in the last hour. After months of Tesla sitting in the #2 spot, SAIC profited from a great month of December to increase its share by 0.3% in the last month of the year, to 7.5%, and thus managing to surpass the US carmaker by … 518 units.

Will the silver medal stay in Shanghai in 2024, or will it be stolen in 2024 by either Tesla or Geely? It is hard to predict at this point, but one thing is certain: #4 Geely–Volvo continues to grow. It ended the year with 7.1%, a significant increase compared to its 5.7% share of 2022.

#5 GAC got the final position in this top 5. It has increased its share significantly, jumping from 4.9% in 2022 to its current 6.5%.

#6 Changan was up one position compared to 2022, having seen its share jump from 4% in 2022 to 4.8% in 2023.

As for Volkswagen Group, things are going from bad to worse. The German conglomerate’s share was down from 3.7% in 2022 to its current 2.9%. Better luck in 2024? The eroding market share of Volkswagen Group in Europe is one thing, but nothing is more concerning than China’s progressive disenchantment with the German conglomerate. How will the German OEM overcome this life-threatening situation? I guess we will see how it plays out this year. But one thing is certain: the window is closing.

Oh, and the same goes for the #2 foreign make in China on the overall market: Toyota. It was down 20% compared to 2022. And this is in the context of an overall growing market — 11% YoY.

Other foreign brands which had a hard time in 2023: Buick (-41%), Ford (-16%), Cadillac (-28%), Chevrolet (-55%), Citroen (-44%), and Skoda (-48%). Of all these brands, Citroen is on the way out, Skoda could be next (maybe that is why they haven’t launched the Enyaq there), and Chevrolet, Cadillac, and Ford are in dangerous waters.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.