Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

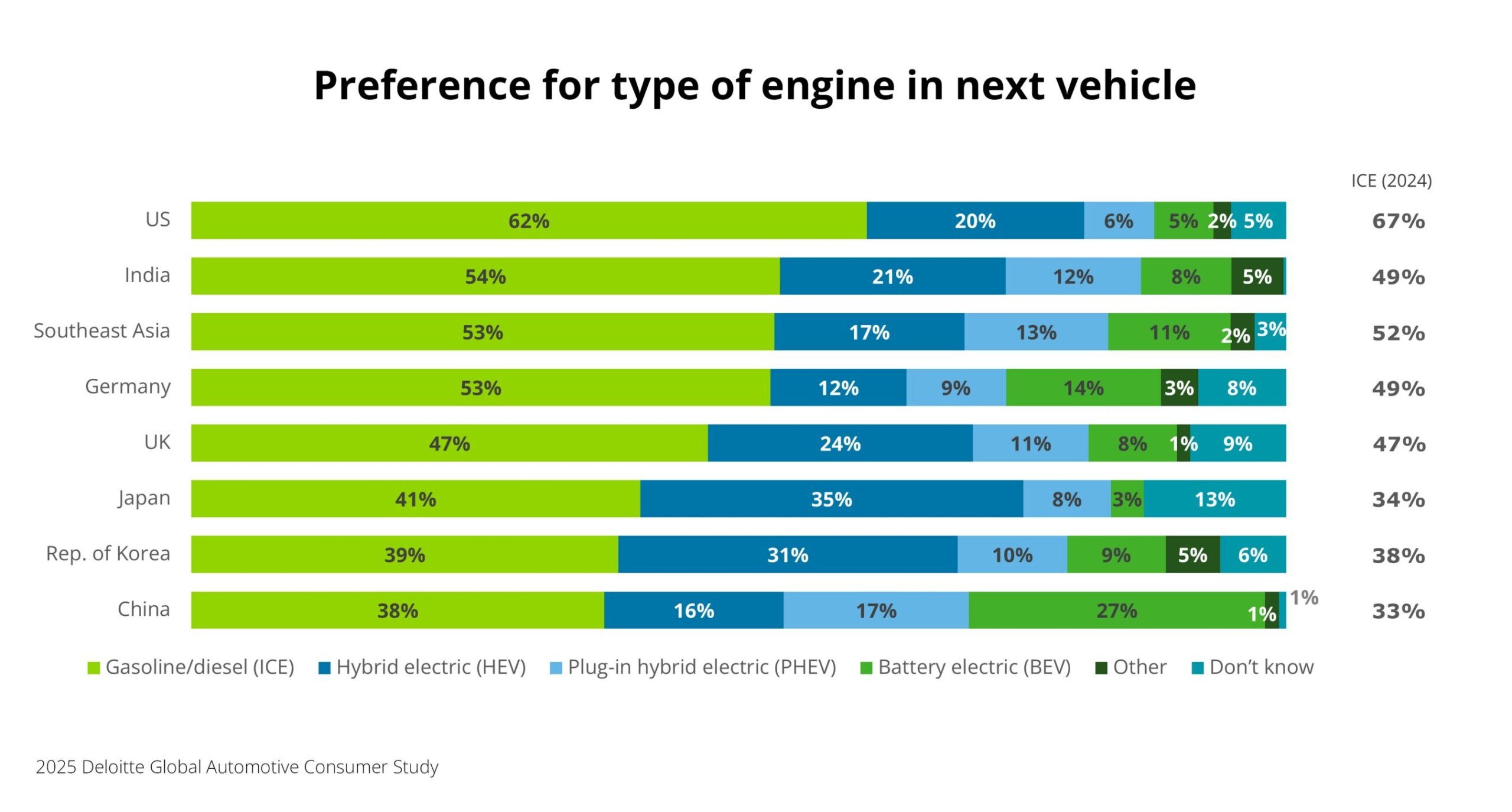

New research from Deloitte finds that 5% of Americans would like a BEV to be their next vehicle and another 6% would like a plugin hybrid to be. That’s … meh, and it’s nothing close to the 27% and 17% of Chinese of the same mindset, respectively. But that’s where we are.

The good news in the US is that intent to buy a hybrid (conventional or plugin) is up 5 percentage points compared to the previous year. The better news is intent to buy a conventional fossil-fueled car is down 5 percentage points. The bad news is intent to buy an EV is down 1 percentage point!

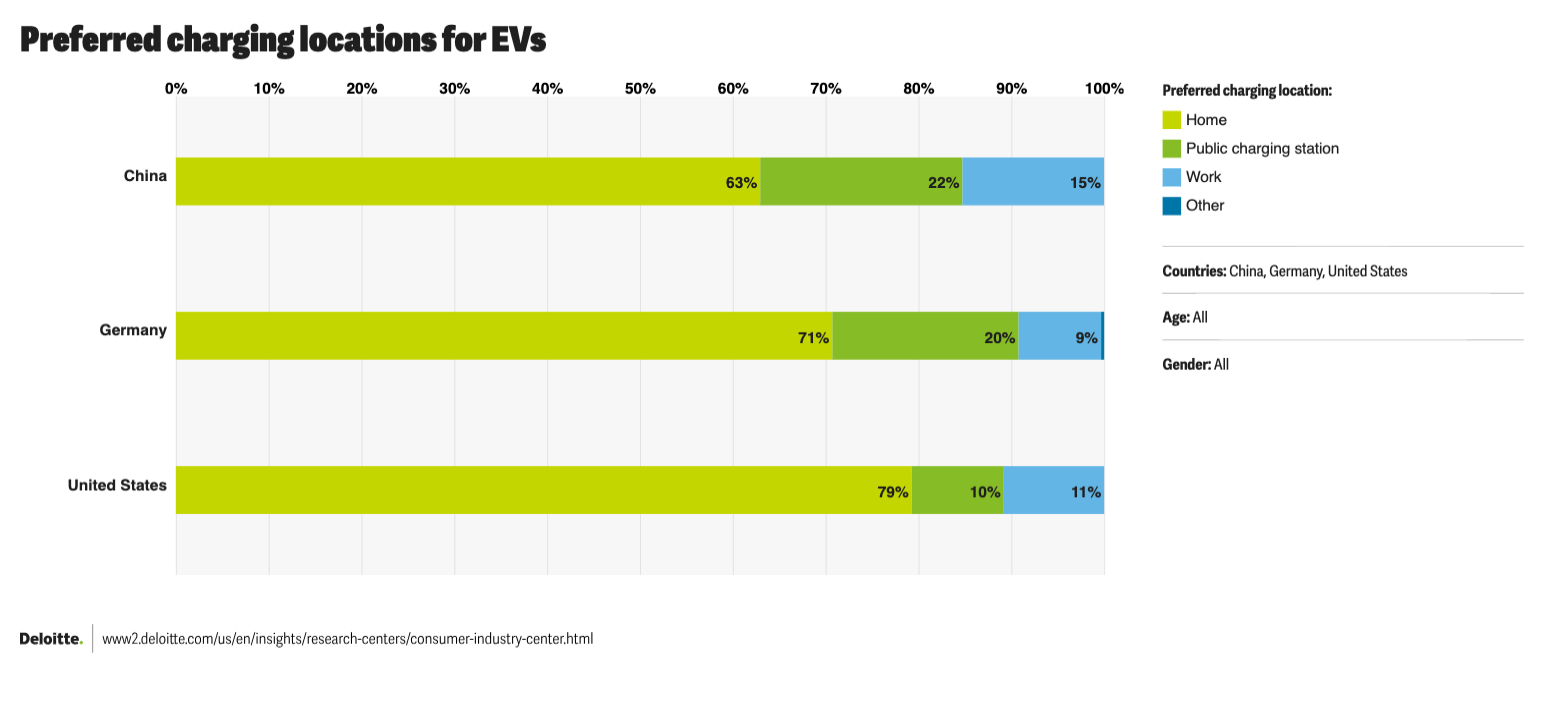

Another good piece of news is that concern about public EV charging may be overhyped. “Demand for public charging infrastructure may be exaggerated, as 79% of U.S. EV intenders surveyed plan to charge their vehicle at home.”

Across the board, I’m not going to lie — it’s an interesting survey. I don’t know if the sampling and methodology is extra good or extra weird, as I’m surprised by a number of the results. It also found that a full 52% of respondents are concerned about fully autonomous robotaxis operating near where they live. Really. I’m not the most gung-ho about robotaxis, and I do think they will increase traffic, but are 52% of people really afraid of them?

On the flip side, “More than 4 in 10 U.S. consumers surveyed aged 18-34 would be willing to give up vehicle ownership in favor of a fully available mobility-as-a-service (MaaS) solution.” So, more than half of Americans are concerned about robotaxis, but more than 40% of American adults under the age of 35 are open to the idea of using MaaS instead of owning a car — and how many of them are fine if that’s a robotaxi instead of human-driven MaaS?

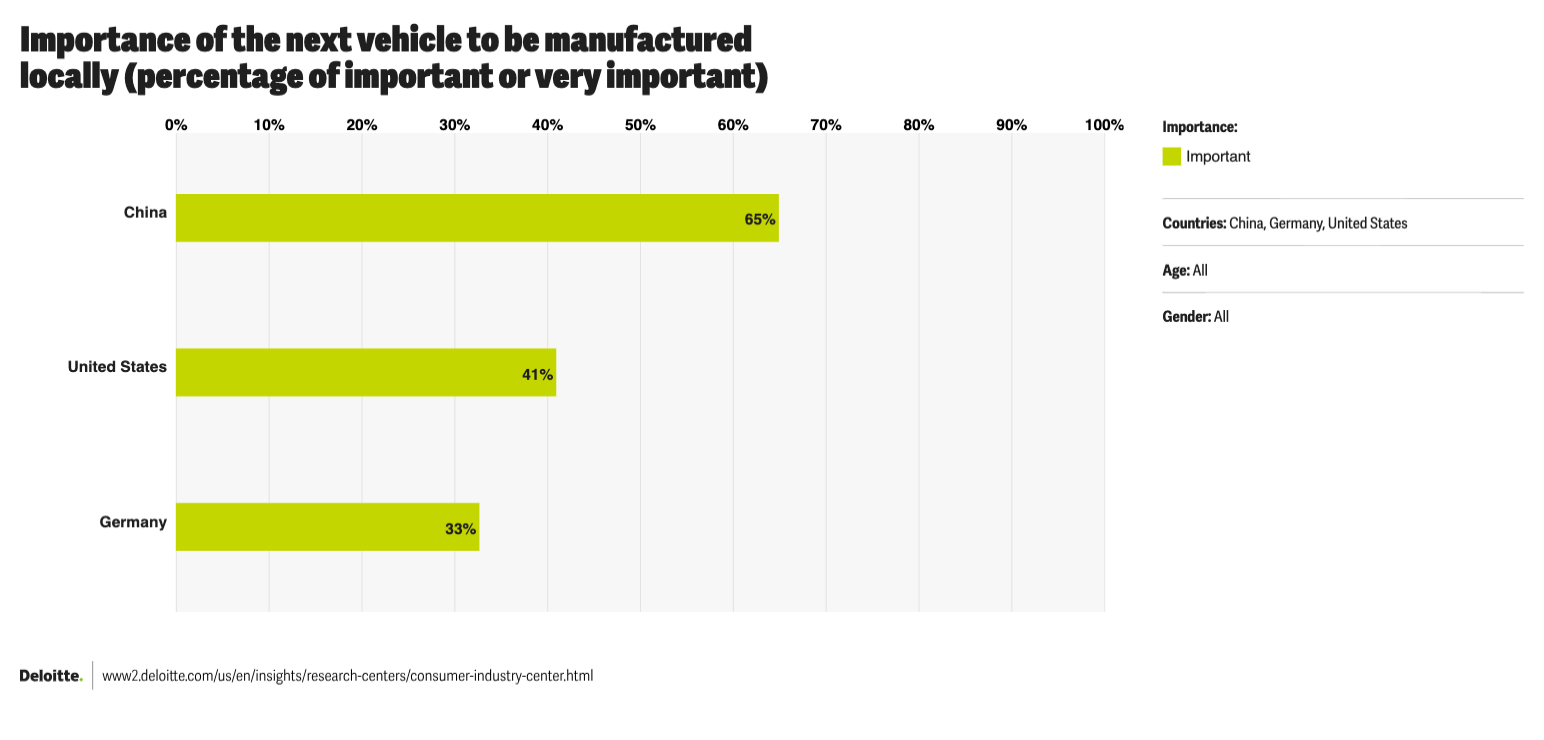

Also, 54% of respondents plan to switch auto brands the next time they buy a car. With so much talk of brand loyalty in the industry, that’s got to be a bit of a disappointing result for automakers — but also opportunity for those much desired “conquest sales.” Interestingly, though, brand loyalty is much weaker in China and India, where 76% and 72%, respectively, plan to buy a different brand with their next vehicle purchase.

Getting back to the topic of EVs, here are some of the key findings:

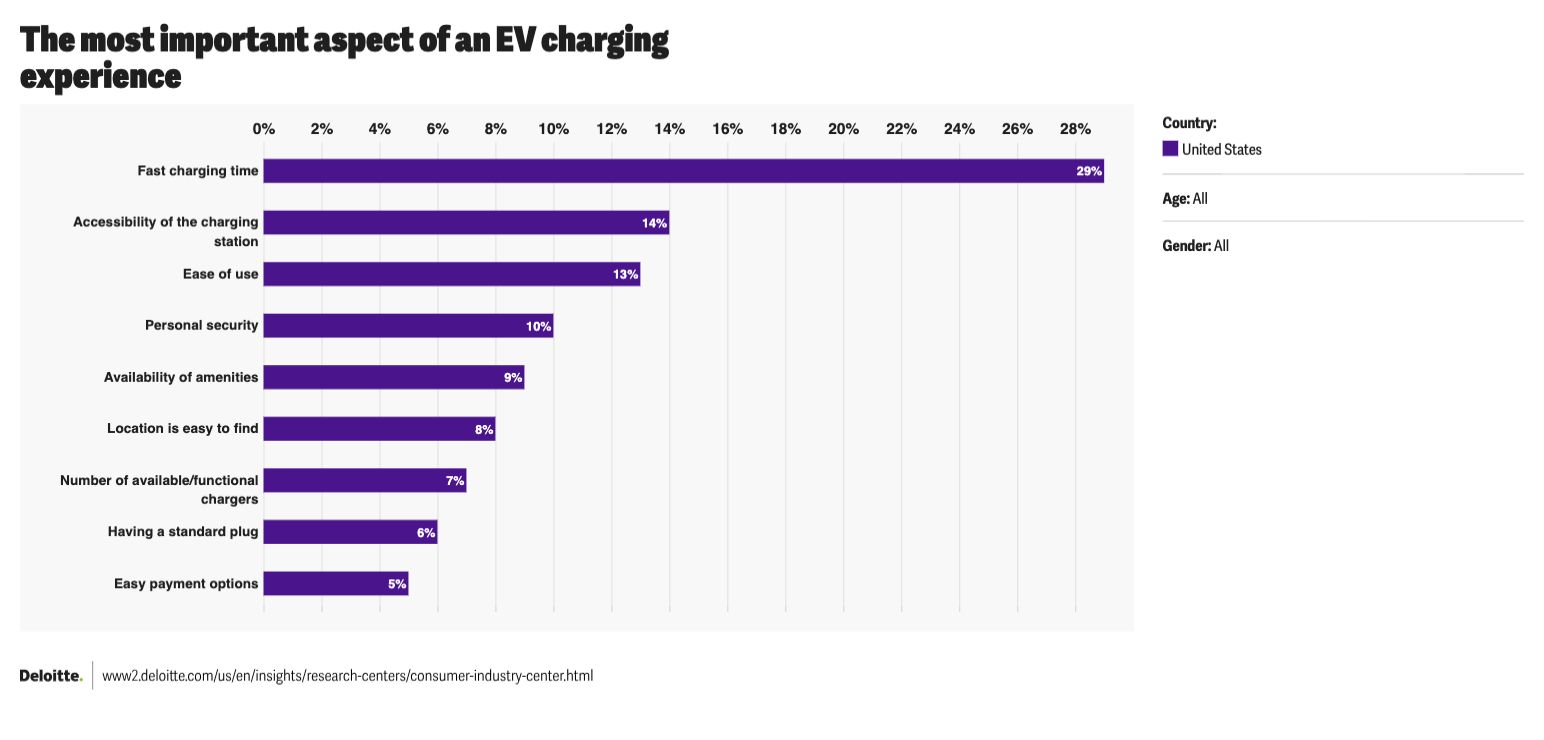

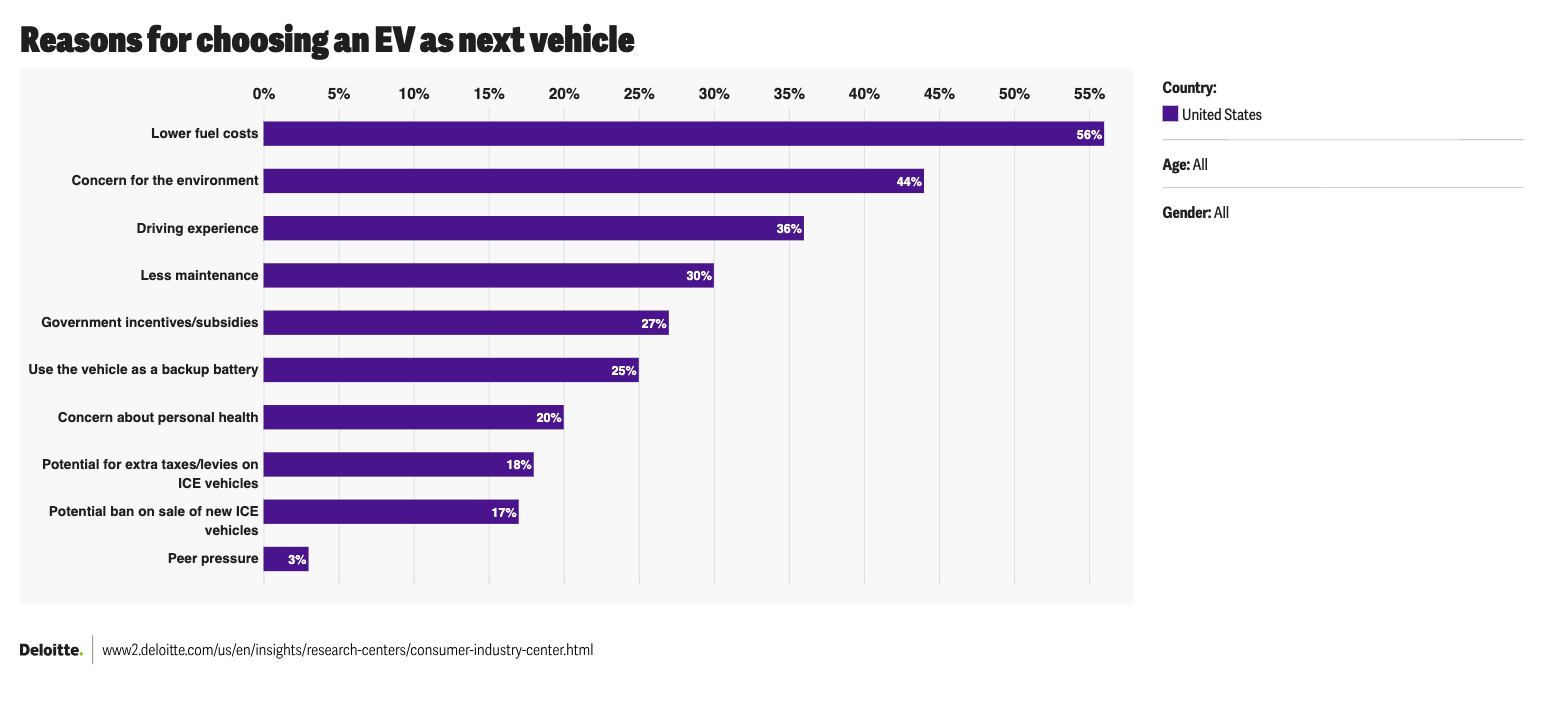

- “Lowering fuel costs remains the top reason among U.S. consumers surveyed to purchase an EV (56%), followed by environmental considerations (44%) and driving experience (36%). However, available battery driving range remains a top concern (49%) for U.S. consumers surveyed, followed by the time required to charge (46%) and the lingering cost premium associated with BEVs (44%).”

- “One-third (35%) of U.S. consumers surveyed said they drive 60 miles or more from their home only once or twice a month with a further 23% saying they never drive that far away, raising an important question regarding the amount of investment being earmarked to build out EV charging infrastructure.” (I think the semi-conclusion at the end there is a weird one — even if most driving is local, there’s still plenty of medium- and long-distance driving that requires public charging, and there are also many people who can’t charge at home, as this survey itself finds.)

- “More focus on making it easy and affordable for people to install a home charger may be required as 58% of those surveyed said they currently do not have access to a dedicated EV charger.”

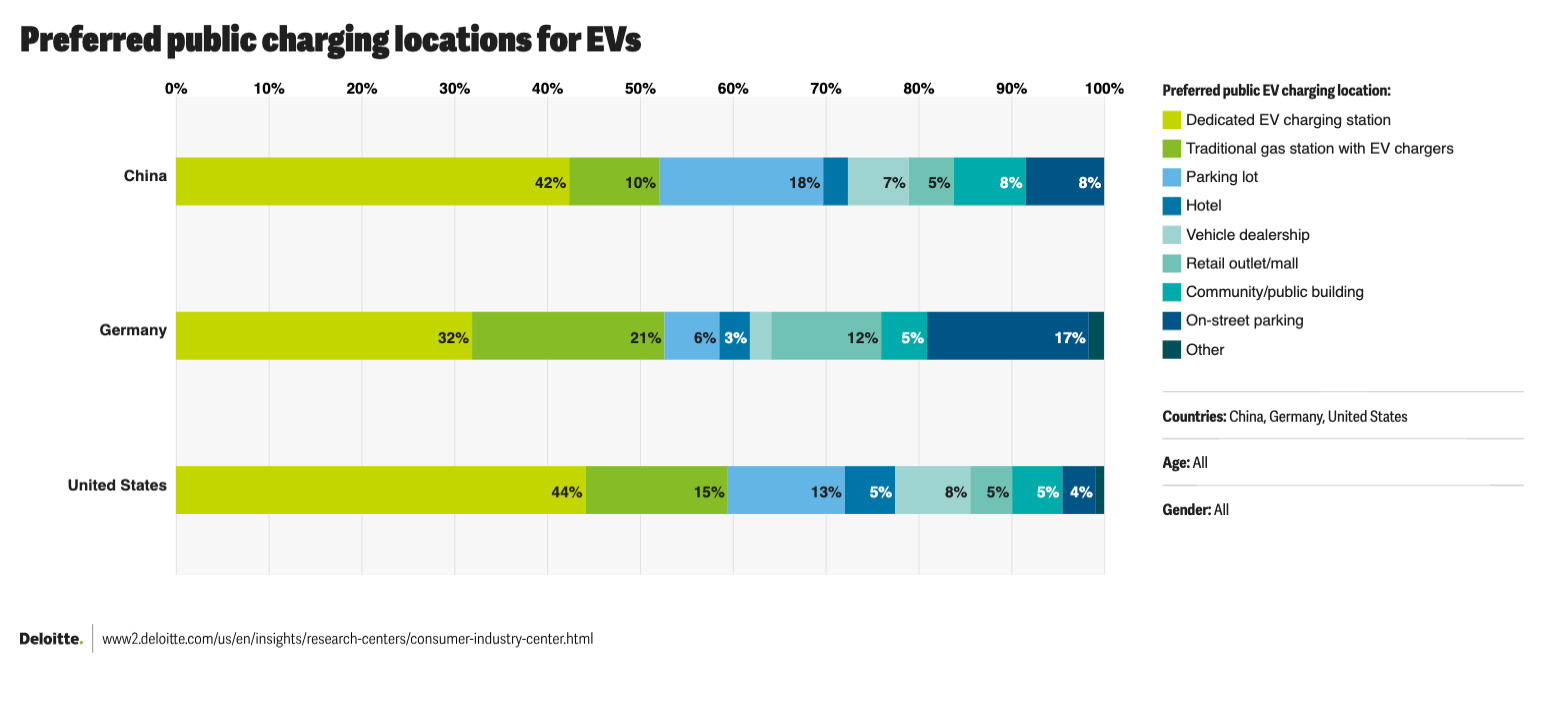

- “Charging wait times may be a softening barrier for U.S. consumers surveyed as three-quarters (77%) are willing to wait up to 40 minutes to charge their vehicle to 80% from zero. U.S. consumers surveyed prefer a dedicated EV charging station (44%) to a traditional gas station with EV chargers (15%).”

All charts courtesy of Deloitte.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy